- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

High Growth Tech Stocks To Watch In August 2024

Reviewed by Simply Wall St

As global markets show signs of recovery and technology stocks lead the charge, investors are keenly watching for high-growth opportunities. In this favorable environment, identifying strong tech stocks involves looking for companies with robust innovation pipelines, solid financial health, and the ability to capitalize on emerging trends such as artificial intelligence and consumer technology.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| eWeLLLtd | 25.55% | 25.92% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| G1 Therapeutics | 24.26% | 51.62% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 22.48% | 26.75% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Seojin SystemLtd | 34.20% | 58.67% | ★★★★★★ |

| Adveritas | 66.47% | 103.87% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

Click here to see the full list of 1273 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Alnylam Pharmaceuticals (NasdaqGS:ALNY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alnylam Pharmaceuticals, Inc. is a biopharmaceutical company specializing in the discovery, development, and commercialization of novel therapeutics based on ribonucleic acid interference, with a market cap of $35.24 billion.

Operations: Alnylam Pharmaceuticals focuses on the discovery, development, and commercialization of RNAi therapeutics, generating $2.34 billion in revenue from this segment. The company operates within the biopharmaceutical industry and has a market cap of $35.24 billion.

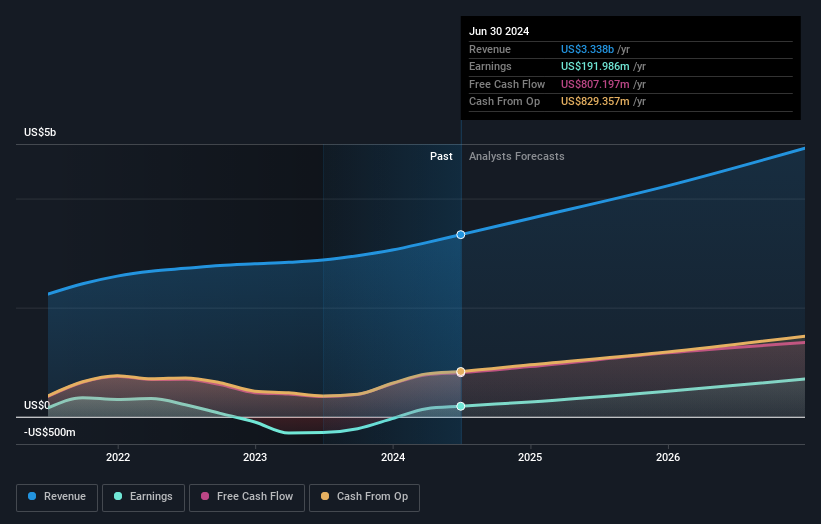

Alnylam Pharmaceuticals has demonstrated significant revenue growth, with a 19.4% annual increase, outpacing the US market's 8.8%. Despite being unprofitable, the company is forecast to achieve profitability within three years with an impressive 65.21% annual earnings growth rate. In Q2 2024, Alnylam reported $659.83 million in revenue and reduced its net loss to $16.89 million from $276.02 million a year ago, highlighting its robust R&D investment strategy that supports innovative RNAi therapeutics like vutrisiran for ATTR amyloidosis with cardiomyopathy.

Pinterest (NYSE:PINS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinterest, Inc. operates as a visual search and discovery platform in the United States and internationally, with a market cap of $21.80 billion.

Operations: Pinterest generates revenue primarily through its Internet Information Providers segment, which brought in $3.34 billion. The company focuses on offering a visual search and discovery platform to users globally.

Pinterest has shown notable progress, reporting Q2 2024 sales of $853.68 million, a 20.5% increase from the previous year. The company achieved profitability with net income of $8.89 million compared to a net loss of $34.94 million in Q2 2023, reflecting improved operational efficiency and strategic partnerships like VTEX's integration for social commerce expansion. With an expected annual earnings growth rate of 34.4% and revenue forecasted to grow at 13.4% annually, Pinterest is poised for robust future performance in the tech sector.

- Delve into the full analysis health report here for a deeper understanding of Pinterest.

Explore historical data to track Pinterest's performance over time in our Past section.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quanta Computer Inc. manufactures and sells notebook computers across Asia, the Americas, Europe, and internationally, with a market cap of approximately NT$1.09 trillion.

Operations: Quanta Computer Inc. generates revenue primarily from its electronics sector, amounting to NT$2.50 billion. The company operates on a global scale, serving markets in Asia, the Americas, and Europe.

Quanta Computer reported Q2 2024 sales of TWD 309.95 billion, a significant increase from TWD 245.03 billion the previous year, reflecting strong market demand and operational efficiency. Net income surged to TWD 15.13 billion from TWD 10.12 billion, highlighting robust profitability improvements. The company's R&D expenses have consistently supported innovation, contributing to its forecasted revenue growth of 36.8% annually and earnings growth of 19.3% per year, outpacing the broader TW market's expectations.

- Click here and access our complete health analysis report to understand the dynamics of Quanta Computer.

Assess Quanta Computer's past performance with our detailed historical performance reports.

Next Steps

- Delve into our full catalog of 1273 High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

A biopharmaceutical company, focuses on discovering, developing, and commercializing novel therapeutics based on ribonucleic acid interference.

High growth potential slight.