- United States

- /

- Media

- /

- NYSE:NIQ

Does NIQ’s Recent Earnings Slump Create a Fresh Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

If you are holding NIQ Global Intelligence or thinking about buying in, you are probably sizing up your next move. After all, the stock has had a choppy stretch lately, dropping 18.5% since the start of the year, including a 7% dip in the last month alone. But not all signals are red. A 0.6% gain over the last week shows that sentiment can shift quickly, and recent sector-wide optimism seems to be putting a floor under further declines. Investors are watching closely as the market weighs new risks alongside fresh growth potential in the data analytics space, and NIQ’s numbers are right in the crosshairs.

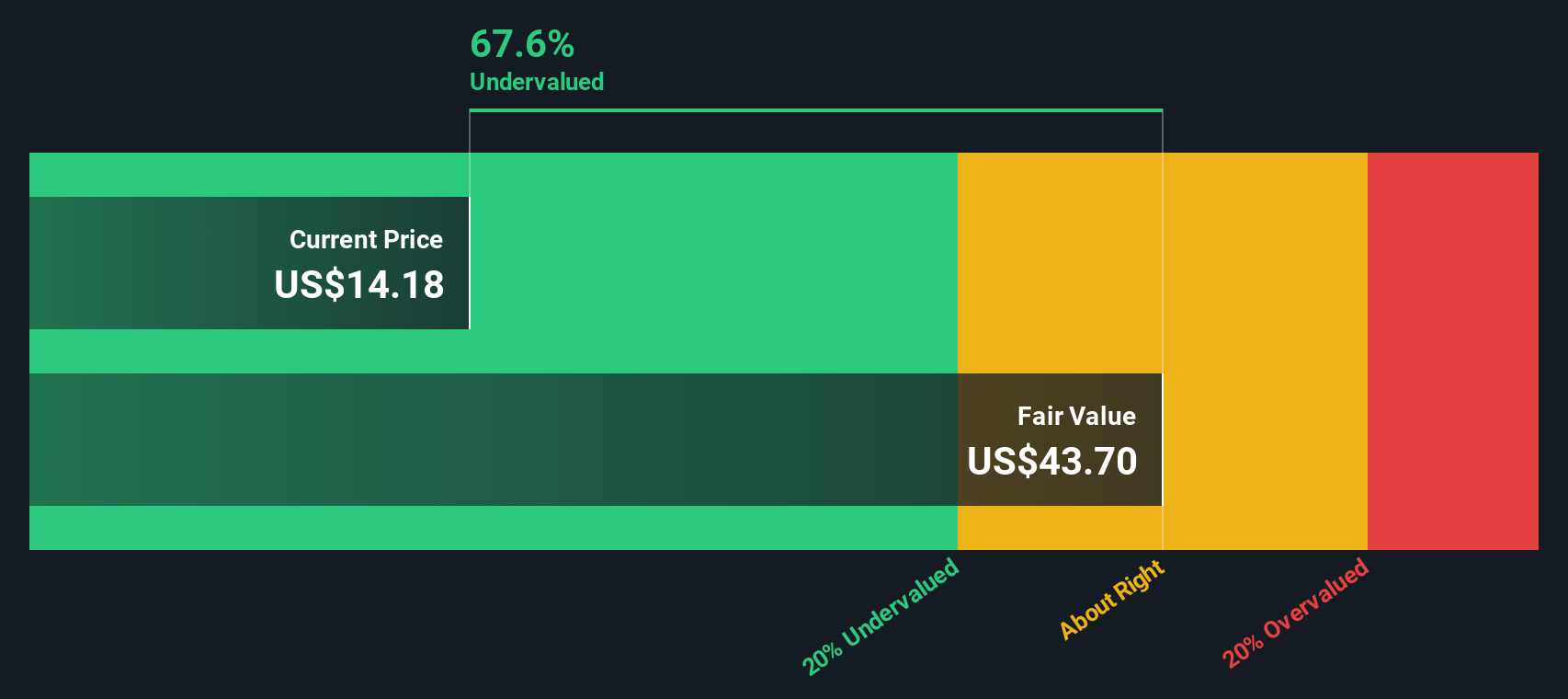

With all this volatility, how do you know what the stock is truly worth? One clue is the valuation score, which puts NIQ Global Intelligence at a robust 4 out of 6. This means it looks undervalued on four key valuation checks. That sparks some confidence, but as with any investment, it pays to dig deeper. In the sections ahead, we will break down the numbers behind that score using several valuation methods. We will then explore a smarter, more nuanced way to gauge just how undervalued NIQ might be.

Approach 1: NIQ Global Intelligence Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model aims to estimate a company's true value by projecting its future cash flows and discounting them back to today's dollars. This approach reflects what investors are willing to pay today for expected cash generated in the years ahead.

