- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

3 US Stocks Estimated To Be Trading Below Their Intrinsic Value In August 2024

Reviewed by Simply Wall St

As of August 20, 2024, the U.S. stock market has seen a slight pullback after an impressive rally, with the S&P 500 and Nasdaq Composite snapping their winning streaks. Despite this minor downturn, the broader market remains near record highs as investors anticipate potential interest rate cuts by the Federal Reserve. In such a fluctuating environment, identifying stocks that are trading below their intrinsic value can offer significant opportunities for investors looking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Owens Corning (NYSE:OC) | $160.67 | $317.23 | 49.4% |

| Avidbank Holdings (OTCPK:AVBH) | $19.027 | $36.92 | 48.5% |

| MaxLinear (NasdaqGS:MXL) | $12.49 | $24.93 | 49.9% |

| Vitesse Energy (NYSE:VTS) | $24.46 | $48.55 | 49.6% |

| QuinStreet (NasdaqGS:QNST) | $17.28 | $34.44 | 49.8% |

| Cytek Biosciences (NasdaqGS:CTKB) | $5.31 | $10.61 | 50% |

| PACS Group (NYSE:PACS) | $39.01 | $76.64 | 49.1% |

| Sportradar Group (NasdaqGS:SRAD) | $11.44 | $22.46 | 49.1% |

| Abacus Life (NasdaqCM:ABL) | $10.98 | $21.55 | 49.1% |

| Zillow Group (NasdaqGS:ZG) | $52.71 | $104.04 | 49.3% |

Here we highlight a subset of our preferred stocks from the screener.

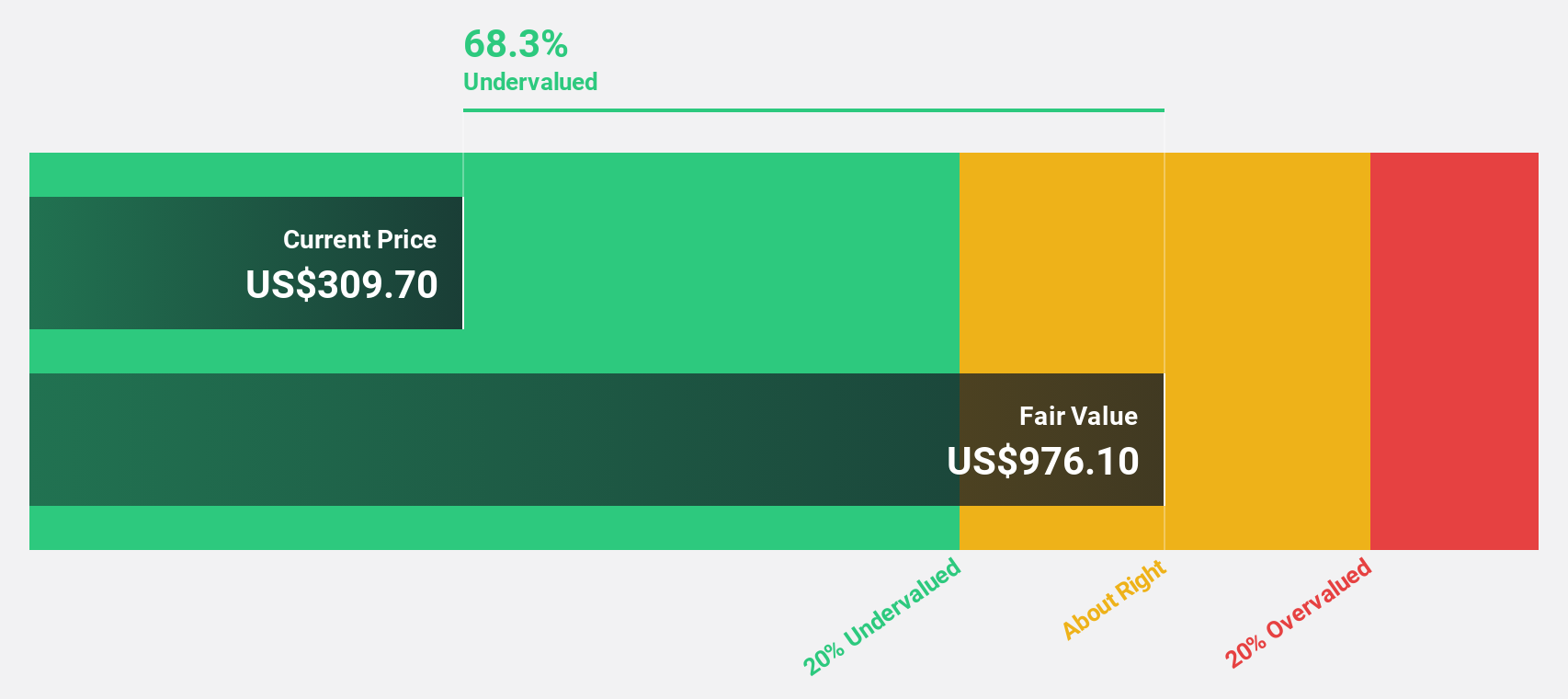

Alnylam Pharmaceuticals (NasdaqGS:ALNY)

Overview: Alnylam Pharmaceuticals, Inc. is a biopharmaceutical company that focuses on discovering, developing, and commercializing novel therapeutics based on ribonucleic acid interference with a market cap of $35.24 billion.

Operations: The company generates $2.34 billion from the discovery, development, and commercialization of RNAi therapeutics.

Estimated Discount To Fair Value: 45.4%

Alnylam Pharmaceuticals is trading at 45.4% below its estimated fair value of US$514.57, with current revenue growth forecasted at 19.4% per year, outpacing the US market's 8.8%. Recent Q2 earnings show significant improvement, with revenues nearly doubling to US$659.83 million and a reduced net loss of US$16.89 million from US$276.02 million a year ago. Despite high volatility and insider selling, Alnylam's strong cash flows suggest it remains undervalued based on discounted cash flow analysis.

- Our expertly prepared growth report on Alnylam Pharmaceuticals implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Alnylam Pharmaceuticals here with our thorough financial health report.

