- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Is Take-Two (TTWO) Still Undervalued After a 35% Year-to-Date Rally?

Reviewed by Simply Wall St

Take-Two Interactive Software (TTWO) has quietly delivered a strong run this year, with the stock up about 35% year-to-date even after a modest pullback over the past month.

See our latest analysis for Take-Two Interactive Software.

That move has been driven more by a reset in expectations around long term growth than any single headline. A 35.4% year to date share price return and a hefty 3 year total shareholder return of 142.9% show momentum that is cooling slightly but still clearly positive.

If TTWO’s run has you thinking about what else could surprise to the upside, it is worth scanning high growth tech and AI stocks for other potential standouts in the broader tech and AI space.

With earnings rebounding, a rich content pipeline, and the stock still trading below consensus targets, investors face a key question: Is Take-Two still undervalued, or is the market already pricing in years of future growth?

Most Popular Narrative: 10.4% Undervalued

With Take-Two Interactive Software last closing at $247.88 against a narrative fair value of about $276.59, the gap suggests potential upside if the long term thesis plays out.

Strategic investments in technology, AI, and content pipeline efficiency, alongside a strong release slate with multiple high profile launches (including Borderlands 4, NBA 2K26, and Mafia: The Old Country), support management's outlook for record net bookings and improved profitability in the coming years.

Want to see how this ambitious launch slate is expected to help narrow today’s losses and support prospects for stronger future results and premium valuation multiples? Explore the details to understand the assumptions behind that fair value target.

Result: Fair Value of $276.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside narrative could unravel if blockbuster launches slip or if mobile engagement fades faster than expected, pressuring margins and valuation.

Find out about the key risks to this Take-Two Interactive Software narrative.

Another Way to Look at Value

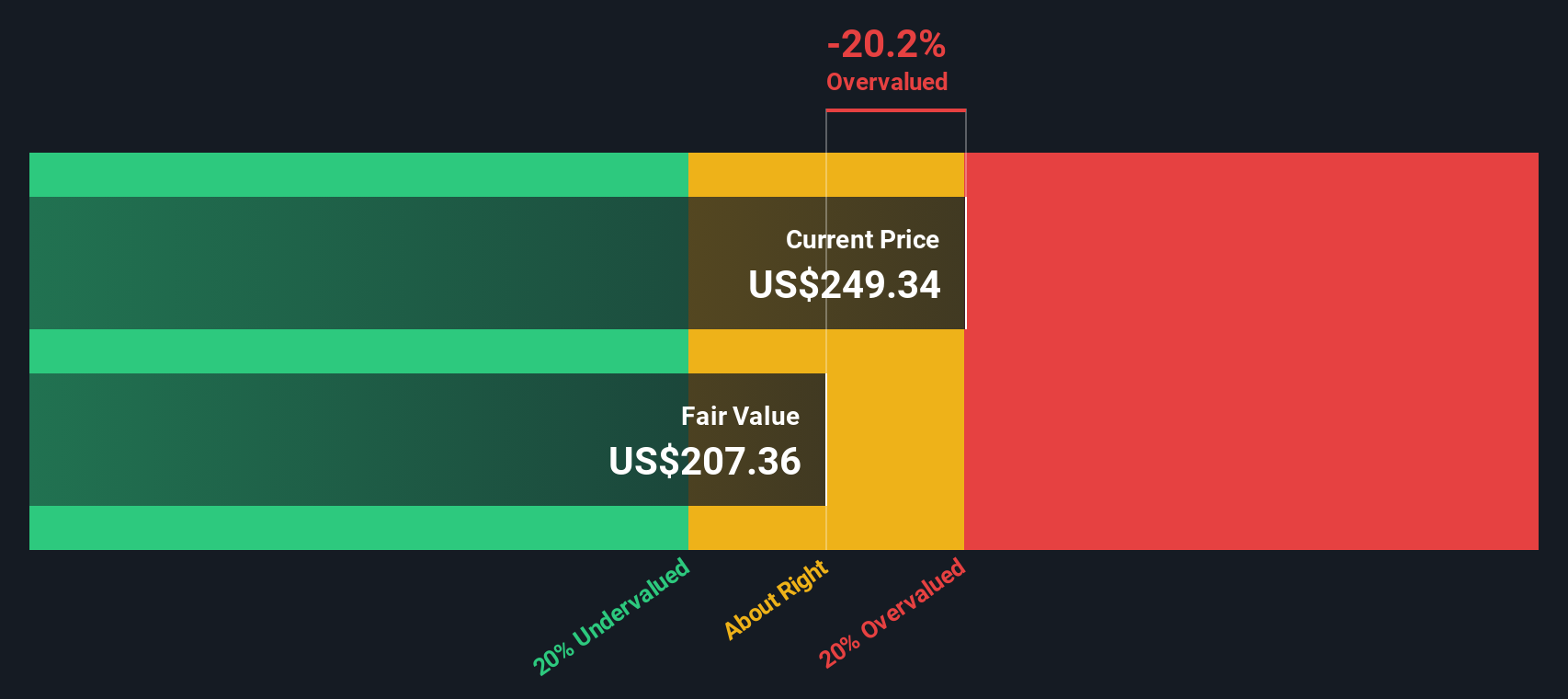

While the narrative fair value suggests Take-Two is 10.4% undervalued, our DCF model points the other way, with fair value closer to $207.99 versus today’s $247.88. That implies the shares might already be pricing in years of optimistic forecasts, so which story do you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Take-Two Interactive Software Narrative

If this view does not fully align with your own or you prefer digging into the numbers yourself, you can craft a personalized narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Take-Two Interactive Software.

Looking for more investment ideas?

Do not stop with one strong opportunity when a whole universe of potential winners is within reach. Line up your next moves now with targeted screeners.

- Capitalize on mispriced opportunities by targeting these 906 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Ride structural tailwinds in innovation by backing these 26 AI penny stocks shaping the next wave of intelligent products and platforms.

- Boost your income potential by focusing on these 15 dividend stocks with yields > 3% that can strengthen total returns through consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026