- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:ZD

Does the Recent 44% Drop Make Ziff Davis a Bargain in 2025?

Reviewed by Bailey Pemberton

- Wondering if Ziff Davis stock is finally trading at a price that makes sense? You are not alone. We are about to break down whether the market might be missing something the numbers reveal.

- After a rough year with the share price down 44.2% over the past twelve months, Ziff Davis saw a small 3.2% lift in the last week. This could be signaling a turning point, or it may just be a short-term bounce.

- Investors have been keeping an eye on management changes and Ziff Davis' recent expansion into new digital markets. Both of these factors may be influencing how the stock is priced. With increased media attention and renewed strategic focus, it is no surprise the volatility has ticked higher lately.

- On our valuation checks, Ziff Davis scores a solid 5 out of 6. There is reason to take a closer look. We will break down the usual valuation approaches in a moment, but stick around for a perspective that goes beyond numbers and ratios at the end of the article.

Find out why Ziff Davis's -44.2% return over the last year is lagging behind its peers.

Approach 1: Ziff Davis Discounted Cash Flow (DCF) Analysis

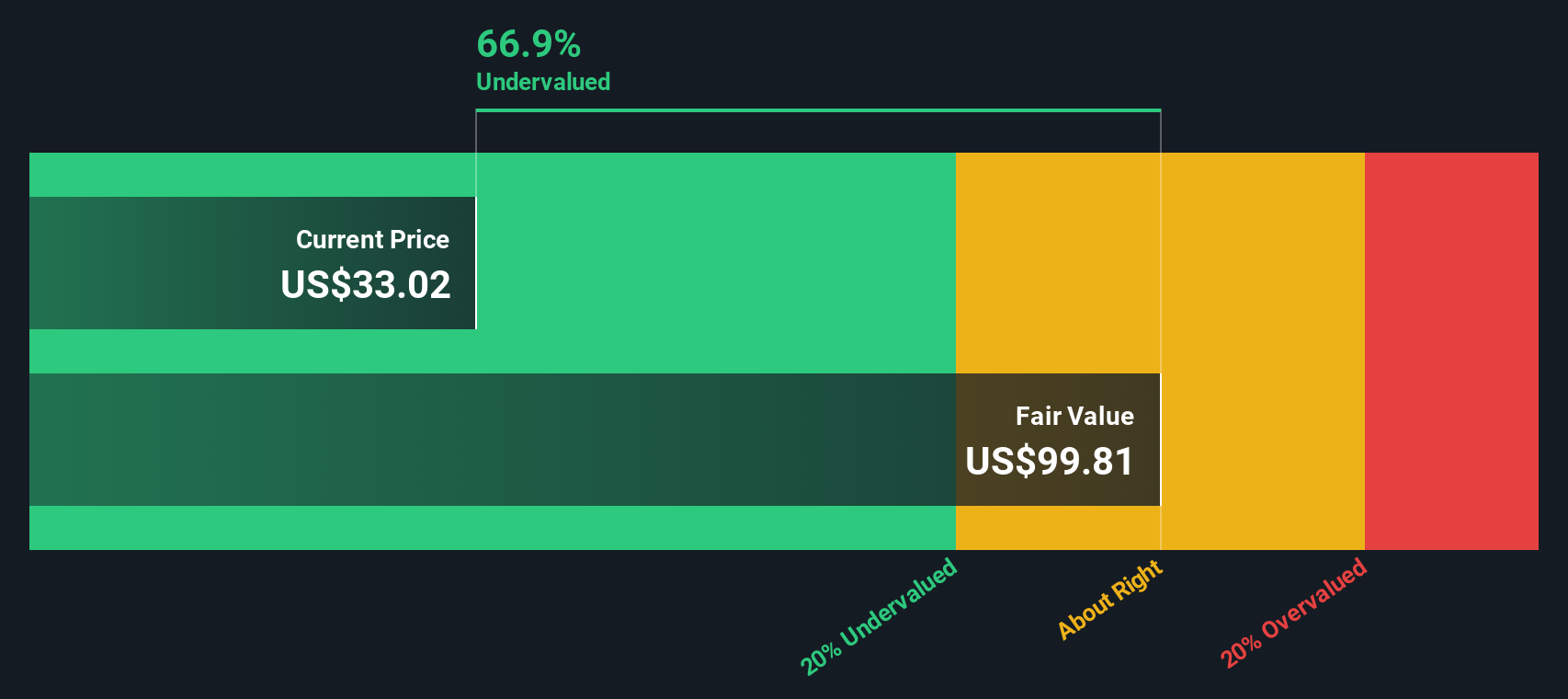

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its expected future cash flows and then discounting them back to their present value. This approach helps investors see what a business is worth today based on its future earning potential.

