- United States

- /

- Biotech

- /

- NasdaqGS:AGIO

A Look at Agios Pharmaceuticals (AGIO) Valuation Following Strong Phase 3 Sickle Cell Trial Results

Reviewed by Simply Wall St

Agios Pharmaceuticals (AGIO) just released topline results from its RISE UP Phase 3 trial of mitapivat in sickle cell disease. The study achieved its primary efficacy goal, showing a clear gap between treatment and placebo groups.

See our latest analysis for Agios Pharmaceuticals.

Agios Pharmaceuticals has grabbed attention with its Phase 3 results, but the share price tells a complex story. Despite excitement following the announcement and a recent 16% rally over the past week, momentum has faded somewhat in the bigger picture. Agios’s year-to-date share price return sits at -8%, while its 1-year total shareholder return stands at a challenging -51%. This mixed performance hints at both renewed optimism from clinical progress and lingering caution among longer-term investors.

If you're keen to spot other breakthrough drug developers and biotech leaders, discover fresh opportunities with our free Healthcare Stocks Screener. Your next winner could be waiting there. See the full list for free.

So with shares still down sharply over the past year but impressive trial results in hand, does Agios Pharmaceuticals represent an undervalued opportunity for investors now, or is the market anticipating more growth ahead?

Most Popular Narrative: 31% Undervalued

Based on the widely followed narrative, Agios Pharmaceuticals' fair value estimate sits well above its last close price, signaling a notable gap in the eyes of the consensus. With shares trading at $29.20 and the narrative fair value at $42.33, the story suggests a valuation disconnect that goes beyond recent price swings.

Upcoming potential FDA approval and commercial launch of PYRUKYND for thalassemia in the U.S. is set to significantly expand Agios' addressable market. This is driven by the high rate of disease diagnosis through newborn screening and well-defined patient populations, and may lift revenue growth in coming years.

Curious about the forecast that powers this valuation? The most popular narrative is built on a set of bold growth assumptions, including anticipated surges in future revenue and profitability. Want to see the numbers that drive this upside? There is a striking story behind the math, and it is revealed in full detail inside the narrative itself.

Result: Fair Value of $42.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high spending and overreliance on PYRUKYND’s expansion could challenge Agios's growth prospects if approvals or launches face obstacles.

Find out about the key risks to this Agios Pharmaceuticals narrative.

Another View: Multiples Raise Red Flags

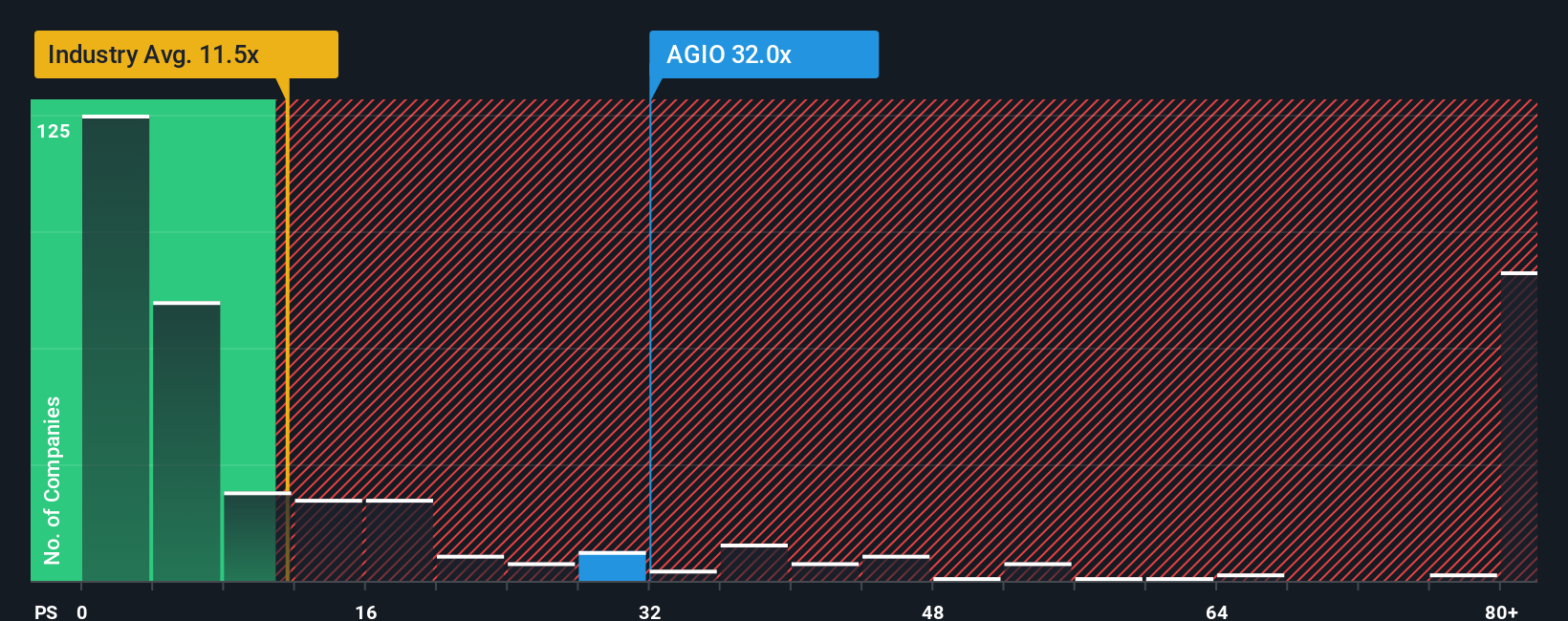

While the narrative suggests Agios Pharmaceuticals is deeply undervalued, a quick check on valuation multiples presents a different viewpoint. The company’s price-to-sales ratio stands at 38x, which is much higher than the US biotech industry’s 13.1x and its peer average of 6x. This significant gap indicates the market may be placing a substantial premium on future growth that is not guaranteed. Is there a real opportunity here, or could investors be paying too much for potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agios Pharmaceuticals Narrative

If you think the story could look different or want to dig into the details yourself, it only takes a few minutes to build your own view. Do it your way

A great starting point for your Agios Pharmaceuticals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let potential winners slip through your fingers. Make your next move by tapping into curated stock ideas that could boost your returns far beyond the ordinary.

- Find explosive opportunity and spot high-upside outliers by checking out these 3572 penny stocks with strong financials before the crowd catches on.

- Unlock leading innovators in artificial intelligence and take your portfolio into the future with these 25 AI penny stocks that are transforming entire industries.

- Secure value with confidence. See which stocks the market may be missing out on and review these 920 undervalued stocks based on cash flows uncovering overlooked gems right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGIO

Agios Pharmaceuticals

A biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.