- United States

- /

- Biotech

- /

- NasdaqGS:ABOS

Uncovering Opportunities: Beauty Health Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As major U.S. stock indexes reach new highs, driven by solid corporate earnings and potential interest rate cuts, investors are increasingly looking beyond the giants of Wall Street for opportunities. Penny stocks—often representing smaller or newer companies—continue to attract attention for their potential to offer both affordability and growth. Despite being an older term, these stocks remain relevant as they can provide a unique blend of financial strength and growth prospects when carefully selected.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.91 | $409.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.77 | $650.99M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.09 | $191.54M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.97 | $869.92M | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $5.00 | $56.92M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $2.00 | $24.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.99 | $7.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.62 | $84.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.78 | $11.73M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 359 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Beauty Health (SKIN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: The Beauty Health Company, along with its subsidiaries, operates in the design, development, manufacturing, marketing, and sales of aesthetic technologies and products across various regions including the Americas, Asia-Pacific, Europe, the Middle East, and Africa with a market cap of $185.17 million.

Operations: The company's revenue is generated from its Personal Products segment, totaling $310.06 million.

Market Cap: $185.17M

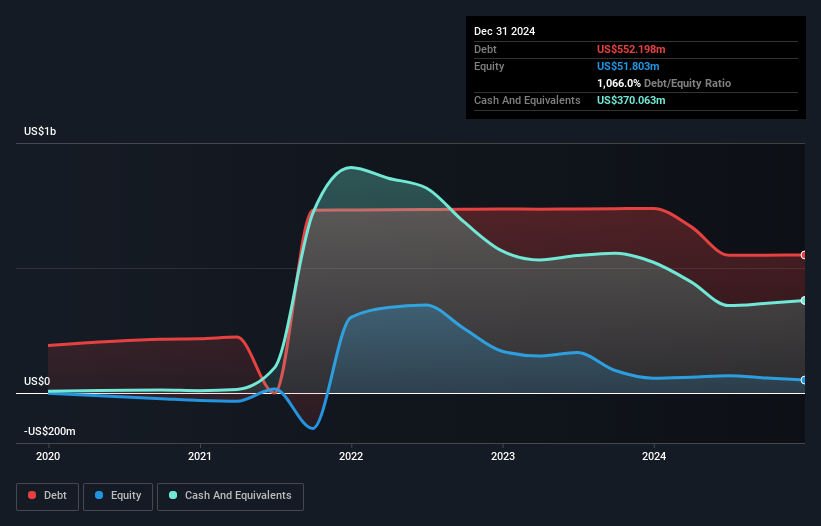

Beauty Health, with a market cap of US$185.17 million, is navigating financial challenges yet showing resilience. Despite being unprofitable with a negative return on equity, it has a positive cash flow and sufficient runway for over three years. Recent leadership changes bring seasoned expertise from the healthcare sector, potentially aiding strategic shifts. The company reported improved earnings in 2025's first half but faces declining sales projections for the year. Share price volatility remains high; however, shareholder dilution hasn't been significant recently. The company's short-term assets cover liabilities well but long-term debt remains an issue to monitor closely.

- Get an in-depth perspective on Beauty Health's performance by reading our balance sheet health report here.

- Learn about Beauty Health's future growth trajectory here.

Acumen Pharmaceuticals (ABOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Acumen Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on developing targeted therapies for Alzheimer's disease, with a market cap of $133.26 million.

Operations: Acumen Pharmaceuticals, Inc. currently does not report any revenue segments as it is focused on developing therapies for Alzheimer's disease.

Market Cap: $133.26M

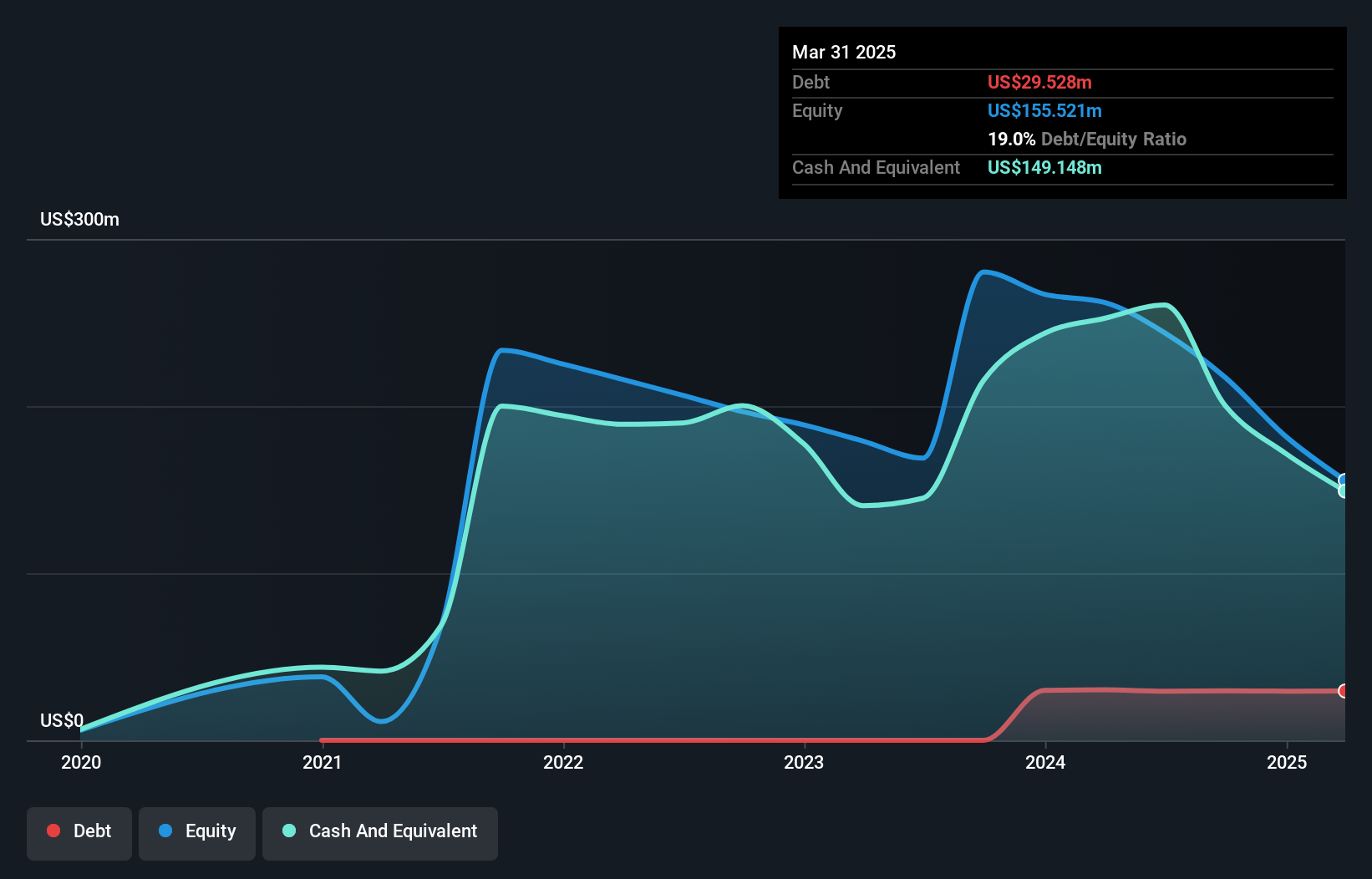

Acumen Pharmaceuticals, with a market cap of US$133.26 million, remains pre-revenue as it focuses on Alzheimer's therapies. Despite its unprofitability and increased losses—US$40.95 million for Q2 2025—the company sustains a solid financial position with short-term assets exceeding liabilities and more cash than debt. The management team is experienced, supporting strategic development efforts amidst high share price volatility. Recent removal from the S&P Global BMI Index highlights market challenges, yet participation in key healthcare conferences suggests ongoing industry engagement and visibility as it seeks future breakthroughs in its clinical endeavors.

- Navigate through the intricacies of Acumen Pharmaceuticals with our comprehensive balance sheet health report here.

- Examine Acumen Pharmaceuticals' earnings growth report to understand how analysts expect it to perform.

Pulmonx (LUNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulmonx Corporation is a commercial-stage medical technology company offering minimally invasive treatments for severe emphysema, with a market cap of $63.56 million.

Operations: Pulmonx generates revenue primarily from its medical products segment, totaling $90.55 million.

