- United States

- /

- Biotech

- /

- NasdaqGM:ALVO

How Investors Are Reacting To Alvotech (ALVO) EU Approval Of AVT03 Denosumab Biosimilar

Reviewed by Sasha Jovanovic

- Alvotech recently announced that the European Commission has approved AVT03 as a biosimilar to denosumab (Prolia and Xgeva), opening access to an estimated US$1.20 billion European market for osteoporosis and cancer-related bone complications, with commercialization in Europe to be led by Dr. Reddy's under the Acvybra and Xbonzy brands.

- The approval, grounded in extensive analytical and clinical data showing equivalent pharmacokinetics, efficacy, safety and immunogenicity to the originators, also serves as a meaningful regulatory endorsement of Alvotech's broader biosimilar platform and manufacturing capabilities.

- We’ll now examine how gaining European Commission approval for AVT03 reshapes Alvotech’s investment narrative around regulatory execution and biosimilar market expansion.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Alvotech Investment Narrative Recap

To own Alvotech, you need to believe its “TSMC of biologics” ambition can translate into recurring biosimilar revenues despite regulatory and pricing pressures. The AVT03 EC approval reinforces the company’s regulatory execution and adds a meaningful new market, but it does not change that the key near term catalyst remains resolving FDA concerns around AVT05, while the biggest risk is continued regulatory or inspection related delays that disrupt the timing of milestone driven revenue.

The most relevant recent news alongside AVT03 is the FDA Complete Response Letter for AVT05 tied to Alvotech’s Reykjavik facility. Together, these events highlight a bifurcated picture for investors: strong validation from European regulators on one hand, and US regulatory setbacks on a core asset on the other, both of which directly influence how “lumpy” approval based milestone payments and near term earnings will be.

Yet investors also need to be aware that, despite new approvals, unresolved manufacturing and inspection issues could still...

Read the full narrative on Alvotech (it's free!)

Alvotech's narrative projects $1.4 billion revenue and $538.9 million earnings by 2028.

Uncover how Alvotech's forecasts yield a $26.40 fair value, a 421% upside to its current price.

Exploring Other Perspectives

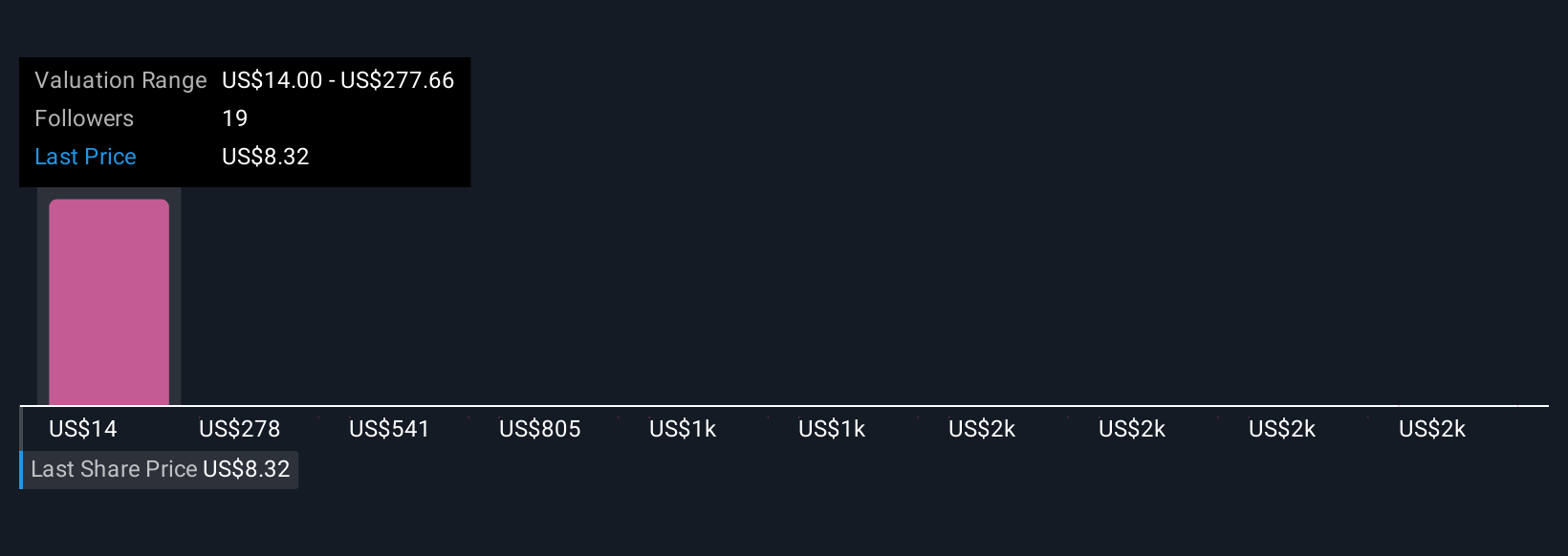

Seven members of the Simply Wall St Community value Alvotech between US$14 and US$2,650.56, underscoring how far apart individual views can be. When you layer in the risk that regulatory delays may disrupt milestone based revenue, it becomes even more important to compare these contrasting perspectives on what could drive the company’s performance.

Explore 7 other fair value estimates on Alvotech - why the stock might be a potential multi-bagger!

Build Your Own Alvotech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alvotech research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Alvotech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alvotech's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ALVO

Alvotech

Through its subsidiaries, develops and manufactures biosimilar medicines for patients worldwide.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026