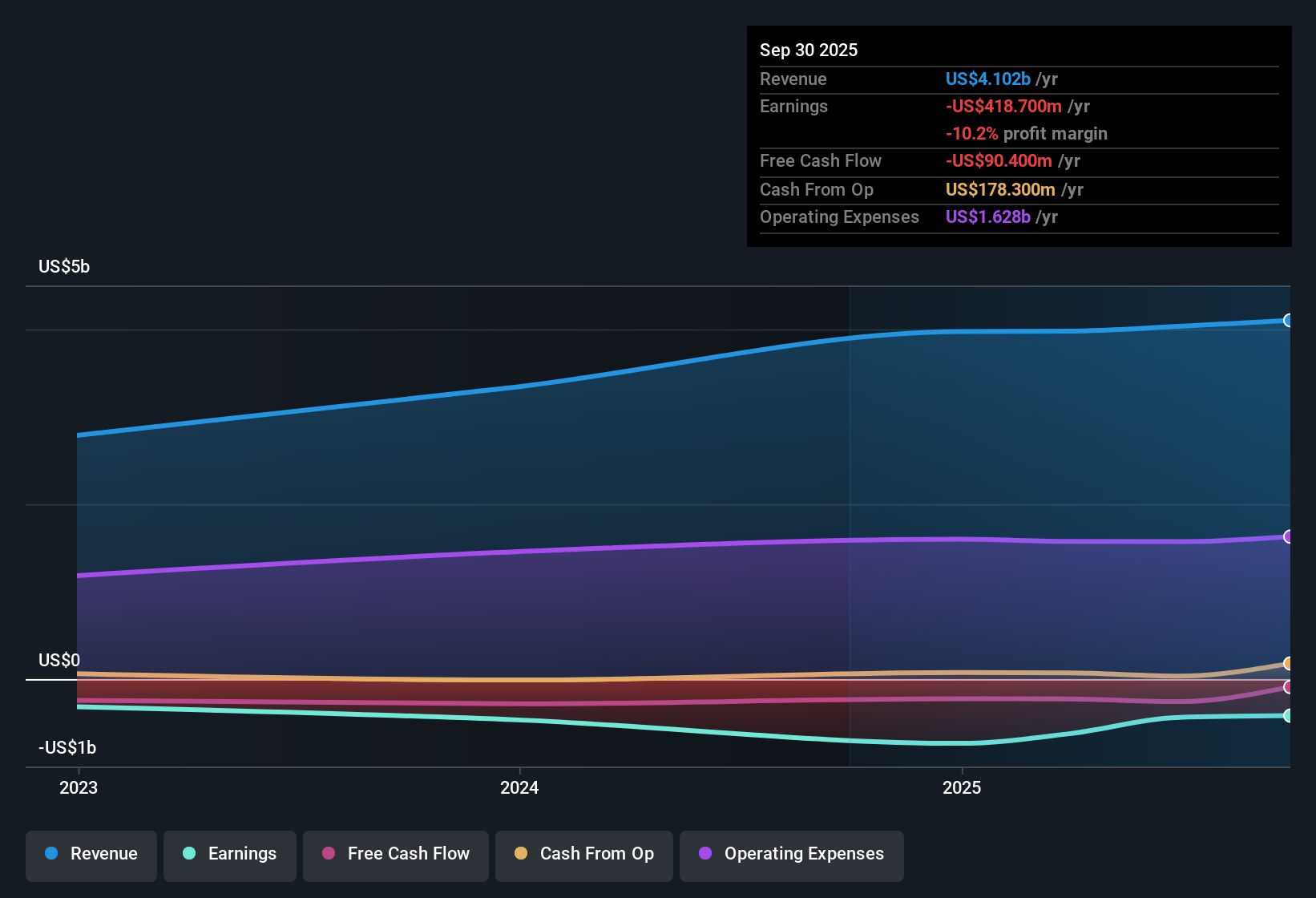

NIQ Global Intelligence currently reports a free cash outflow of $291 million, but the forecast points to a sharp reversal. Analyst estimates suggest annual free cash flow will grow rapidly, reaching $251 million by 2026 and $369 million by 2027. Longer-term projections, which extend a decade into the future, estimate free cash flow climbing as high as $892 million by 2035. Most of these projections are in the hundreds of millions, all reported in $.

Using these forward-looking cash flows, the DCF model calculates an estimated fair value for NIQ stock at $38.51 per share. With the current share price trading at a 59.8% discount to this intrinsic value, the model signals that NIQ Global Intelligence appears significantly undervalued based on its future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NIQ Global Intelligence is undervalued by 59.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

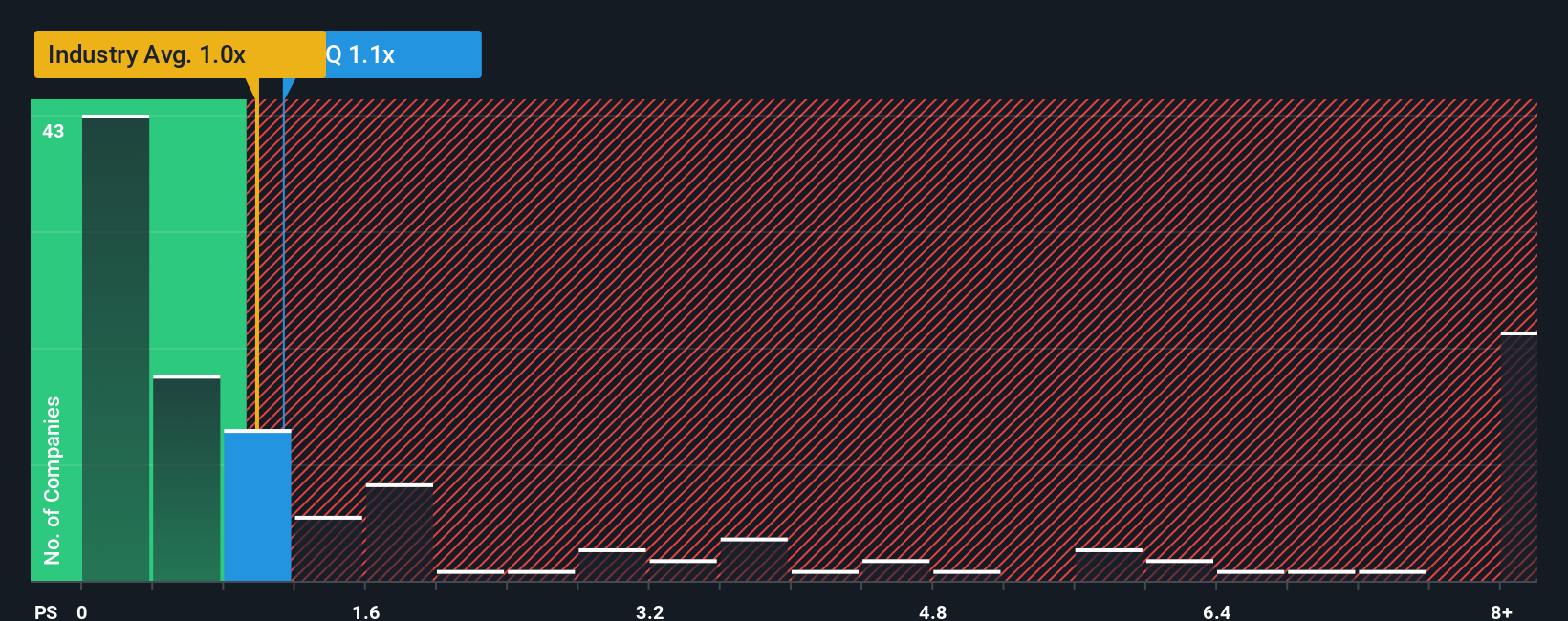

Approach 2: NIQ Global Intelligence Price vs Sales

The price-to-sales (P/S) ratio is the preferred valuation metric for NIQ Global Intelligence because it provides a clear snapshot of how the market is valuing the company’s revenues, especially when net earnings are negative or volatile. This metric is particularly useful for companies in transition or those reinvesting heavily for future growth where profits may not yet fully reflect business momentum.

Normally, expectations for sales growth, profit margins, and the risk profile of a business all influence what constitutes a fair P/S ratio. For companies with strong sales growth and lower risk, investors are willing to pay a higher multiple per dollar of revenue because the future earning potential is seen as more robust and reliable.

NIQ Global Intelligence currently trades at a P/S ratio of 1.13x, which sits just above the Media industry average of 1.05x but well below the peer average at 2.71x. This suggests the stock is relatively modestly priced when compared to similar companies. However, simple comparisons with industry averages or peers have their limitations since they ignore factors unique to NIQ, such as its specific growth outlook and risk profile.

This is where Simply Wall St's Fair Ratio comes in. The Fair Ratio is a proprietary multiple that reflects not just industry and company size, but also key drivers like growth, profitability, and risk. It offers a more tailored and accurate benchmark than using peers or sector averages alone. By directly comparing NIQ’s actual P/S ratio with this Fair Ratio, investors can get a more nuanced signal of whether the stock is currently undervalued, overvalued, or priced about right.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NIQ Global Intelligence Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your unique perspective or story about a company. It’s the "why" behind the numbers, reflecting how you think NIQ Global Intelligence will perform in the future based on your assumptions about future revenue, earnings, margins, and fair value.

Narratives connect a company’s story to a financial forecast, then to an actionable fair value, making it easier to see how your view stacks up. Available on Simply Wall St’s Community page, Narratives are a simple and accessible tool used by millions of investors that let you build or follow different investment viewpoints.

By comparing your Narrative’s Fair Value with NIQ’s current share price, you gain clear insight into whether the stock is a buy, hold, or sell. Since Narratives are updated live as new information or earnings come in, your investment thesis always stays fresh.

For example, some investors may project a much higher fair value for NIQ Global Intelligence by forecasting rapid revenue growth, while others might be more conservative and arrive at a lower estimate based on modest profit margins and slower market expansion.

Do you think there's more to the story for NIQ Global Intelligence? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIQ Global Intelligence might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIQ

NIQ Global Intelligence

A consumer intelligence company, provides software applications and analytics solutions.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026