For Ziff Davis, the DCF analysis uses its most recent Free Cash Flow, which was $261 million over the last twelve months. Analyst estimates continue from this starting point, projecting Free Cash Flow to reach $295 million by 2027. Beyond that, projections extend over a decade, with FCF expected to gradually increase, as Simply Wall St’s extrapolation suggests, to approximately $353 million by 2035.

Based on this progression of cash flow growth, the DCF valuation places Ziff Davis’ intrinsic value at $99.64 per share. With the current market price reflecting a 67.1% discount to this estimated fair value, the model indicates the stock is significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ziff Davis is undervalued by 67.1%. Track this in your watchlist or portfolio, or discover 917 more undervalued stocks based on cash flows.

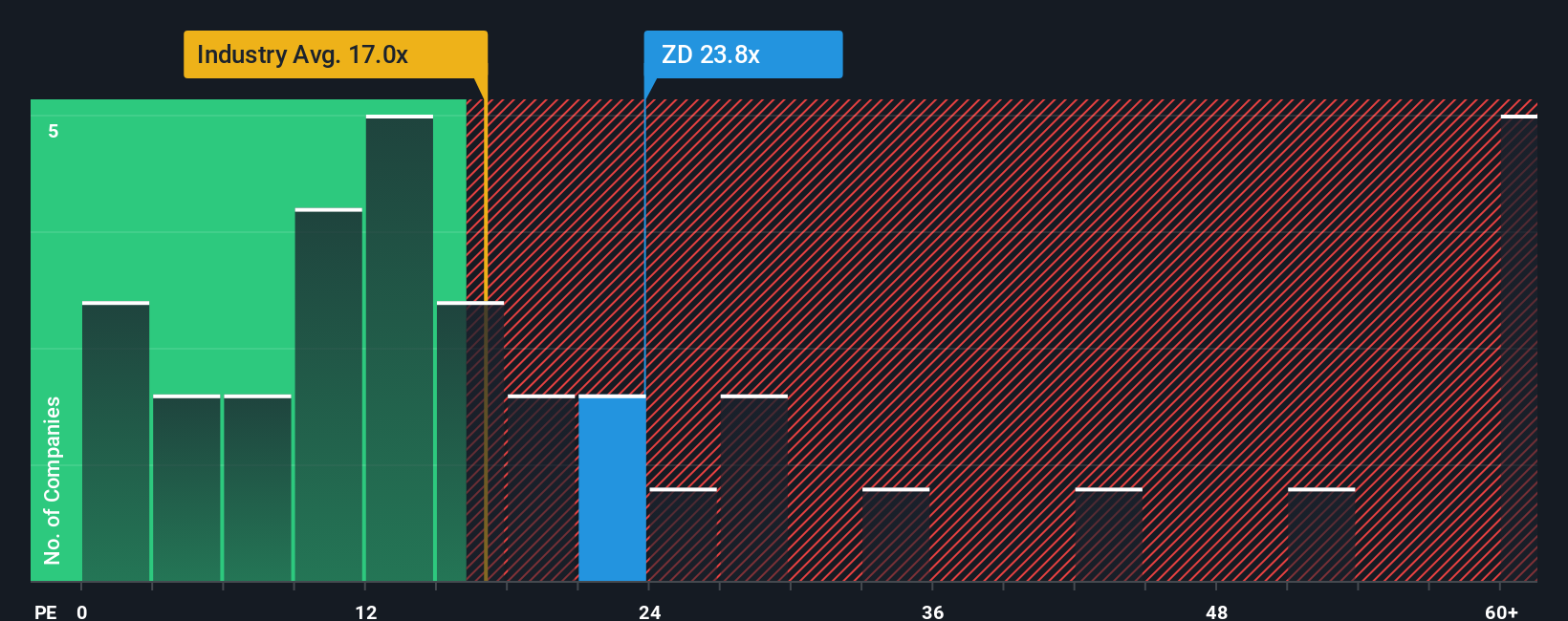

Approach 2: Ziff Davis Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a common measure to value profitable companies, as it compares a company's share price to its earnings and shows how much investors are willing to pay for each dollar of profit. For established companies that generate consistent profit, the PE ratio helps investors quickly size up whether a stock looks cheap or expensive.

A company's "normal" or "fair" PE ratio depends on growth expectations and risk. Higher expected earnings growth usually justifies a higher PE, while greater uncertainty or risk typically results in a lower one.

