- United States

- /

- Entertainment

- /

- NYSE:SPHR

Sphere Entertainment (SPHR): Evaluating Valuation as Short Interest Surges to 33%

Reviewed by Simply Wall St

The biggest thing drawing attention to Sphere Entertainment (SPHR) right now is a substantial jump in short interest, with roughly a third of shares sold short. This trend is bringing increased focus to investor sentiment.

See our latest analysis for Sphere Entertainment.

Despite the high short interest making headlines, Sphere Entertainment’s share price has powered higher, posting a 21.4% gain over the past month and a notable 100.3% year-to-date share price return. The stock’s one-year total shareholder return of 105% highlights how strongly momentum has shifted in the company’s favor, even as bearish bets rise and executive changes are made in the background.

If this level of volatility and momentum has you wondering what other dynamic teams are making market moves, now’s the perfect time to discover fast growing stocks with high insider ownership

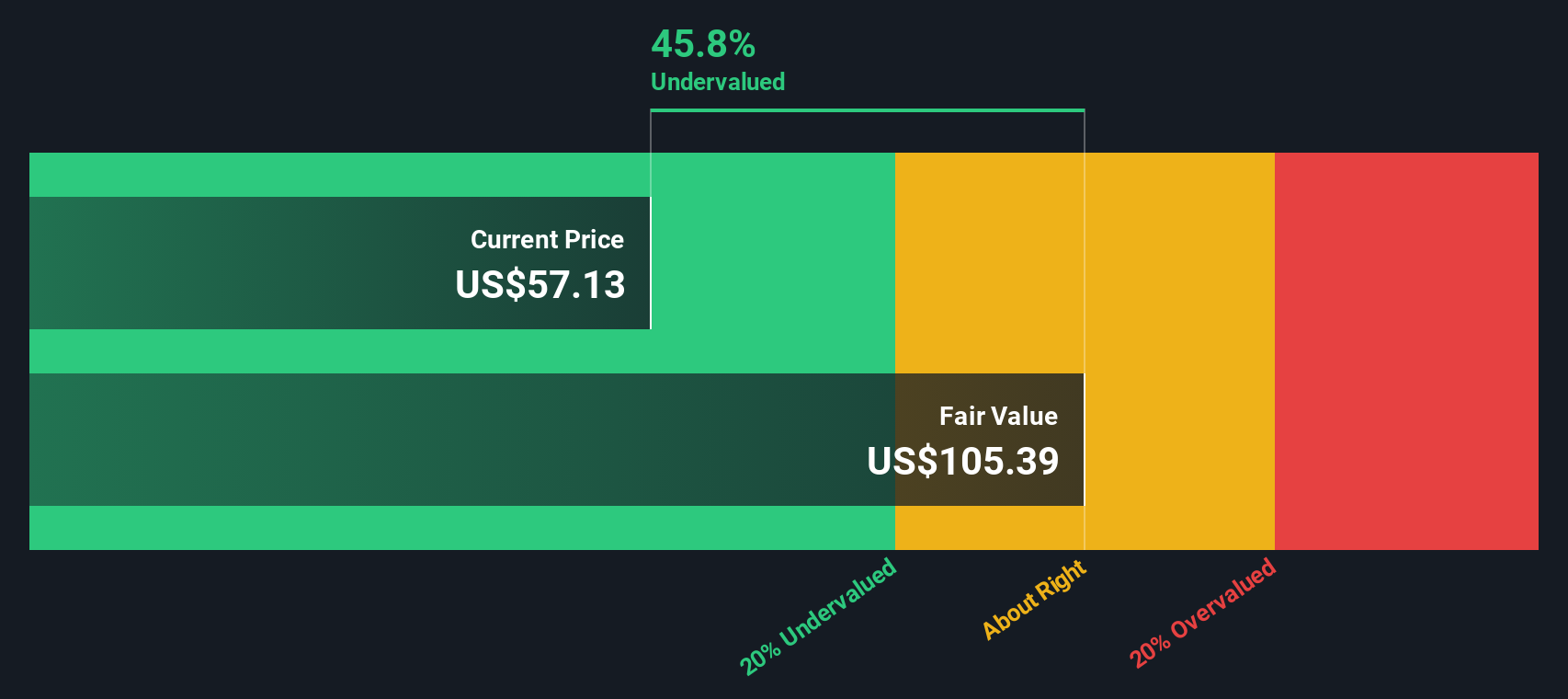

With short sellers increasing their bets against Sphere Entertainment even as shares soar, the key question now is whether the company is still undervalued or if current valuations already reflect all the anticipated growth, leaving little room for upside.

Most Popular Narrative: 10% Overvalued

Sphere Entertainment’s last close price of $83.14 sits well above the narrative’s fair value estimate. This sets the stage for debate over whether optimistic growth drivers truly justify current valuations.

The expansion into new markets, particularly the development of both full-size and smaller franchise-model Spheres internationally (such as in Abu Dhabi and potential other cities), directly positions Sphere Entertainment to benefit from the increasing demand for experiential destination entertainment. This supports long-term revenue growth and margin scalability through asset-light models.

What underpins this aggressive pricing? Behind the scenes, projections hinge on bold international moves, scaling high-margin technology, and achieving profit multiples that only top industry players tend to see. Is the market rewarding real future earnings, or are expectations running ahead of reality? Dive deeper into the narrative and see what numbers drive this valuation verdict.

Result: Fair Value of $75.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering questions around sluggish Las Vegas consumer trends and high ongoing venue costs could quickly temper current optimism if either of these factors weakens further.

Find out about the key risks to this Sphere Entertainment narrative.

Another View: What Does the SWS DCF Model Say?

Looking beyond market momentum and analyst targets, our DCF model estimates Sphere Entertainment’s fair value at $90.47 per share, which is higher than the current share price. This suggests that, based on long-term cash flow assumptions, the stock may still be undervalued. Is this model identifying value others are missing, or are its forecasts optimistic compared to today's risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sphere Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 930 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sphere Entertainment Narrative

If you see the numbers differently or want to take a closer look for yourself, it's easy to build your own view in just a few minutes. Do it your way

A great starting point for your Sphere Entertainment research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't let your momentum stop here. Propel your portfolio forward by tapping into additional powerful trends and strategies you can act on today:

- Capture steady income streams by analyzing these 14 dividend stocks with yields > 3% with yields strong enough to reinforce your financial goals, even in changing markets.

- Capitalize on future-shaping breakthroughs when you target companies at the forefront of innovation by starting with these 25 AI penny stocks.

- Seize undervalued market gems by evaluating these 930 undervalued stocks based on cash flows poised for potential upside others might overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPHR

Sphere Entertainment

Operates as a live entertainment and media company in the United States.

Imperfect balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026