Market Cap: $63.56M

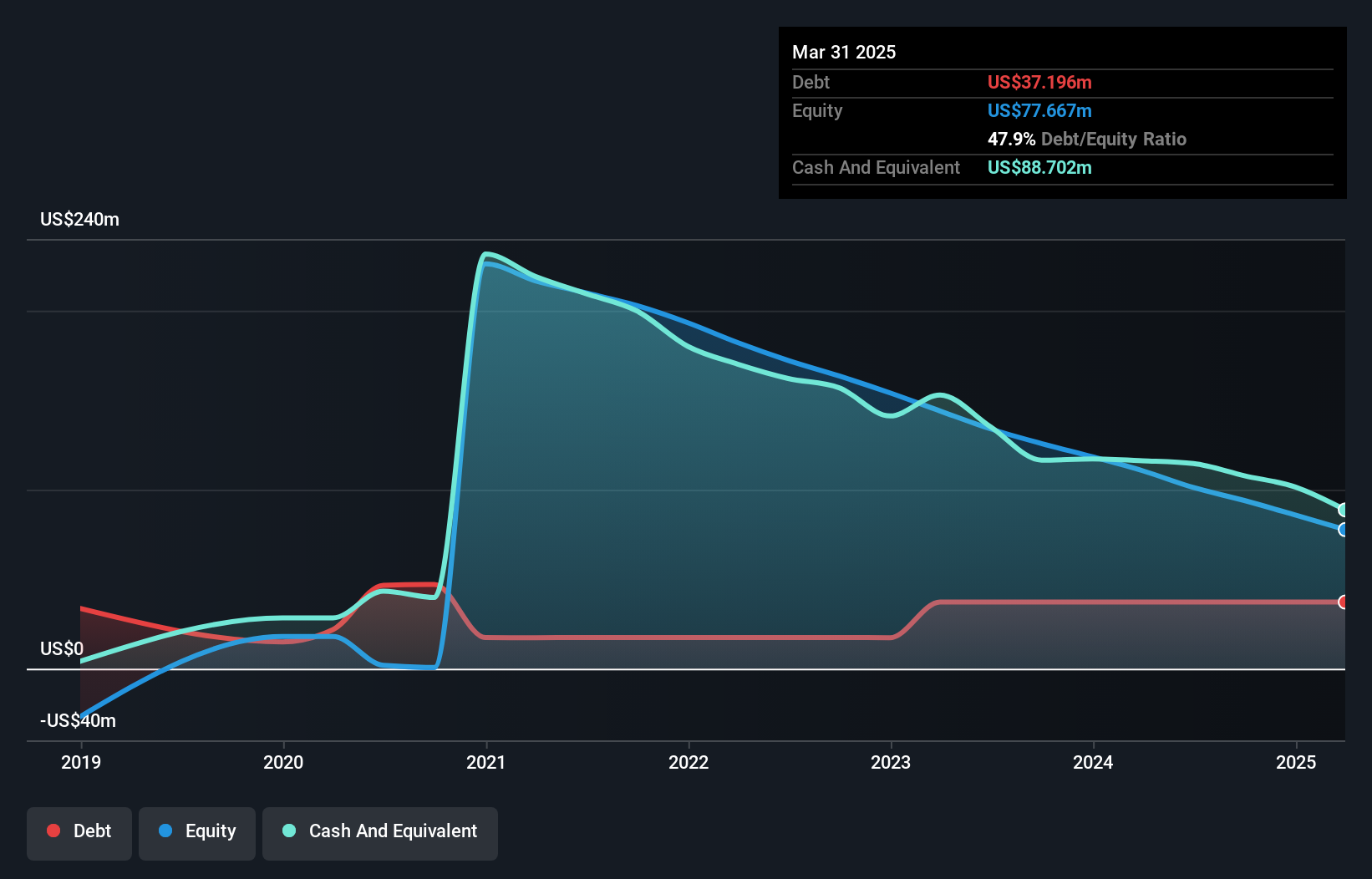

Pulmonx Corporation, with a market cap of US$63.56 million, is navigating significant executive changes as Glendon E. French returns as CEO amidst recent leadership transitions. The company anticipates Q3 2025 revenue of approximately US$21.5 million, reflecting its ongoing commercial operations in medical technology for emphysema treatment despite current unprofitability and a negative return on equity. Pulmonx maintains a solid cash position exceeding its debt and short-term liabilities, while its share price remains highly volatile. Recent partnerships and conference engagements indicate strategic efforts to enhance industry presence and product integration capabilities amidst financial challenges.

- Take a closer look at Pulmonx's potential here in our financial health report.

- Gain insights into Pulmonx's future direction by reviewing our growth report.

Next Steps

- Unlock more gems! Our US Penny Stocks screener has unearthed 356 more companies for you to explore.Click here to unveil our expertly curated list of 359 US Penny Stocks.

- Curious About Other Options? The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABOS

Acumen Pharmaceuticals

A clinical-stage biopharmaceutical company, develops targeted therapies for the treatment of Alzheimer’s disease.

Excellent balance sheet with low risk.

Market Insights

Community Narratives