- United States

- /

- Media

- /

- NasdaqGM:TTD

High Growth Tech Stocks To Watch In August 2024

Reviewed by Simply Wall St

The market has climbed by 4.9% over the past week, with every sector up, and in the last year, it has surged by 26%, with earnings expected to grow by 15% per annum over the next few years. In such a robust environment, identifying high-growth tech stocks that can capitalize on these favorable conditions is essential for investors looking to enhance their portfolios.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Super Micro Computer | 20.84% | 35.00% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| Iris Energy | 70.63% | 125.09% | ★★★★★★ |

| G1 Therapeutics | 24.26% | 51.62% | ★★★★★★ |

| Invivyd | 42.85% | 71.50% | ★★★★★★ |

| Clene | 73.06% | 62.58% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 254 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Trade Desk (NasdaqGM:TTD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Trade Desk, Inc. operates as a technology company in the United States and internationally with a market cap of $49.86 billion.

Operations: Trade Desk generates revenue primarily from its software and programming segment, amounting to $2.17 billion. The company focuses on providing technology solutions for digital advertising across various platforms globally.

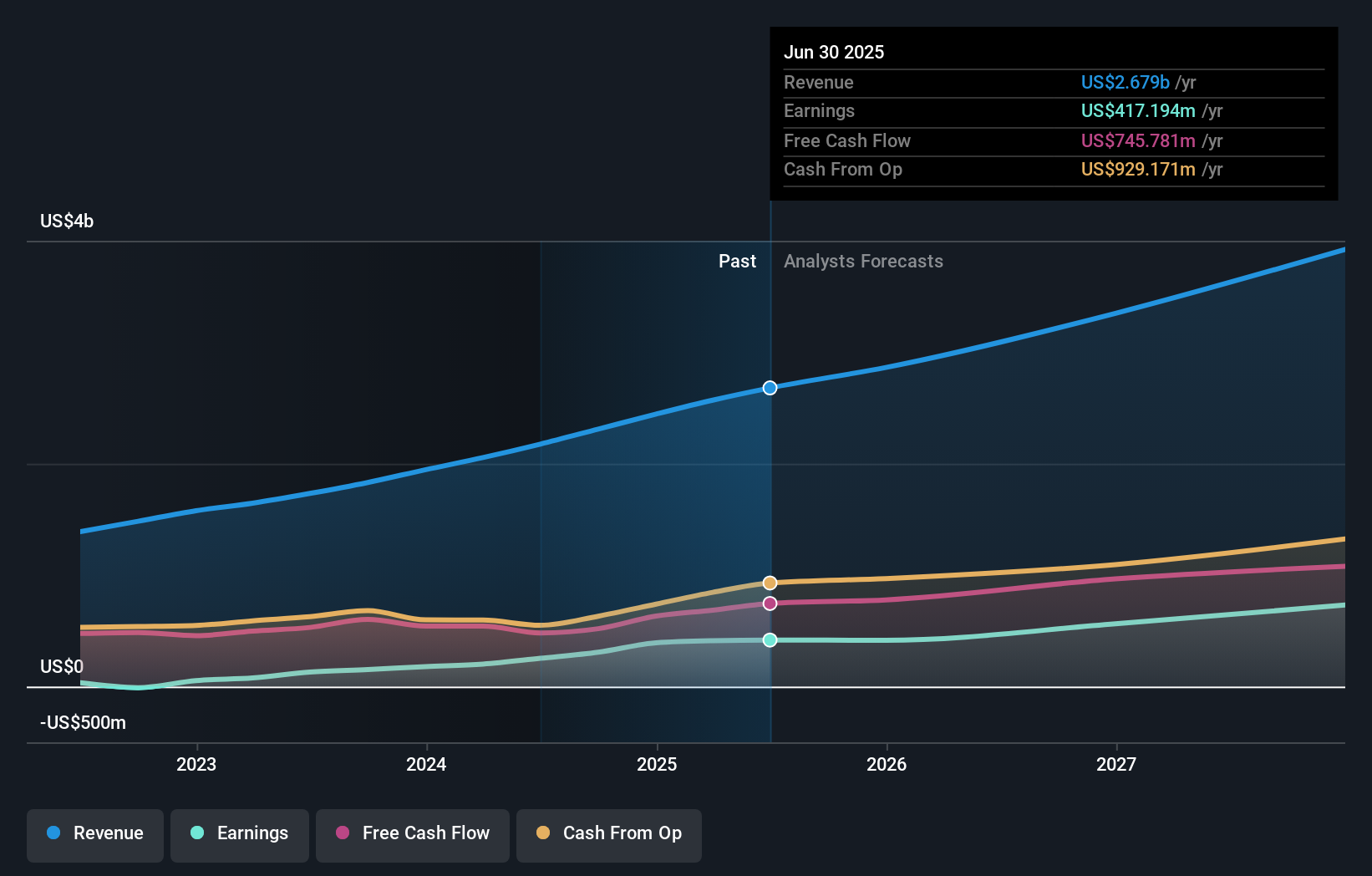

Trade Desk's recent earnings report showed a significant increase, with Q2 sales reaching $584.55 million, up from $464.25 million last year, and net income rising to $85.03 million from $32.94 million. The company is also projecting future growth with expected Q3 revenue of at least $618 million, underscoring its robust performance in the advertising technology sector. Additionally, Trade Desk's partnership with Admiral and Fox Corporation highlights its strategic moves to enhance user authentication and leverage advanced ad technologies like UID2 and OpenPath for better audience targeting and campaign measurement. In terms of R&D investment, Trade Desk has consistently allocated substantial resources towards innovation; their R&D expenses have grown by 17.2%, reflecting a commitment to maintaining a competitive edge through technological advancements. This focus on R&D supports their ability to deliver cutting-edge solutions that address industry challenges such as signal loss and consumer privacy concerns while driving revenue growth through improved visitor engagement strategies for publishers on platforms like Admiral’s VRM system.

