- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit’s Surging Ad Revenue and User Growth Might Change The Case For Investing In Reddit (RDDT)

Reviewed by Sasha Jovanovic

- Reddit recently reported very large year-over-year growth in advertising revenue, with daily active users up 19% and improved monetization driven by the integration of 'Reddit Answers' into its enhanced search function.

- This shift reflects Reddit's growing leverage from product innovation and international expansion, while maintaining strong 28% profitability margins and delivering US$163 million in net income despite a slowdown in licensing growth.

- We'll examine how Reddit's surging advertising revenue and user engagement could influence its investment narrative and long-term prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Reddit Investment Narrative Recap

To be a Reddit shareholder, you have to believe the company can quickly scale its user-generated content model and diversify revenue beyond advertising, even as competition and regulatory risk loom large. The recent surge in advertising revenue supports optimism around monetization and user engagement as short-term catalysts, but does little to change the most significant risk, ongoing sensitivity to changes in digital ad markets and privacy regulations. For now, this news event is positive for sentiment but does not fundamentally alter the risk-reward balance.

Of Reddit’s recent announcements, the integration of 'Reddit Answers' into its enhanced search function stands out as most relevant. This directly supports the surge in ad revenue by improving search-driven discovery and monetization efficiency, two areas seen as pivotal to sustaining higher daily active user growth and retention. In this context, improved product experience could become an advantage, provided Reddit keeps pace with rivals for engagement and community vibrancy.

But while ad-driven growth is impressive, investors should not overlook the ongoing risk from evolving privacy restrictions and online ad tracking changes, especially as...

Read the full narrative on Reddit (it's free!)

Reddit's narrative projects $3.8 billion revenue and $1.0 billion earnings by 2028. This requires 31.8% yearly revenue growth and a $783.7 million earnings increase from $216.3 million today.

Uncover how Reddit's forecasts yield a $240.27 fair value, a 24% upside to its current price.

Exploring Other Perspectives

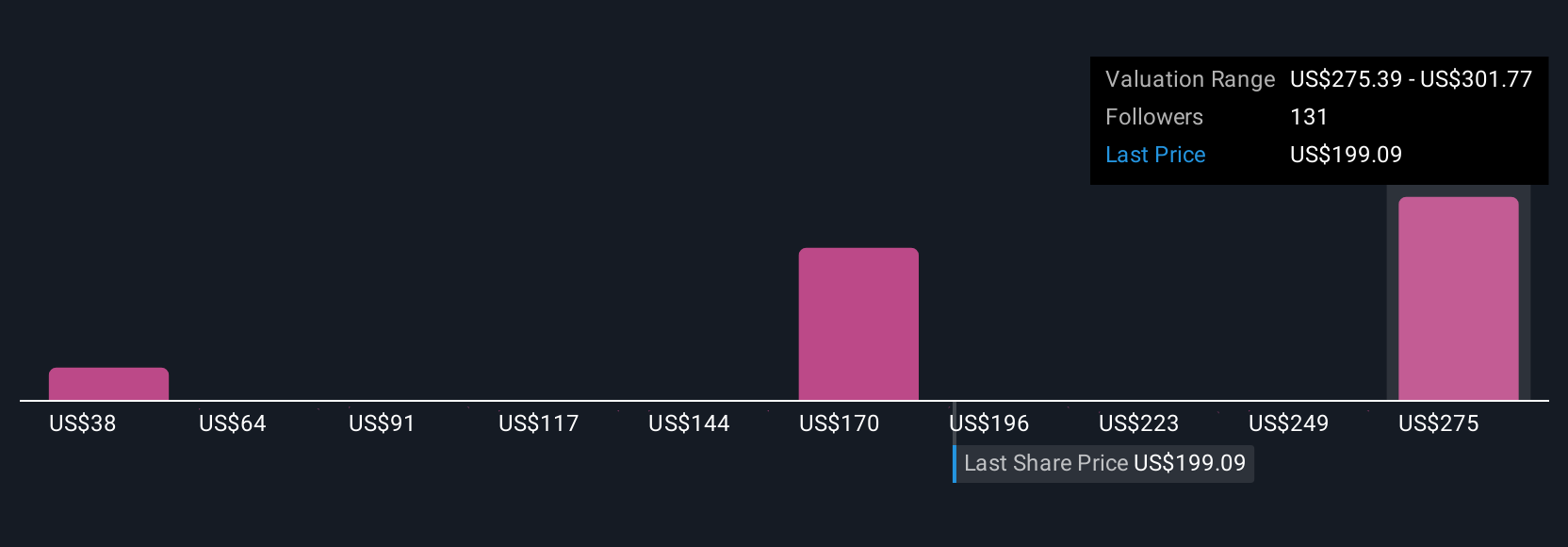

Fair value opinions from 22 Simply Wall St Community members span US$97 to US$307 per share, reflecting broad disagreement on Reddit’s future potential. Keep in mind, high dependence on digital advertising revenue means Reddit’s outlook remains closely tied to the unpredictable shifts in the online ad market, consider how this might shape your own view.

Explore 22 other fair value estimates on Reddit - why the stock might be worth as much as 59% more than the current price!

Build Your Own Reddit Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reddit research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Reddit research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reddit's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives