- United States

- /

- Media

- /

- NYSE:DV

AI-Powered Ad Verification and Streaming TV Launches Could Be a Game Changer for DoubleVerify (DV)

Reviewed by Sasha Jovanovic

- DoubleVerify Holdings recently reported third-quarter 2025 financial results, highlighting US$188.62 million in sales, up from US$169.56 million a year ago, with robust growth fueled by new AI-driven ad verification and streaming TV product launches.

- The introduction of industry-first streaming TV solutions and advanced AI verification tools underscores DoubleVerify's commitment to enhancing transparency and security across digital advertising, positioning the company at the forefront of evolving advertiser needs.

- We'll now explore how these AI-powered product rollouts and rising revenue inform and potentially reshape DoubleVerify's investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

DoubleVerify Holdings Investment Narrative Recap

To be a shareholder in DoubleVerify Holdings, you need to believe the company can maintain strong revenue growth by consistently launching relevant AI-powered verification solutions and broadening its reach across Connected TV and social platforms. The recent third-quarter results confirmed robust sales acceleration from new product rollouts, but the most important short-term catalyst, continued adoption in fast-growing digital ad formats, remains largely unchanged. Meanwhile, tighter platform controls or rapid shifts in digital ad spend still loom as key risks; the recent news does not materially diminish these vulnerabilities.

The launch of DoubleVerify’s industry-first streaming TV products, unveiled just days before earnings, is particularly relevant. These offerings directly support advertisers seeking better transparency, addressing a major industry concern and reinforcing DoubleVerify’s potential to unlock further revenue as CTV adoption grows rapidly. That said, challenges tied to access restrictions within walled gardens remain a significant concern even as product innovation advances.

Yet investors should be aware that, while innovation drives opportunity, tougher platform restrictions could mean DoubleVerify faces...

Read the full narrative on DoubleVerify Holdings (it's free!)

DoubleVerify Holdings is projected to reach $1.0 billion in revenue and $114.0 million in earnings by 2028. This outlook is based on an anticipated 11.9% annual revenue growth rate and a $61.3 million increase in earnings from the current $52.7 million.

Uncover how DoubleVerify Holdings' forecasts yield a $16.24 fair value, a 49% upside to its current price.

Exploring Other Perspectives

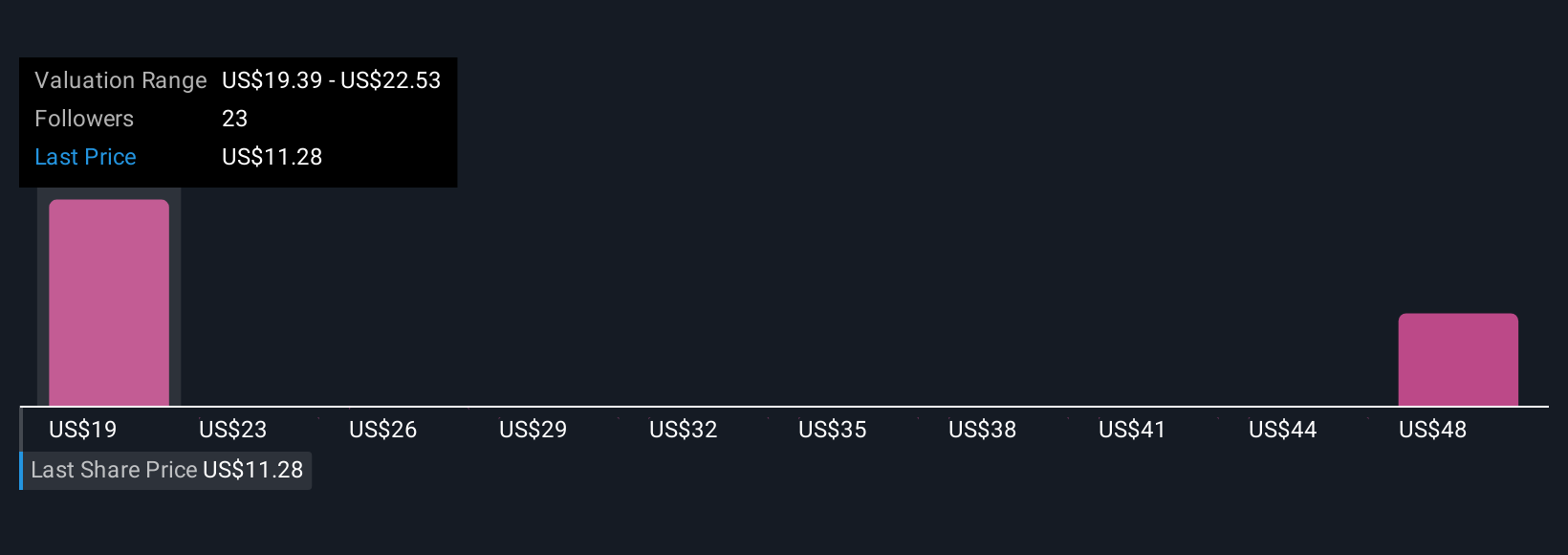

Simply Wall St Community members provided four fair value estimates ranging from US$16.24 to US$50.39. This wide spectrum of opinions sits against the backdrop of DoubleVerify’s exposure to tighter platform access controls, which can limit future growth and affect overall investor confidence.

Explore 4 other fair value estimates on DoubleVerify Holdings - why the stock might be worth just $16.24!

Build Your Own DoubleVerify Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DoubleVerify Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DoubleVerify Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DoubleVerify Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DV

DoubleVerify Holdings

Provides media effectiveness platforms in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives