- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:ZD

What Ziff Davis (ZD)'s First Organic Growth in Four Years Means for Shareholders

Reviewed by Sasha Jovanovic

- In late 2025, Meridian Growth Fund highlighted Ziff Davis, Inc.'s return to organic growth and its enhanced segment-level financial disclosure, which improved transparency for investors.

- This marked the company’s first period of organic growth in nearly four years and enabled more accurate assessments of its underlying business value.

- We'll explore how improved financial transparency and renewed organic growth are influencing current views on Ziff Davis's investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Ziff Davis Investment Narrative Recap

To be a Ziff Davis shareholder, you need to be confident in the company’s ability to pivot toward consistent organic growth in digital media and technology services while maintaining disciplined capital allocation. The recent news of improved segment-level disclosure and a return to organic growth is likely to reinforce the main short-term catalyst, restoring investor confidence in the underlying health of the core business, while only modestly reducing the persistent risk tied to acquisition-driven expansion and sector headwinds.

Among the company's recent actions, the November 2025 third-quarter earnings report is especially relevant. It showed improved net margins and a much smaller goodwill impairment, offering tangible evidence that better transparency and steady operational performance may support the case for a more reliable revenue base and earnings improvement as highlighted by the news event.

By contrast, investors should stay alert to the ongoing risk that Ziff Davis’s reliance on acquisitions for growth could expose them to…

Read the full narrative on Ziff Davis (it's free!)

Ziff Davis' outlook projects $1.6 billion in revenue and $235.9 million in earnings by 2028. This assumes a 3.9% annual revenue growth and a $169.8 million increase in earnings from current earnings of $66.1 million.

Uncover how Ziff Davis' forecasts yield a $43.43 fair value, a 32% upside to its current price.

Exploring Other Perspectives

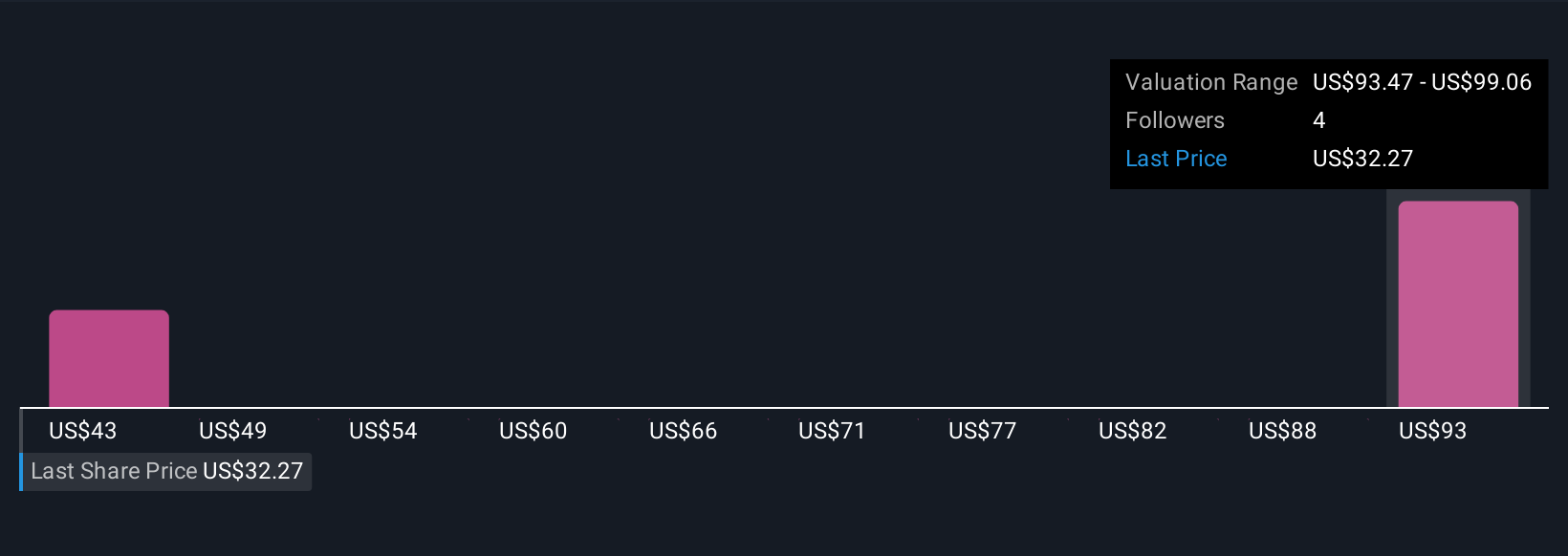

Ziff Davis’s fair value estimates from the Simply Wall St Community span from US$43.43 to US$99.81 based on two distinct forecasts. As optimism for organic growth builds, remember opinions differ widely on how M&A risks could affect long-run value, explore several viewpoints before you decide.

Explore 2 other fair value estimates on Ziff Davis - why the stock might be worth over 3x more than the current price!

Build Your Own Ziff Davis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ziff Davis research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Ziff Davis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ziff Davis' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ziff Davis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZD

Ziff Davis

Operates as a digital media and internet company in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026