- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

Will Board Overhaul And CEO Stock Moves Reshape Alnylam Pharmaceuticals' (ALNY) RNAi Investment Narrative

Reviewed by Sasha Jovanovic

- Alnylam Pharmaceuticals recently reshaped its Board of Directors, with long-serving members Mike Bonney and Carolyn Bertozzi, Ph.D., stepping down and industry veteran Stuart Arbuckle set to join as an independent director in early 2026.

- The leadership shift, combined with CEO Yvonne Greenstreet’s exercise of US$1.72 million in stock options, highlights both governance evolution and continued executive alignment with the company’s RNAi-focused trajectory.

- We’ll now explore how Arbuckle’s commercialization background and these board changes may influence Alnylam’s existing investment narrative and growth priorities.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Alnylam Pharmaceuticals Investment Narrative Recap

To own Alnylam, you need to believe RNAi therapies can keep scaling commercially while the TTR franchise funds broader pipeline success. The latest board refresh does not materially change the near term focus on executing AMVUTTRA’s rollout and managing payer and pricing pressures, which remain the key catalyst and a central risk.

The recent HELIOS B post hoc data on AMVUTTRA is especially relevant here, as it reinforces the clinical backbone of Alnylam’s TTR franchise at a time when revenue concentration, pricing pressure and payer dynamics are front of mind.

Yet beneath the strong TTR momentum, investors should still be aware of how rising gross to net adjustments and payer pressure could...

Read the full narrative on Alnylam Pharmaceuticals (it's free!)

Alnylam Pharmaceuticals' narrative projects $7.0 billion revenue and $1.9 billion earnings by 2028. This requires 41.8% yearly revenue growth and about a $2.2 billion earnings increase from -$319.1 million today.

Uncover how Alnylam Pharmaceuticals' forecasts yield a $489.09 fair value, a 7% upside to its current price.

Exploring Other Perspectives

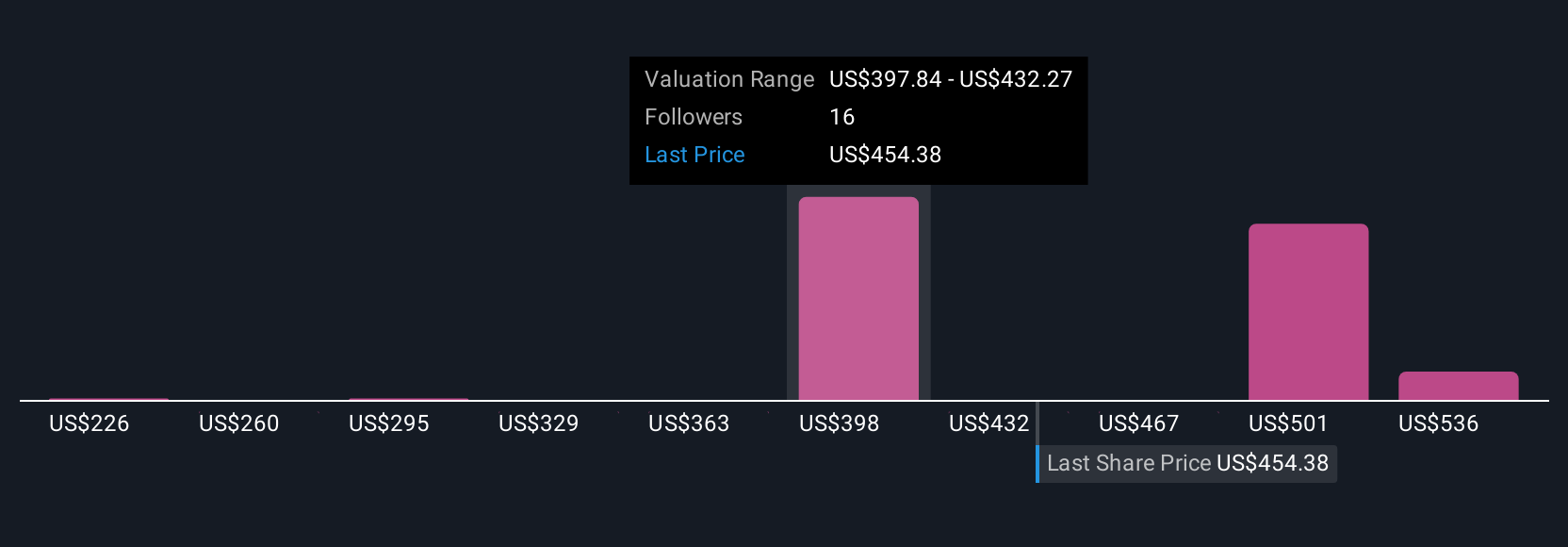

Five fair value estimates from the Simply Wall St Community span roughly US$260 to US$603 per share, underscoring how far opinions can stretch. You can weigh these against Alnylam’s reliance on AMVUTTRA pricing and payer support to judge potential outcomes for the business.

Explore 5 other fair value estimates on Alnylam Pharmaceuticals - why the stock might be worth 43% less than the current price!

Build Your Own Alnylam Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alnylam Pharmaceuticals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alnylam Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alnylam Pharmaceuticals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026