- United States

- /

- Biotech

- /

- NasdaqGS:ANAB

Jemperli Royalty Dispute Could Be a Game Changer for AnaptysBio (ANAB)

Reviewed by Sasha Jovanovic

- In late November 2025, AnaptysBio and GSK/Tesaro initiated competing lawsuits in Delaware Chancery Court, each accusing the other of breaching their collaboration and exclusive license agreement involving the oncology drug Jemperli.

- This legal conflict places the terms surrounding milestone and royalty payments, exclusivity rights, and the ongoing commercial development of Jemperli at the center of uncertainty for both parties.

- We'll examine how the dispute over Jemperli's exclusivity and royalty terms adds complexity to AnaptysBio's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is AnaptysBio's Investment Narrative?

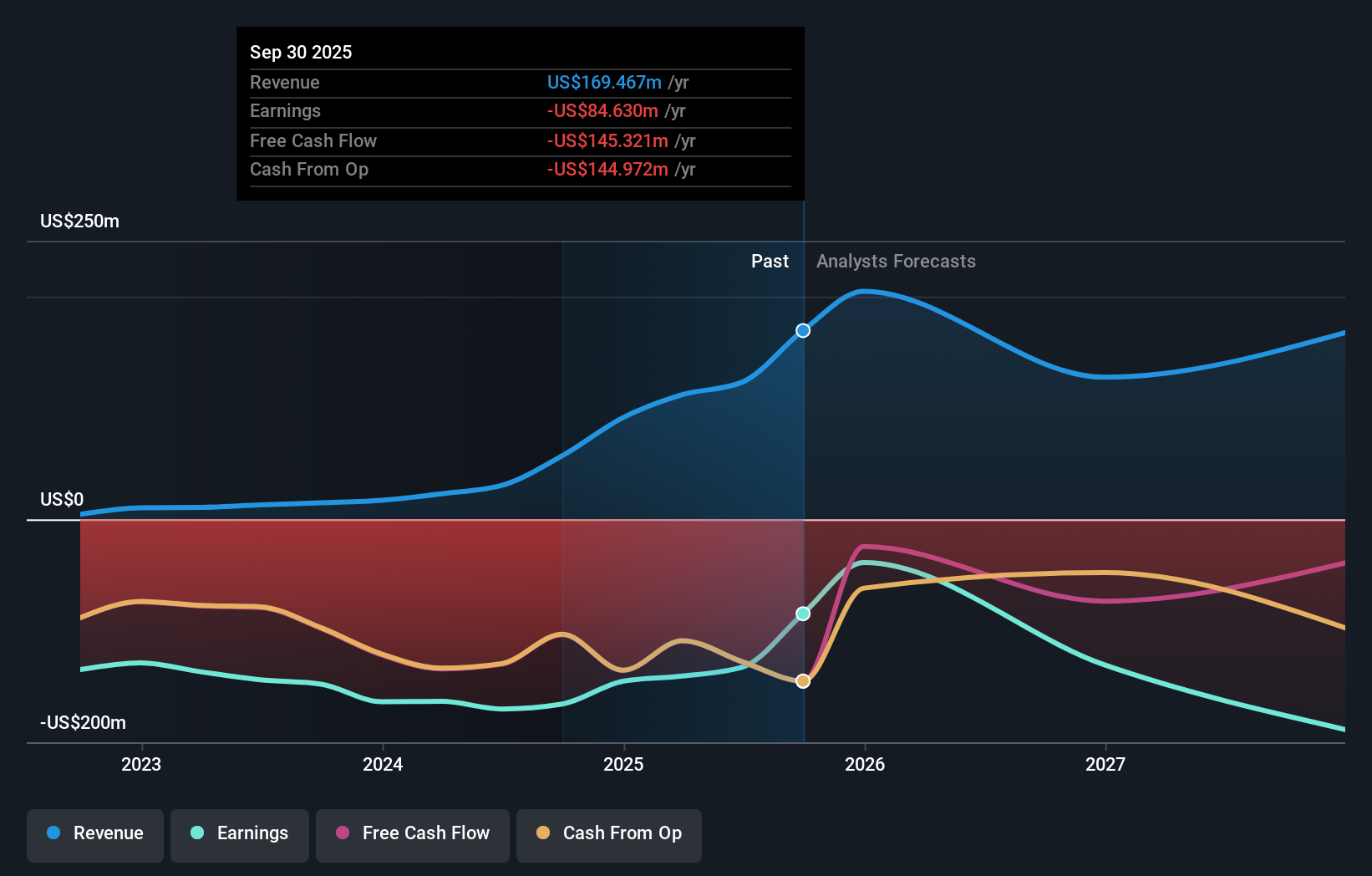

To own shares of AnaptysBio right now is to believe in the value of its royalty streams, potential pipeline breakthroughs, and any upside from a possible business reorganization. The recent lawsuit with GSK/Tesaro over Jemperli’s collaboration terms materially affects this thesis by injecting risk around royalty and milestone certainty, currently a vital catalyst, especially with a one-time US$75 million milestone anticipated if Jemperli’s sales hit US$1 billion. The legal outcome could shift both near-term cash flow and longer-term royalty rights, which until now were taken as relatively stable, and it adds uncertainty at a time when the company is already unprofitable and discontinuing some development programs. That said, buybacks and revenue growth remain positive backdrops, but the current core risk is whether royalty flows from Jemperli will remain insulated during this dispute.

In contrast, not everything about AnaptysBio’s future payments is guaranteed, read on for what's at stake.

Exploring Other Perspectives

Explore another fair value estimate on AnaptysBio - why the stock might be worth just $63.91!

Build Your Own AnaptysBio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AnaptysBio research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free AnaptysBio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AnaptysBio's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ANAB

AnaptysBio

A clinical-stage biotechnology company, focuses in delivering immunology therapeutics.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026