- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:WBTN

Disney and Marvel Comics Partnership Might Change the Case for Investing in WEBTOON Entertainment (WBTN)

Reviewed by Sasha Jovanovic

- WEBTOON Entertainment announced a new partnership with Disney to bring around 100 blockbuster comics, including content from Marvel and Star Wars, to its global English-language app.

- This collaboration is part of broader efforts by WEBTOON to expand its reach and enhance user engagement by reformatting popular franchises and leveraging cross-platform media strategies.

- We’ll examine how WEBTOON’s Disney partnership could influence its investment outlook, especially as it aims to drive deeper global engagement.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

WEBTOON Entertainment Investment Narrative Recap

To be a WEBTOON Entertainment shareholder, you need to believe in the company’s ability to reignite sustainable global user growth and convert high-profile content partnerships into deeper engagement and monetization. The Disney collaboration is a headline catalyst that may help reverse recent declines in monthly active users by attracting new audiences and leveraging blockbuster franchises, but it also raises the immediate risk of higher costs and margin pressure from upfront investments, meaning short-term profitability improvements remain uncertain.

Another relevant development is the launch of Video Ep episodes, which incorporates short-form, voice-acted video content into 14 original series. This aligns directly with WEBTOON’s goal to heighten user engagement and compete for attention against video-first platforms, addressing part of the underlying user growth challenge linked to shifting consumption habits.

Yet, against these promising headlines, investors should be aware of the elevated risks tied to margin compression from new content and marketing investments...

Read the full narrative on WEBTOON Entertainment (it's free!)

WEBTOON Entertainment's narrative projects $2.0 billion in revenue and $30.0 million in earnings by 2028. This requires 13.8% yearly revenue growth and a $130.1 million earnings increase from current earnings of -$100.1 million.

Uncover how WEBTOON Entertainment's forecasts yield a $19.38 fair value, a 18% upside to its current price.

Exploring Other Perspectives

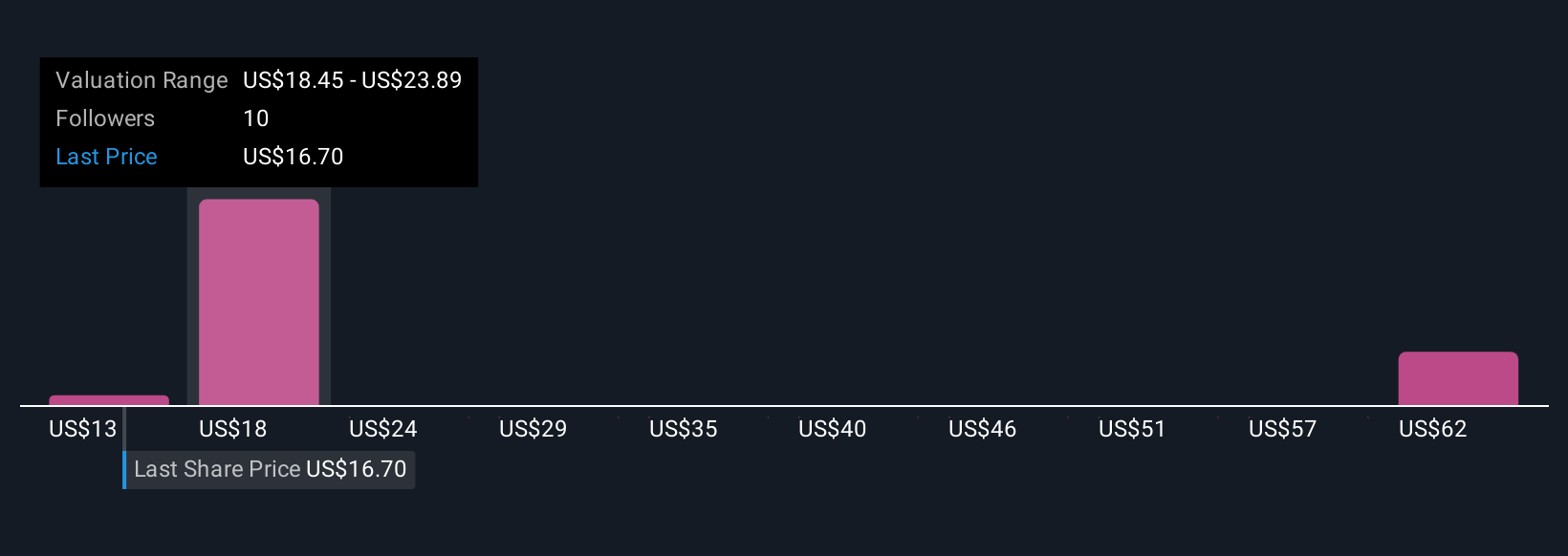

Simply Wall St Community members posted three fair value estimates for WEBTOON, spanning a wide US$13 to US$58.02 range. While key partnerships could provide growth tailwinds, the recent decline in global users highlights substantial uncertainty and invites you to explore a variety of viewpoints on where the company is heading.

Explore 3 other fair value estimates on WEBTOON Entertainment - why the stock might be worth 21% less than the current price!

Build Your Own WEBTOON Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WEBTOON Entertainment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free WEBTOON Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WEBTOON Entertainment's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEBTOON Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WBTN

WEBTOON Entertainment

Operates a storytelling platform in the United States, Korea, Japan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives