- United States

- /

- Entertainment

- /

- NYSE:MSGS

Madison Square Garden Sports (MSGS): Valuation Check After BARINGTON’s New High-Conviction Investment

Reviewed by Simply Wall St

BARINGTON Companies Management’s new $3.4 million position in Madison Square Garden Sports (MSGS) is drawing fresh attention, as the stake now represents a meaningful slice of the fund’s overall portfolio.

See our latest analysis for Madison Square Garden Sports.

That confidence comes as MSGS shares change hands around $225.40, with a solid 90 day share price return of 9.23% contrasting with a slightly negative one year total shareholder return. This hints that momentum is quietly rebuilding after a softer spell.

If BARINGTON’s move has you thinking about what else could rerate next, it might be worth exploring fast growing stocks with high insider ownership as a way to spot other potential inflection stories.

With MSGS still trading below consensus targets but already showing strong multiyear returns and rapid profit growth, the key question is whether investors are overlooking further upside or if the market is already pricing in future gains.

Most Popular Narrative Narrative: 14.8% Undervalued

With Madison Square Garden Sports closing at $225.40 against a narrative fair value of $264.50, the story leans toward hidden upside, rooted in long run earnings power.

The upcoming ramp up in high value national media rights fees for the NBA (beginning in fiscal '26) will offset the recent step down in local media rights, positioning MSG Sports for an overall increase in recurring media revenue and supporting both revenue growth and higher net margins over the next several years.

Curious how modest top line growth, rising margins and a punchy future earnings multiple can still argue for upside from here? The narrative’s math may surprise you.

Result: Fair Value of $264.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reduced local media fees and rising player costs could squeeze margins and challenge assumptions about MSGS’s earnings power and the current undervaluation narrative.

Find out about the key risks to this Madison Square Garden Sports narrative.

Another Angle on Valuation

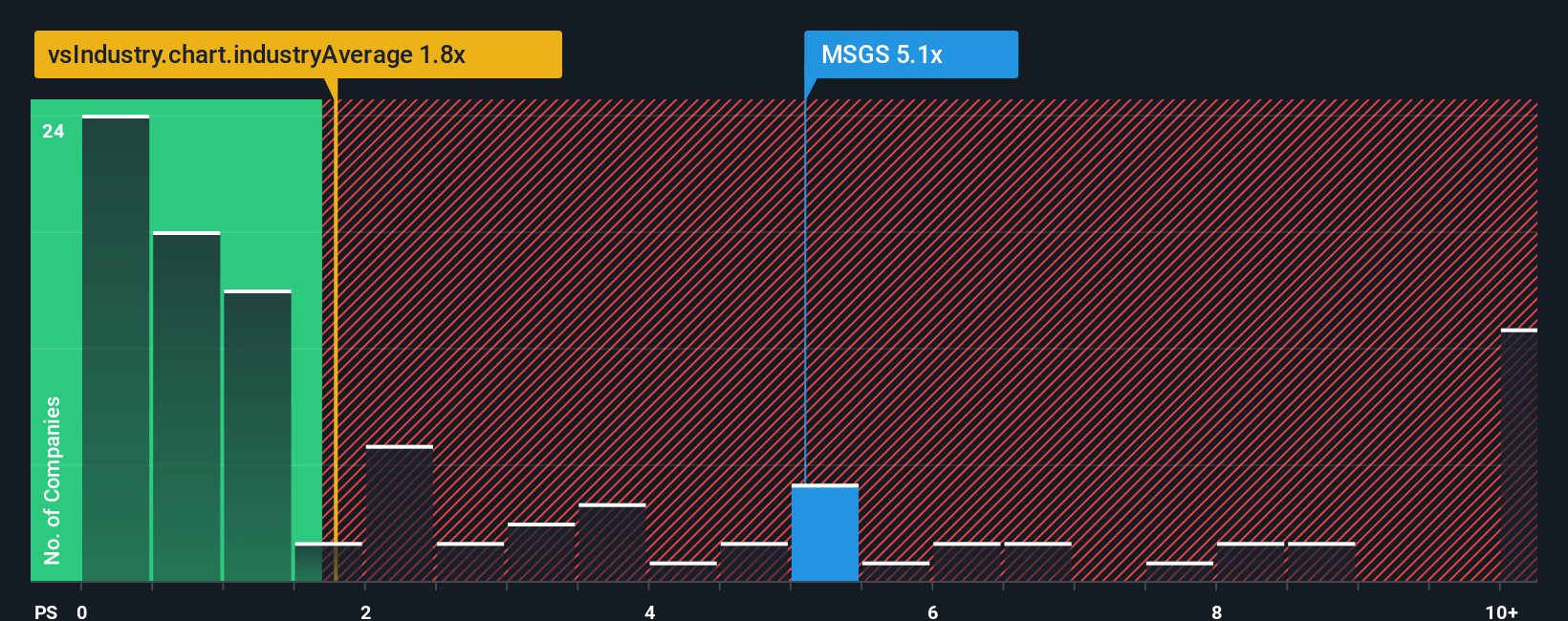

While the narrative points to upside, the price to sales ratio tells a tougher story. MSGS trades at 5.3 times sales, far richer than both the US Entertainment average of 1.4 times and peers at 2.4 times, and well above a fair ratio of 1.1 times. That premium suggests meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Madison Square Garden Sports Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Madison Square Garden Sports research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at MSGS when the market is full of overlooked opportunities. Use our powerful screeners now so you do not miss your next potential opportunity.

- Explore income-focused ideas with these 15 dividend stocks with yields > 3% that highlight companies paying reliable yields above 3%.

- Look for exposure to the next major tech wave by targeting innovators at the frontier of computing through these 28 quantum computing stocks.

- Search for opportunities in structural growth themes by filtering ideas using these 908 undervalued stocks based on cash flows based on projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSGS

Madison Square Garden Sports

Operates as a professional sports company in the United States.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026