- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (RDDT) Reports Q2 2025 Earnings Surge With Sales Up To US$500M

Reviewed by Simply Wall St

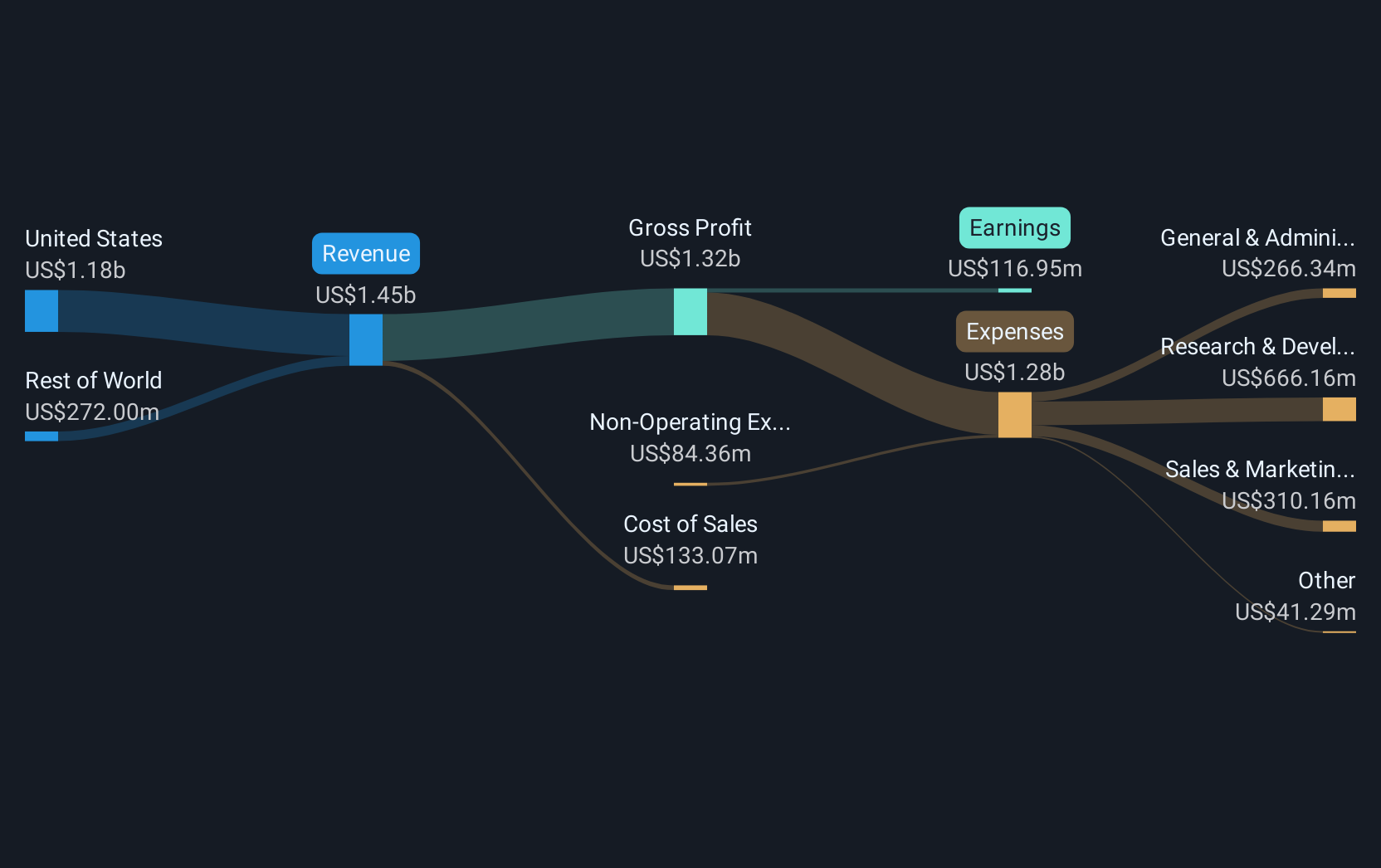

Reddit (RDDT) experienced a substantial legal development when a class action lawsuit was filed against it in August 2025, centered on allegedly misleading statements related to Google Search. Despite these challenges, the company reported a significant improvement in its Q2 2025 earnings, with sales jumping to $500 million from $281 million year-over-year, and net income rising to $89 million. Additionally, market optimism about potential rate cuts fueled by recent consumer inflation data likely aided the positive environment, aligning with the broader market gains. These elements contributed to Reddit's impressive 123% price increase over the last quarter.

Buy, Hold or Sell Reddit? View our complete analysis and fair value estimate and you decide.

Reddit's recent legal challenges and notable Q2 earnings improvement highlight potential areas of impact on its growth narrative. The 123% share price increase last quarter reflects strong investor sentiment amid these developments. However, assessing the company's longer-term performance, its total shareholder return was very large at over 300% over the past year, indicating strong performance beyond the recent quarterly spike. In the broader context, Reddit's stock outperformed the US market's 19.1% return and the Interactive Media and Services industry's 53% return over the past year.

The legal issues could impact Reddit's future revenue and earnings forecasts, depending on the outcome. Such uncertainties, coupled with existing reliance on digital ad revenue, necessitate careful monitoring. Despite these challenges, Reddit's earnings forecast growth of 37.4% annually suggests strong future potential, albeit with risks. The current share price of $259.03 surpasses the consensus price target of $200.00, signaling potential market overvaluation. Nonetheless, given the extensive positive movement, investors might still perceive Reddit's growth outlook favorably, despite its substantial rise and inherent risks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success