- United States

- /

- Biotech

- /

- NasdaqCM:ABEO

Abeona Therapeutics (ABEO): Assessing Value After J-Code Milestone for ZEVASKYN Approval

Reviewed by Simply Wall St

Abeona Therapeutics (ABEO) just announced that the Centers for Medicare and Medicaid Services has established a permanent J-code for ZEVASKYN, its gene therapy for RDEB. The code takes effect in January 2026, making billing and access for providers more efficient.

See our latest analysis for Abeona Therapeutics.

Even with this major regulatory milestone for ZEVASKYN, Abeona Therapeutics’ share price return has been under pressure, with a 30-day retreat of 22.2% and a year-to-date slide of 29.44%. Over the past year, the total shareholder return is down 31.7%. Patient long-term investors may note the company’s positive three-year total return of 3.2% even after big swings, indicating that momentum has been both volatile and cautious as the market weighs both progress and risks.

If you’re tracking moves in biotech, consider exploring See the full list for free. for more healthcare companies making headlines and driving innovation.

With the stock now trading well below analyst targets despite recent progress, investors must ask if this beaten-down valuation signals an attractive entry point or if Abeona’s future growth prospects are already reflected in the price.

Price-to-Earnings of 3.7x: Is it justified?

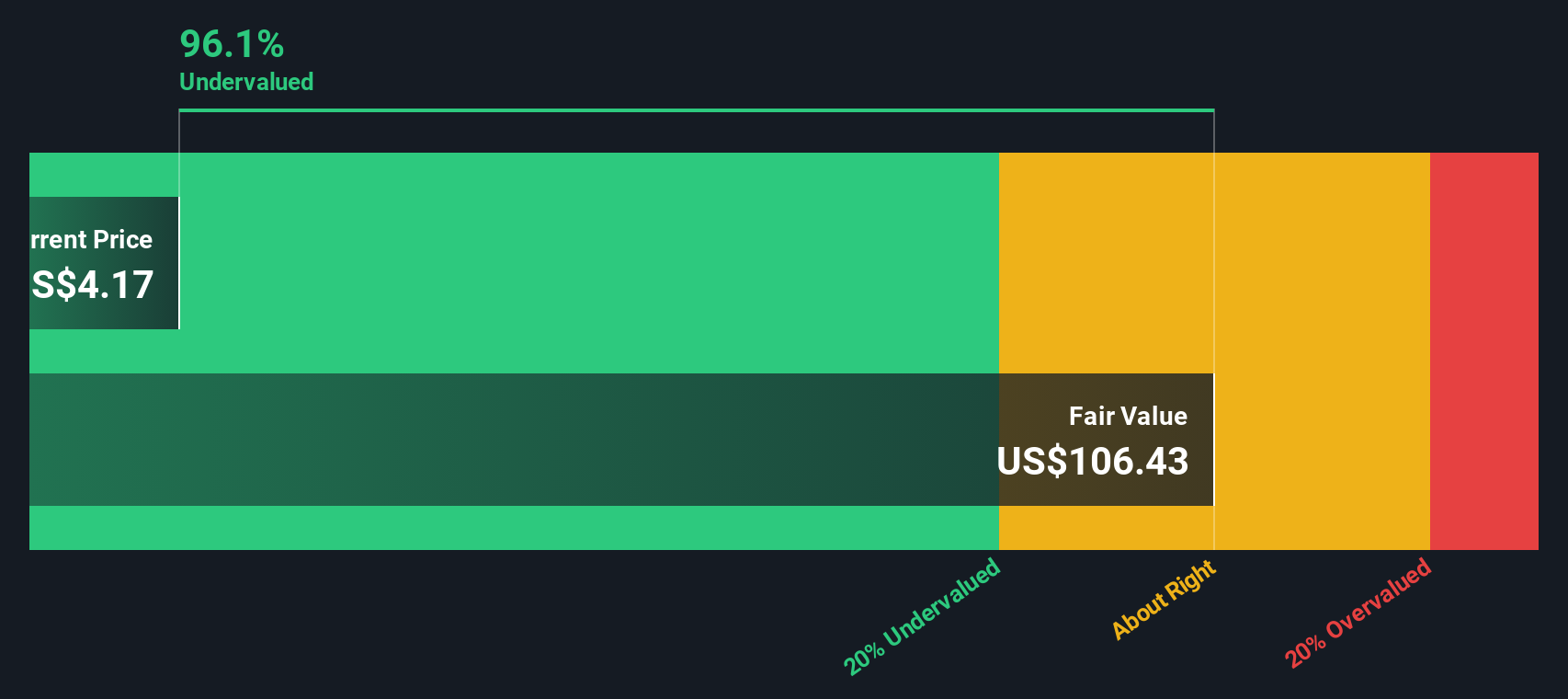

With Abeona Therapeutics trading at a price-to-earnings (P/E) ratio of just 3.7x, the latest closing price of $4.17 looks deeply discounted compared to both industry peers and fair value benchmarks.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings, capturing the market’s expectations for future profit growth. In the biotech sector, above-average growth companies often command much higher multiples due to the potential for breakthroughs and new therapies that may drive profits higher over time.

Abeona’s current P/E is significantly lower than the US Biotechs industry average of 17.1x, the peer group average of 15.5x, and its estimated fair P/E of 16.5x. This substantial gap suggests the market may be undervaluing Abeona’s profit potential, possibly due to lingering concerns about recent volatility or uncertainty around future milestones. If sentiment changes, the multiple could move toward the fair ratio indicated by regression analysis, which may result in meaningful upside.

Explore the SWS fair ratio for Abeona Therapeutics

Result: Price-to-Earnings of 3.7x (UNDERVALUED)

However, continued clinical or regulatory setbacks, along with ongoing share price volatility, could easily curb investor optimism despite the company’s discounted valuation.

Find out about the key risks to this Abeona Therapeutics narrative.

Another View: SWS DCF Model Offers a Different Perspective

While multiples suggest Abeona Therapeutics is undervalued, the SWS DCF model tells a strikingly different story. According to this method, Abeona’s fair value is estimated at $106.43, which is substantially higher than the current price. This contrast raises the question: is the market missing a deeper value, or simply discounting risks that the DCF model overlooks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Abeona Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Abeona Therapeutics Narrative

If you’d rather chart your own course or have a different view of the numbers, you can build your own Abeona Therapeutics narrative in minutes: Do it your way

A great starting point for your Abeona Therapeutics research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Tired of watching from the sidelines? Make your next smart move with actionable ideas from trusted screeners and take your investing up a level today.

- Unlock hidden opportunities by checking out these 872 undervalued stocks based on cash flows, which features companies trading below their intrinsic value and potentially set for growth.

- Supercharge your search for long-term income by scanning these 15 dividend stocks with yields > 3%, featuring stocks that deliver steady yields over 3%.

- Get ahead of the curve with these 26 AI penny stocks, highlighting fast-moving businesses using artificial intelligence innovations to transform entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ABEO

Abeona Therapeutics

A clinical-stage biopharmaceutical company, develops gene and cell therapies for life-threatening diseases.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives