- United States

- /

- Entertainment

- /

- NYSE:SE

Sea (SE) Reports First-Quarter Net Income Of US$403M

Reviewed by Simply Wall St

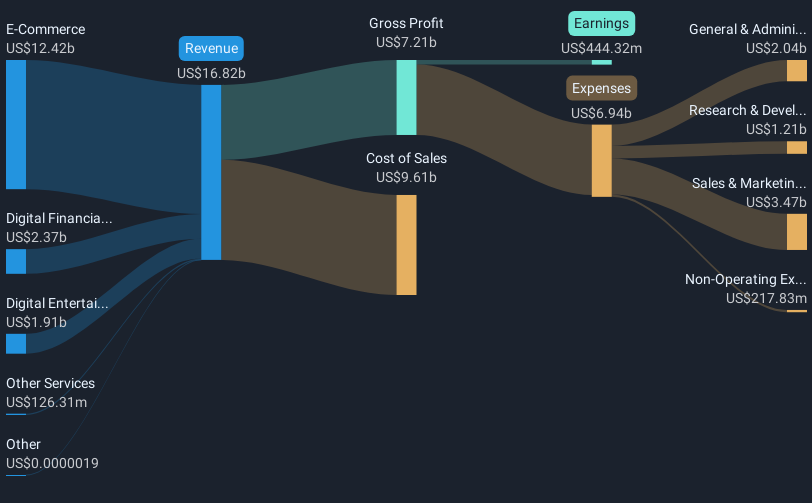

Following the latest announcement of impressive first-quarter earnings, Sea (SE) witnessed a notable upward movement in its stock price, registering a 38% increase over the last quarter. During this period, Sea's income statement revealed a significant turnaround with the company reporting a net income of USD 403 million, a decisive shift from the previous yearly net loss. The reported revenues of USD 4.8 billion also reflected substantial year-over-year growth. These strong financial results likely bolstered investor confidence, aligning with broader market optimism driven by robust corporate earnings, even as indices like the S&P 500 slipped from record highs.

Buy, Hold or Sell Sea? View our complete analysis and fair value estimate and you decide.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

The recent earnings announcement has seemingly reinforced the optimistic narrative around Sea’s future growth, facilitating a robust 38% lift in its share price over the current quarter. With the reported revenue reaching US$4.8 billion and a swing to profitability with a net income of US$403 million, it's realistic to expect these financial achievements to bolster revenue and earnings forecasts. Furthermore, the company's ongoing expansion into markets like Brazil and its focus on AI adoption are components likely to support future profitability, aligning well with the company's current strategic ambitions.

Over the past year, Sea's total returns, including share price and dividends, surged 142.99%. Compared to the industry, Sea surpassed the one-year return of 73.6% for the US Entertainment industry. Despite these impressive returns, Sea's share price at US$167.08 is closely aligned with its targeted price based on analyst projections, with a marginal 6% discount to the consensus price target of US$177.27. This suggests analysts view the stock as near fair value, emphasizing the importance for investors to cautiously verify these projections against their own criteria and expectations.

Assess Sea's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives