- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Amgen (AMGN): Assessing Valuation After Strong Q3 Growth and Raised 2025 Guidance

Reviewed by Simply Wall St

Amgen (AMGN) released its third quarter 2025 results this week, reporting double-digit revenue growth and raising its outlook for the rest of the year. The update sent investors a strong message about management’s confidence.

See our latest analysis for Amgen.

Amgen’s upbeat earnings and guidance have clearly energized its stock, with a 7% gain over the past week and an 8.7% share price return in the last month. Momentum has been building all year as shares are up 23.5% year-to-date. While the total shareholder return is just 1.7% over the past year, the 56.8% five-year total return highlights the company’s ability to deliver for long-term investors. With fresh clinical trial wins, a newly affirmed dividend, and guidance pointing higher, it is not surprising to see bullish sentiment reflected in recent price action.

If Amgen’s strong run has you rethinking the healthcare landscape, it might be the perfect moment to explore See the full list for free.

With so much momentum behind Amgen’s stock, the key question for investors now becomes: Is there still room for meaningful upside, or is all that optimism already reflected in the current price?

Most Popular Narrative: 3% Overvalued

Compared to Amgen's last close of $320.20, the most widely followed narrative estimates fair value at $311.88, just below the current share price. This creates a tight debate over whether optimism is already fully priced in, or if market expectations might be overreaching.

Advancements in personalized and targeted therapies, reflected in the robust late-stage pipeline (for example, MariTide for obesity and type 2 diabetes, Repatha and olpasiran for cardiovascular, multiple bispecific T-cell engagers for oncology), position Amgen to launch high-margin, first-in-class products that drive both top-line growth and margin expansion in the coming years.

Want to know why the narrative gives Amgen a premium valuation? One bold assumption ties future profits to therapies still in the pipeline. What market bets and projected margins shape this high-stakes pricing? The details might surprise you.

Result: Fair Value of $311.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing drug pricing pressures and rising biosimilar competition could quickly shift market expectations, which may make future revenue growth less certain.

Find out about the key risks to this Amgen narrative.

Another View: Discounted Cash Flow Points Higher

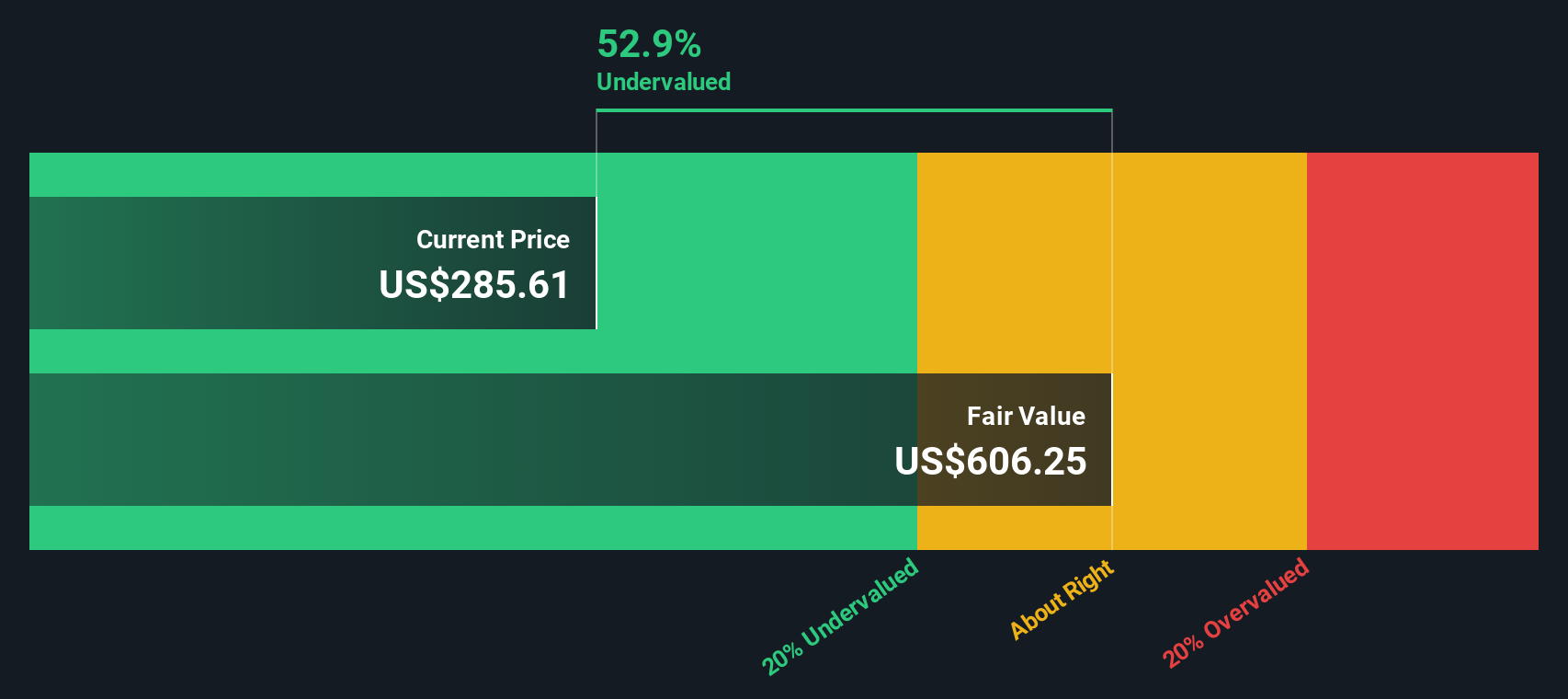

While the most popular narrative sees Amgen as slightly overvalued based on analyst earnings and multiples, our DCF model paints a very different picture. According to the SWS DCF model, Amgen is trading more than 45% below its estimated fair value. This suggests far more upside than traditional ratios reflect. Which scenario is closer to reality? Is the market underestimating Amgen's cash flow power, or are traditional multiples flashing a warning sign?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Amgen Narrative

If you have a different outlook or prefer hands-on research, it takes less than three minutes to shape your own perspective from the data. So why not Do it your way

A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Take advantage of today’s market by uncovering fresh stock ideas you might not see anywhere else. Don’t let another potential winner pass you by. Your next investment could be right here:

- Capture high yields and stable income when you review these 16 dividend stocks with yields > 3%, packed with established companies offering over 3% returns.

- Ride the future of medicine and technology by checking out these 32 healthcare AI stocks, featuring healthcare pioneers harnessing the power of AI for better patient outcomes.

- Position yourself ahead of the curve as you browse these 24 AI penny stocks, which are pushing the boundaries with innovative artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives