- United States

- /

- Biotech

- /

- NasdaqGS:ACLX

Arcellx (ACLX) Valuation Check After Strong Phase 2 iMMagine-1 Results for Anito-cel in Multiple Myeloma

Reviewed by Simply Wall St

Arcellx (ACLX) just put fresh clinical data on the table, and it is the kind investors tend to pay attention to. The company reported pivotal Phase 2 results for its multiple myeloma CAR T, anito cel.

See our latest analysis for Arcellx.

The upbeat iMMagine 1 readout has arrived after a choppy stretch, with the stock’s 30 day share price return still negative even as the 90 day move turns positive and three year total shareholder returns remain very strong. This hints that momentum may be rebuilding.

If this kind of late stage biotech catalyst has your attention, it could be a good moment to see what else is brewing across healthcare stocks.

With the shares still down double digits over the past year yet trading at a steep discount to Wall Street price targets, is Arcellx quietly setting up as a mispriced growth story, or are markets already looking ahead?

Price to Book of 9.7x: Is it justified?

On a price to book basis, Arcellx looks expensive at $74.08 per share, trading well above both biotech peers and its closest comparisons.

The price to book multiple compares the market value of the company to its net assets, a common yardstick for early stage, loss making biotechs where earnings are not yet meaningful. For Arcellx, a 9.7 times price to book ratio suggests investors are assigning a substantial premium to its clinical assets and future revenue potential rather than its current balance sheet.

Relative to the broader US biotech industry average of 2.7 times price to book, Arcellx is valued at more than triple the typical multiple. It still screens as pricey compared with a peer group average of 5.8 times. That kind of rich premium signals the market is pricing in strong execution on its CAR T and pipeline strategy and it leaves less room for disappointment if development timelines slip or competitive dynamics shift.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 9.7x (OVERVALUED)

However, setbacks in pivotal trials or delays with partners like Kite Pharma could quickly challenge the optimistic expectations embedded in Arcellx’s lofty valuation.

Find out about the key risks to this Arcellx narrative.

Another View, Through Our DCF Lens

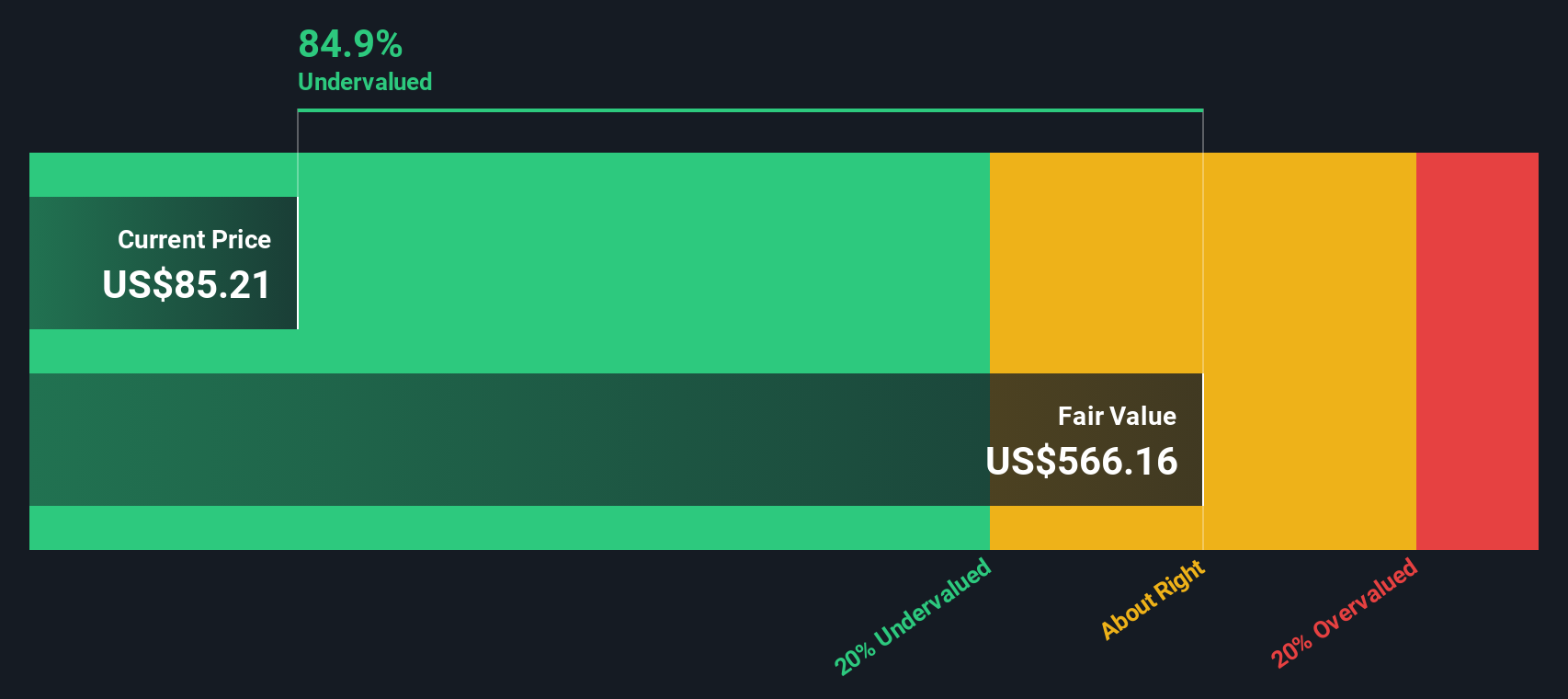

While the price to book ratio says Arcellx is expensive, our SWS DCF model suggests the opposite, with the shares trading around 86% below an estimated fair value of approximately $538 per share. One model flags valuation risk, and the other implies potential upside, so which story will markets believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arcellx for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arcellx Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes, Do it your way.

A great starting point for your Arcellx research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single ticker. Your next standout opportunity could be hiding in plain sight on the Simply Wall St Screener, waiting for you to act.

- Capitalize on potential mispricings by reviewing these 902 undervalued stocks based on cash flows that strong cash flow analysis suggests the market is overlooking.

- Get ahead of the next wave of innovation by scanning these 27 AI penny stocks shaping the future of automation, data insight, and intelligent products.

- Strengthen your income strategy by evaluating these 15 dividend stocks with yields > 3% that combine meaningful yields with the potential for long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLX

Arcellx

Together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026