Currently, Ziff Davis trades at a PE ratio of 11.7x. This is well below its industry average PE of 19.6x and the peer group average of 21.3x. This suggests a substantial discount relative to similar companies. However, just looking at peers or the industry does not account for Ziff Davis' unique growth profile, business mix, profitability, and risks.

Simply Wall St's "Fair Ratio" is a proprietary metric designed to establish what a reasonable PE ratio would be for Ziff Davis considering its specific growth rate, profit margins, industry features, market cap, and risk factors. This approach offers a more nuanced and individualized benchmark than broad-brush comparisons with peers or industry averages.

For Ziff Davis, the Fair Ratio is 19.3x, which reflects where its unique characteristics would normally place its valuation. Since the current PE of 11.7x is well below this benchmark, it strongly indicates that Ziff Davis is undervalued by the market on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ziff Davis Narrative

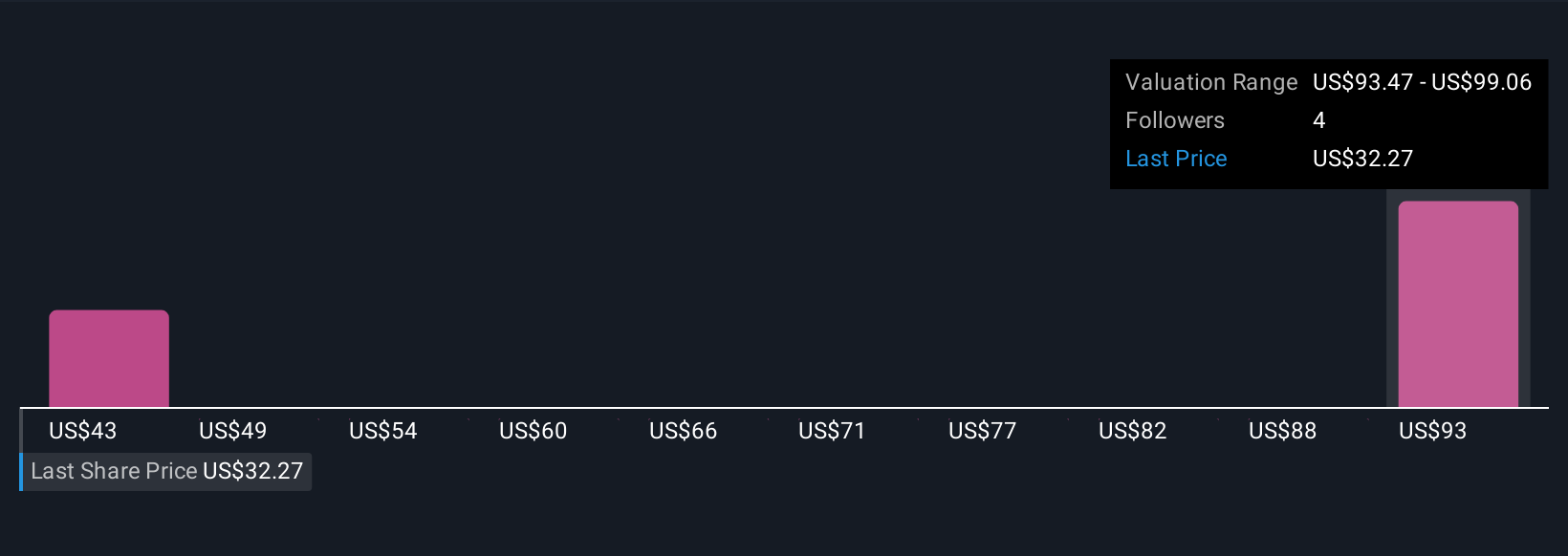

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your personalized investment story. It is a way to add your perspective to the numbers by connecting your own expectations for a company’s future revenue, earnings, and margins to a specific fair value today.

Narratives go beyond simple ratios by linking a company’s underlying story, such as new market expansions or evolving industry trends, with a financial forecast and a calculated fair value. On Simply Wall St’s Community page, millions of investors can create and compare these Narratives in a matter of minutes.

With Narratives, you visualize how your view, or the collective views of the community, compares fair value to the current share price so you can make smarter, more timely buy or sell decisions. What makes Narratives powerful is that they update automatically as fresh news and earnings data arrive, helping you stay aligned with the latest facts and market sentiment.

For example, while some investors believe Ziff Davis could be worth as much as $60.00 per share if its digital strategy and cost controls beat expectations, others see fair value as low as $40.00 if industry risks and acquisition challenges weigh on performance.

Do you think there's more to the story for Ziff Davis? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ziff Davis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZD

Ziff Davis

Operates as a digital media and internet company in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026