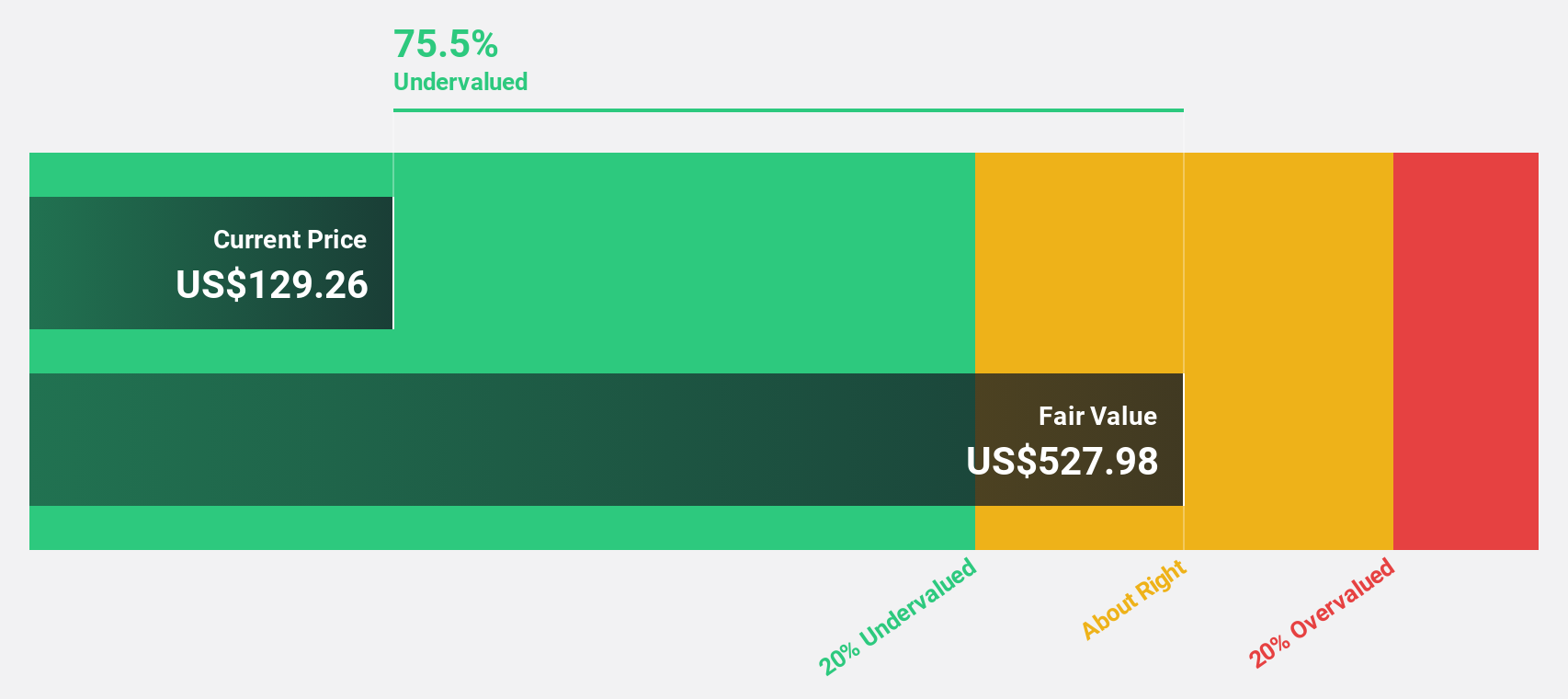

Clorox (NYSE:CLX)

Overview: The Clorox Company manufactures and markets consumer and professional products globally, with a market cap of approximately $18.48 billion.

Operations: Clorox generates revenue through several segments: Household ($1.95 billion), Lifestyle ($1.28 billion), International ($1.16 billion), and Health and Wellness ($2.49 billion).

Estimated Discount To Fair Value: 40%

Clorox is trading at 40% below its estimated fair value of US$252.08, with a strong return on equity forecasted to be very high in three years. Despite recent earnings growth of 87.9%, the company's revenue growth is slower than the market average and it has a high level of debt. Recent product expansions and M&A pursuits indicate strategic efforts to boost future cash flows, though its dividend sustainability remains questionable due to low coverage by earnings or free cash flows.

- Our comprehensive growth report raises the possibility that Clorox is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Clorox.

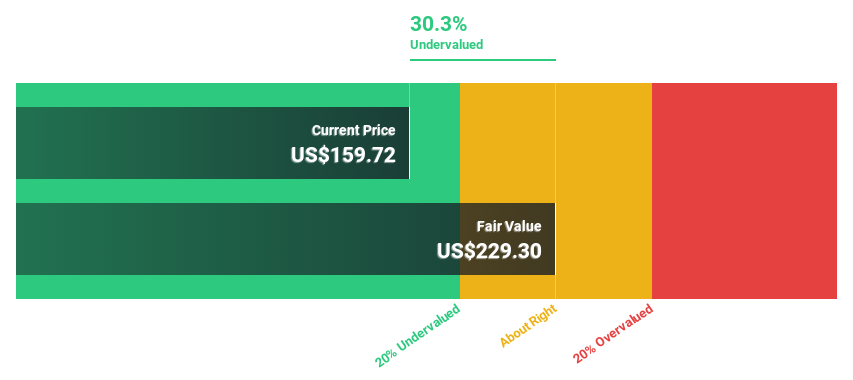

Leidos Holdings (NYSE:LDOS)

Overview: Leidos Holdings, Inc. provides services and solutions in the defense, intelligence, civil, and health markets both in the United States and internationally, with a market cap of $20.23 billion.

Operations: The company's revenue segments include defense, intelligence, civil, and health markets in the United States and internationally, with a segment adjustment of $16.01 million.

Estimated Discount To Fair Value: 32.3%

Leidos Holdings is trading at 32.3% below its estimated fair value of US$221.7, suggesting it may be undervalued based on cash flows. Despite a high level of debt and recent profit margin declines, the company's earnings are forecast to grow significantly at 29% per year over the next three years, outpacing the US market average. Recent substantial contracts with NIH and NGA bolster future cash flow prospects, reinforcing its position in secure software development and AI-assisted solutions.

- According our earnings growth report, there's an indication that Leidos Holdings might be ready to expand.

- Take a closer look at Leidos Holdings' balance sheet health here in our report.

Where To Now?

- Unlock our comprehensive list of 182 Undervalued US Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

A biopharmaceutical company, focuses on discovering, developing, and commercializing novel therapeutics based on ribonucleic acid interference.

High growth potential low.