- United States

- /

- Entertainment

- /

- NYSE:IMAX

The Bull Case For IMAX (IMAX) Could Change Following Its Pivot Toward a Broader Entertainment Platform

Reviewed by Sasha Jovanovic

- In recent weeks, IMAX has held an investor day outlining three-year financial goals, pursued deeper partnerships such as its merchandise and IP memorandum with Wanda Film, and highlighted upcoming tentpole releases and re-release initiatives aimed at drawing broader audiences to its premium large-format screens.

- Together, these moves suggest IMAX is trying to shift from a pure box office technology play toward a wider entertainment platform that monetizes its brand, footprint, and fan engagement beyond ticket sales.

- Next, we’ll examine how IMAX’s ambitious margin targets and widened Wanda Film partnership could influence the company’s existing investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

IMAX Investment Narrative Recap

To own IMAX, you need to believe premium, out of home movie experiences can keep drawing audiences despite competition from streaming and other at home options. Recent box office records and fan driven re release campaigns support the near term content pipeline and ticket demand, but they do not remove the key risk that IMAX remains highly dependent on a steady flow of tentpole releases from studios.

The most relevant recent announcement here is IMAX’s three year target for adjusted EBITDA margins above 50%, with earnings growth expected to outpace revenue. If IMAX can sustain strong box office performance across more family titles and event style re releases while also expanding higher margin revenue streams, that margin ambition could become an important catalyst for how investors frame the stock over the next few years.

But behind the box office headlines, investors should also be aware that IMAX’s heavy reliance on blockbuster release schedules could...

Read the full narrative on IMAX (it's free!)

IMAX's narrative projects $466.0 million revenue and $74.0 million earnings by 2028. This requires 8.7% yearly revenue growth and about a $41 million earnings increase from $32.8 million today.

Uncover how IMAX's forecasts yield a $37.18 fair value, a 3% upside to its current price.

Exploring Other Perspectives

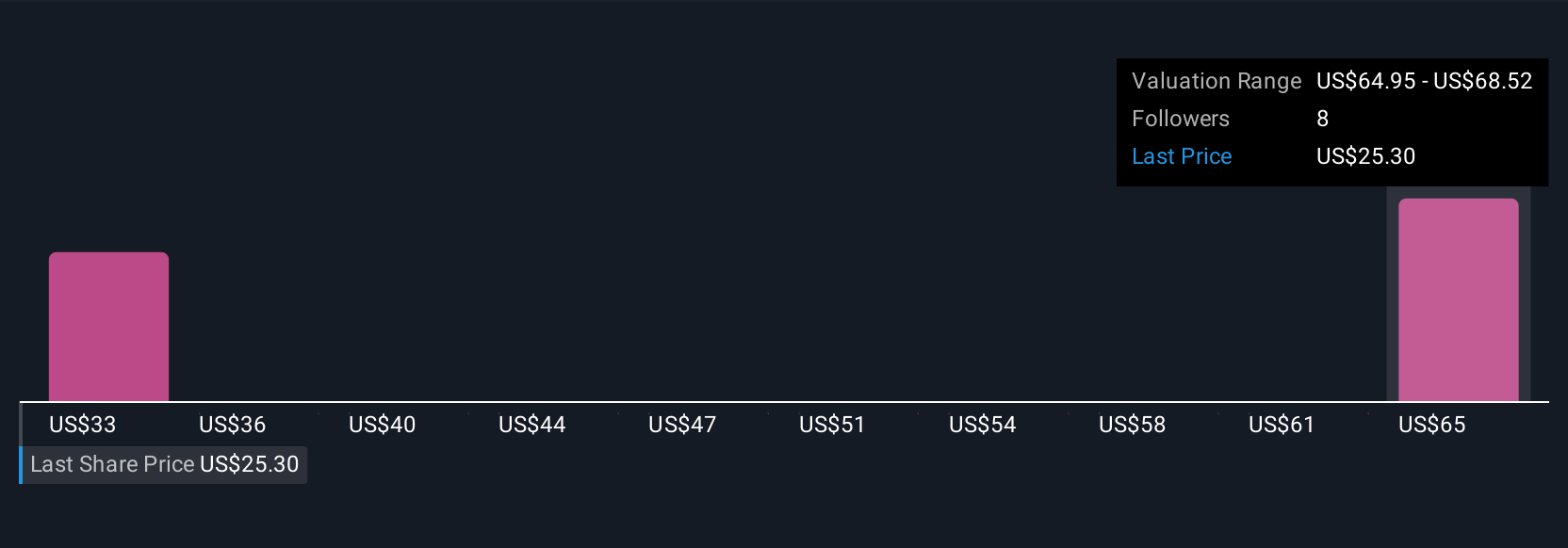

Three Simply Wall St Community fair value estimates for IMAX range from US$37.18 to US$59.26, highlighting very different views on upside. Against that spread, IMAX’s dependence on a consistent blockbuster pipeline remains a core issue you should weigh when comparing these alternative viewpoints.

Explore 3 other fair value estimates on IMAX - why the stock might be worth just $37.18!

Build Your Own IMAX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IMAX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IMAX's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IMAX

IMAX

Operates as a technology platform for entertainment and events in the United States, Greater China, rest of Asia, Western Europe, Canada, Latin America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026