- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Positive Phase 3 Data for Rocatinlimab Might Change the Case for Investing in Amgen (AMGN)

Reviewed by Simply Wall St

- In early September 2025, Amgen and Kyowa Kirin announced preliminary top-line results from the Phase 3 ASCEND study, showing their investigational therapy rocatinlimab provided sustained efficacy and a favorable safety profile in adults and adolescents with moderate to severe atopic dermatitis.

- This data suggests rocatinlimab’s differentiated mechanism may allow for less frequent maintenance dosing, potentially setting it apart in the atopic dermatitis treatment landscape compared to existing options.

- We'll explore how these positive Phase 3 results for rocatinlimab could alter Amgen's investment outlook, especially concerning pipeline-driven growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Amgen Investment Narrative Recap

To be an Amgen shareholder, you need confidence in its large, innovative pipeline that balances aging blockbuster drugs with promising new therapies. The recent positive Phase 3 results for rocatinlimab highlight pipeline strength, but do not materially change the biggest near-term catalyst: successful late-stage product launches that counteract mounting biosimilar competition. The major risk remains persistent pricing and policy headwinds, which could weigh on future margins and cash flow if top-line growth stalls.

In the context of pipeline expansion, Amgen’s September announcement to invest over US$600 million in a new science and innovation center stands out. This facility aims to further disrupt chronic disease treatment by equipping researchers with advanced technologies, potentially supporting upcoming launches like rocatinlimab and strengthening the company’s innovation-driven growth catalysts.

However, investors should also be aware that, while new drugs like rocatinlimab show promise, major risks such as escalating pricing pressures and the speed of biosimilar adoption remain...

Read the full narrative on Amgen (it's free!)

Amgen's narrative projects $37.4 billion revenue and $8.2 billion earnings by 2028. This requires 2.3% yearly revenue growth and a $1.6 billion earnings increase from $6.6 billion today.

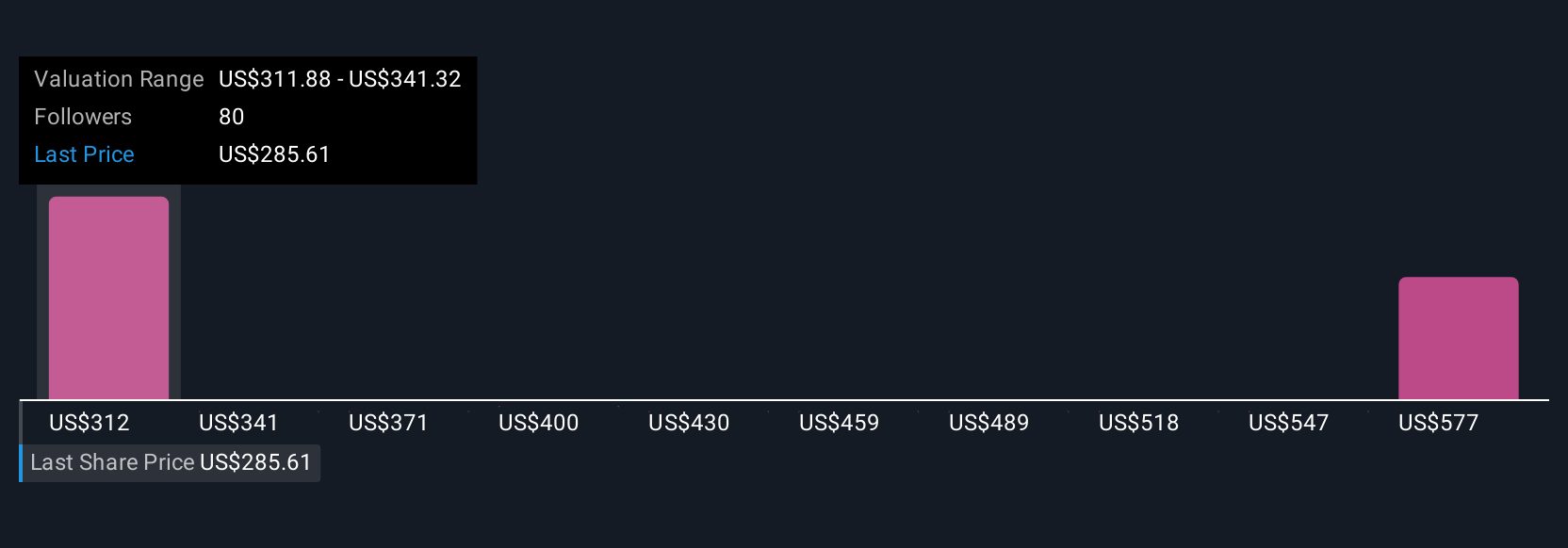

Uncover how Amgen's forecasts yield a $311.88 fair value, a 13% upside to its current price.

Exploring Other Perspectives

The most pessimistic analysts paint a different picture, forecasting Amgen’s annual revenues falling below US$34,400 million and earnings dropping to US$5,200 million by 2028. If you focus on the risks of eroding margins from biosimilar and pricing pressures, this outlook shows just how much views can differ. You may want to compare these expectations to newer events and decide for yourself.

Explore 5 other fair value estimates on Amgen - why the stock might be worth just $311.88!

Build Your Own Amgen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Amgen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amgen's overall financial health at a glance.

No Opportunity In Amgen?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026