- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

Alnylam Pharmaceuticals (ALNY): Assessing Valuation After ZENITH Phase 3 Trial Launch and HELIOS-B Data Reveal

Reviewed by Kshitija Bhandaru

Alnylam Pharmaceuticals (ALNY) recently dosed the first patient in its global ZENITH Phase 3 trial for zilebesiran, a move that signals the company's push into larger cardiovascular markets. Alongside this, fresh data from the HELIOS-B trial presented at a major conference showed Amvuttra’s ability to reduce gastrointestinal issues in ATTR-CM patients.

See our latest analysis for Alnylam Pharmaceuticals.

Alnylam’s latest pipeline updates have kept the spotlight on its growth potential, with momentum steadying in recent weeks. Despite a modest 1-year total shareholder return of 0.7%, the stock has held up well as the company advances high-impact clinical programs and expands its commercial reach. Investors seem cautiously optimistic as Alnylam continues to strengthen its position with strategic partnerships and promising late-stage data.

If these breakthroughs have you wondering what else is happening in biotech, it could be a good time to explore new trends and innovation with our See the full list for free.

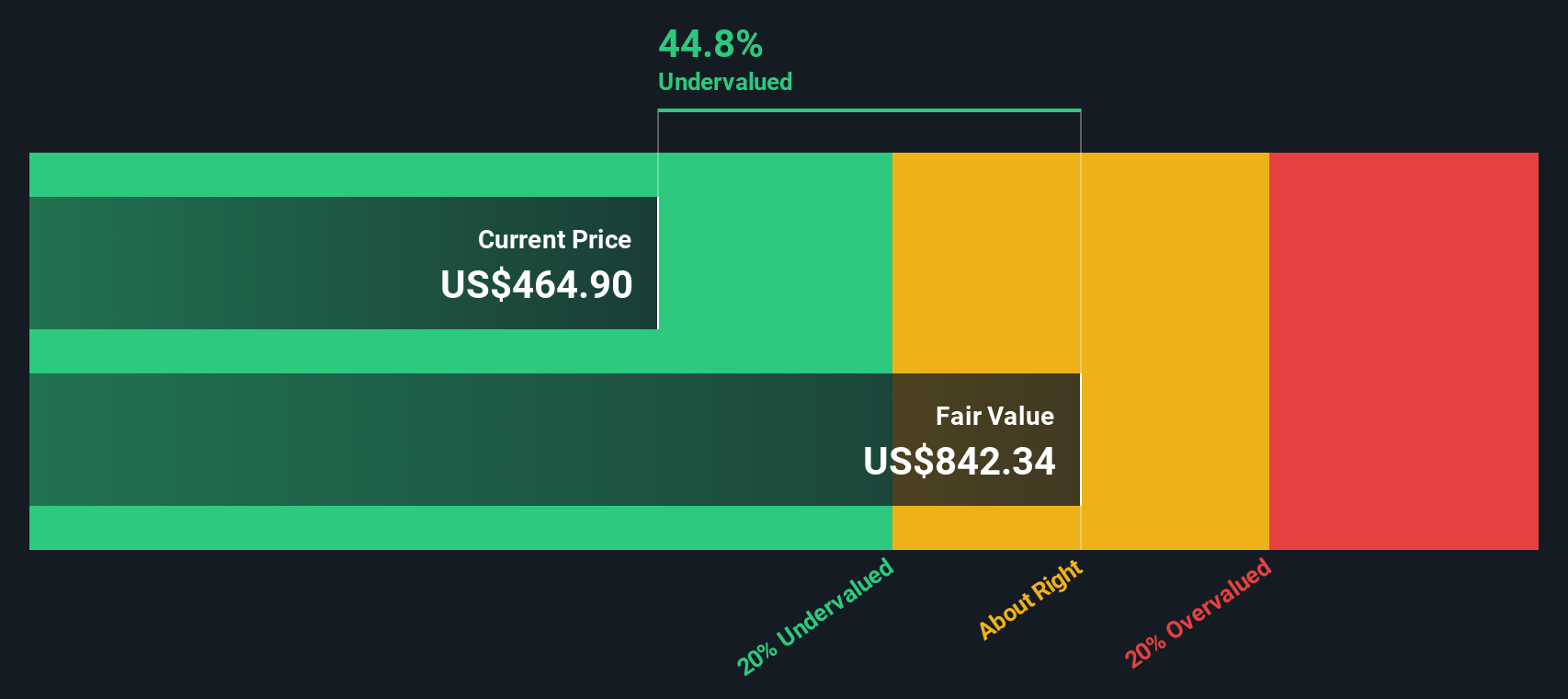

With strong pipeline momentum and record product sales, investors may be left wondering if Alnylam is now undervalued compared to its future prospects, or if the market has already accounted for its expected growth.

Most Popular Narrative: 2.1% Overvalued

With Alnylam's latest close at $456.35 and the most widely tracked fair value pegged at $447.15, the current share price sits just above consensus. Expectations for near-term revenue acceleration and commercial progress set the backdrop for a sharply divided valuation outlook.

Bullish analysts see Alnylam’s siRNA platform and first-to-market positioning in TTR silencing as creating significant long-term market opportunities not yet fully reflected in valuation.

Want to know the growth blueprint behind this high valuation? Analysts are betting on explosive margin expansion and long-term profit surges that few biotech firms ever achieve. What are the wild assumptions behind these bold calculations? The full narrative reveals the numbers propelling this price target.

Result: Fair Value of $447.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the company's increasing reliance on Amvuttra’s franchise and potential payer pressures may threaten both revenue growth and profit margins in the future.

Find out about the key risks to this Alnylam Pharmaceuticals narrative.

Another View: Discounted Cash Flow Sees Deep Value

While traditional price-to-sales comparisons suggest Alnylam is expensive, the SWS DCF model tells a sharply different story. This cash flow-based analysis estimates Alnylam’s fair value at $887.20 per share, which is nearly double the current price. This could imply potential undervaluation if forecasts unfold as projected. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alnylam Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alnylam Pharmaceuticals Narrative

If you see the numbers differently or want to dig into the details on your own, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your Alnylam Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Your smartest move today might be checking out stocks that others are overlooking. Give yourself the edge and spot tomorrow’s winners before everyone else does.

- Target consistent income right now by selecting investments among these 19 dividend stocks with yields > 3%, where yields top 3% and strong payouts distinguish these stocks.

- Seize early innovation by seeking out these 24 AI penny stocks, which are reshaping industries with artificial intelligence breakthroughs and rapid market adoption.

- Outsmart the market by scanning these 896 undervalued stocks based on cash flows to uncover companies trading below their intrinsic worth before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives