- United States

- /

- Entertainment

- /

- NYSE:LYV

Live Nation (LYV) Valuation Update After FTC Complaint and Investor Rights Investigations

Reviewed by Simply Wall St

Live Nation Entertainment (LYV) is back in the spotlight after the Federal Trade Commission and several states filed a civil complaint over alleged deceptive ticket pricing and resale controls, drawing swift scrutiny from investor rights law firms.

See our latest analysis for Live Nation Entertainment.

Despite the regulatory overhang, Live Nation Entertainment's share price has climbed to $139.33. The stock has delivered a solid year to date share price return, and a standout three year total shareholder return above 90 percent suggests longer term momentum remains broadly intact, even as recent quarterly share price performance has softened.

If this spotlight on Live Nation has you rethinking your exposure to live events and entertainment, it could be a smart moment to explore fast growing stocks with high insider ownership for other potential market leaders.

With regulators circling but earnings and revenue still growing, investors face a key question: Is Live Nation now trading below its true value, or has the market already priced in years of future growth?

Most Popular Narrative Narrative: 17.8% Undervalued

With Live Nation Entertainment last closing at $139.33 against a narrative fair value of $169.40, the story centers on whether growth can keep powering that gap.

Continued focus on vertical integration, especially in global venue development and operation, allows Live Nation to capture a greater share of the event value chain, facilitates operational efficiency, and enhances ancillary revenues (e.g., sponsorships, food and beverage, VIP packages), directly benefiting net margins and overall earnings.

Curious how long term venue control, rising fan spend, and richer margins combine into a higher future earnings profile and premium valuation? The narrative connects these moving parts into one bold valuation roadmap. Want to see the exact growth and profitability path it is banking on?

Result: Fair Value of $169.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory pressure around Ticketmaster and growing artist resistance to exclusive deals could unsettle margins and challenge Live Nation’s integrated growth story.

Find out about the key risks to this Live Nation Entertainment narrative.

Another Look at Valuation

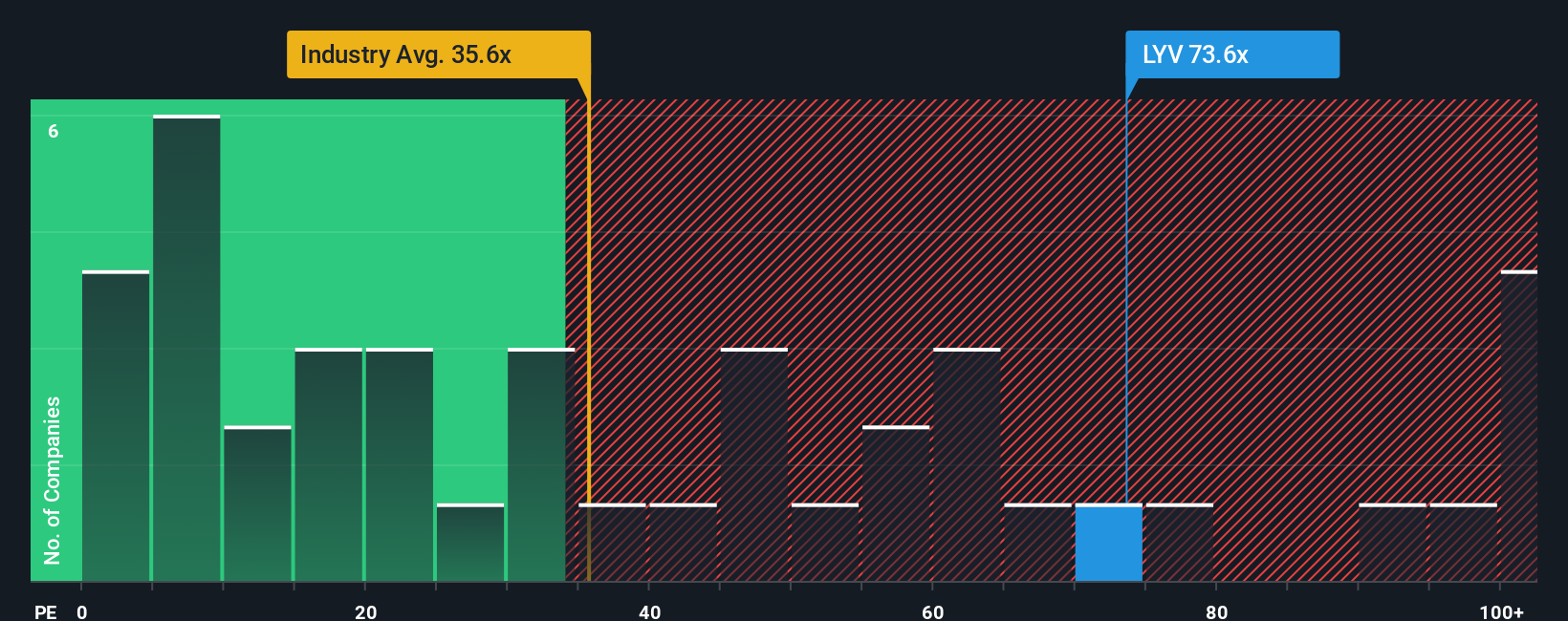

That optimistic narrative about fair value collides with what current earnings ratios are saying. Live Nation trades on a steep 100.4 times earnings versus 23.2 times for the US entertainment industry and 81.2 times for peers, while our fair ratio is just 37.1 times. Is the market paying too much for growth that may already be priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Nation Entertainment Narrative

If this view does not fully resonate or you prefer exploring the numbers on your own, you can create a new perspective in just minutes using Do it your way.

A great starting point for your Live Nation Entertainment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next opportunities by putting the Simply Wall Street Screener to work and lining up your potential candidates now.

- Explore potentially mispriced opportunities by targeting value rich companies using these 906 undervalued stocks based on cash flows that stand out on cash flow strength.

- Follow long-term structural trends by focusing on innovation driven businesses through these 26 AI penny stocks positioned at the forefront of artificial intelligence.

- Enhance your income focus by narrowing in on established payers via these 15 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYV

Live Nation Entertainment

Operates as a live entertainment company worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026