- Dive into the specifics of Trade Desk here with our thorough health report.

Explore historical data to track Trade Desk's performance over time in our Past section.

Autodesk (NasdaqGS:ADSK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Autodesk, Inc. provides 3D design, engineering, and entertainment technology solutions worldwide with a market cap of $53.50 billion.

Operations: Autodesk generates revenue primarily from its CAD/CAM software segment, which contributed $5.65 billion. The company's gross profit margin stands at 92%.

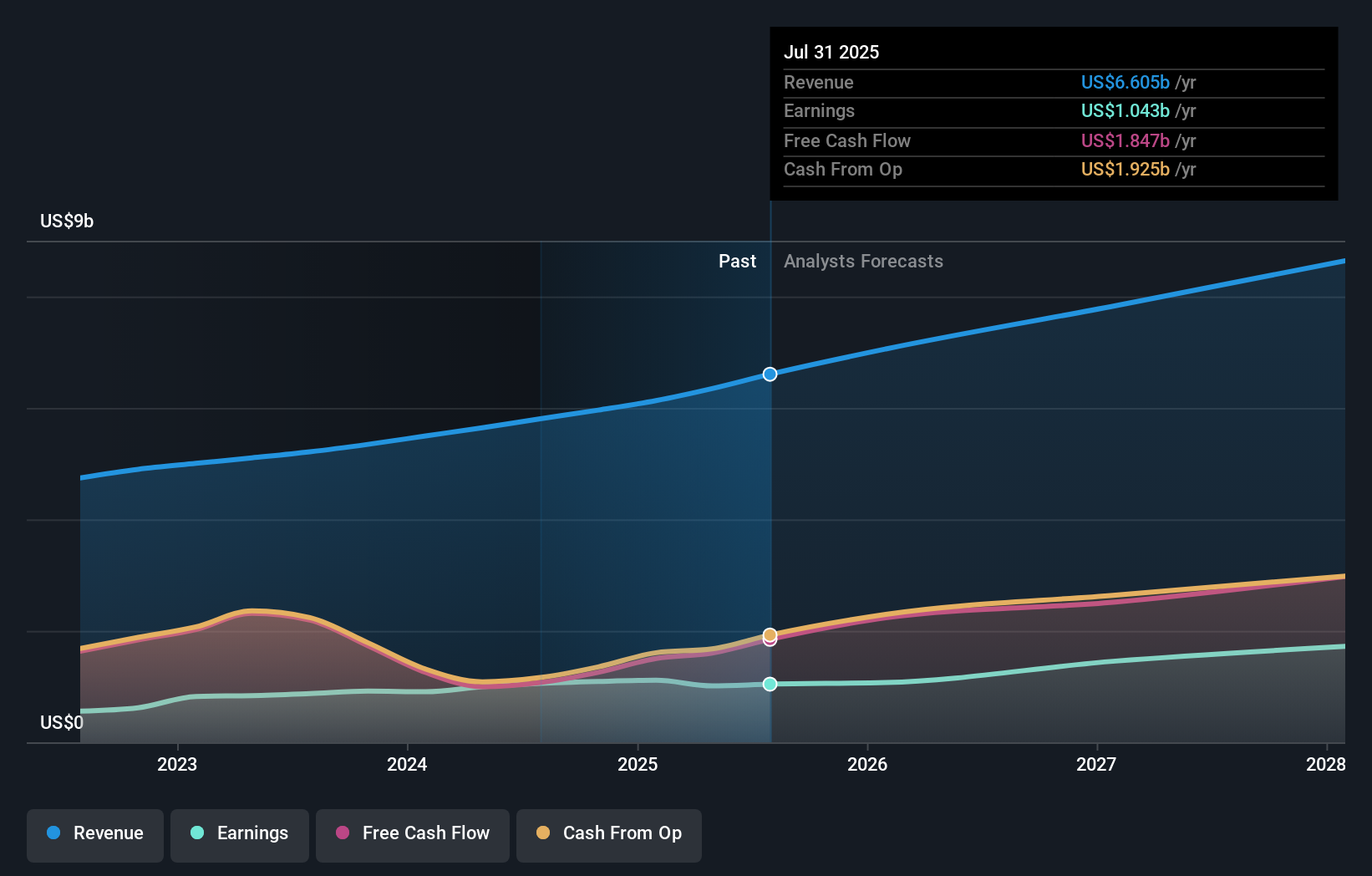

Autodesk's transition to a SaaS model has bolstered recurring revenue streams, with annual earnings projected to grow 16.3%. The company's R&D expenses, representing 9.5% of revenue, underscore its commitment to innovation and maintaining a competitive edge. Despite activist pressure from Starboard Value for governance improvements and cost cuts, Autodesk repurchased $270 million worth of shares in the past year, indicating confidence in its long-term strategy.

- Click here and access our complete health analysis report to understand the dynamics of Autodesk.

Assess Autodesk's past performance with our detailed historical performance reports.

Zscaler (NasdaqGS:ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. operates as a cloud security company worldwide with a market cap of $29.16 billion.

Operations: Zscaler generates revenue primarily through the sale of subscription services to its cloud platform and related support services, totaling $2.03 billion. The company's business model focuses on providing comprehensive cloud security solutions globally.

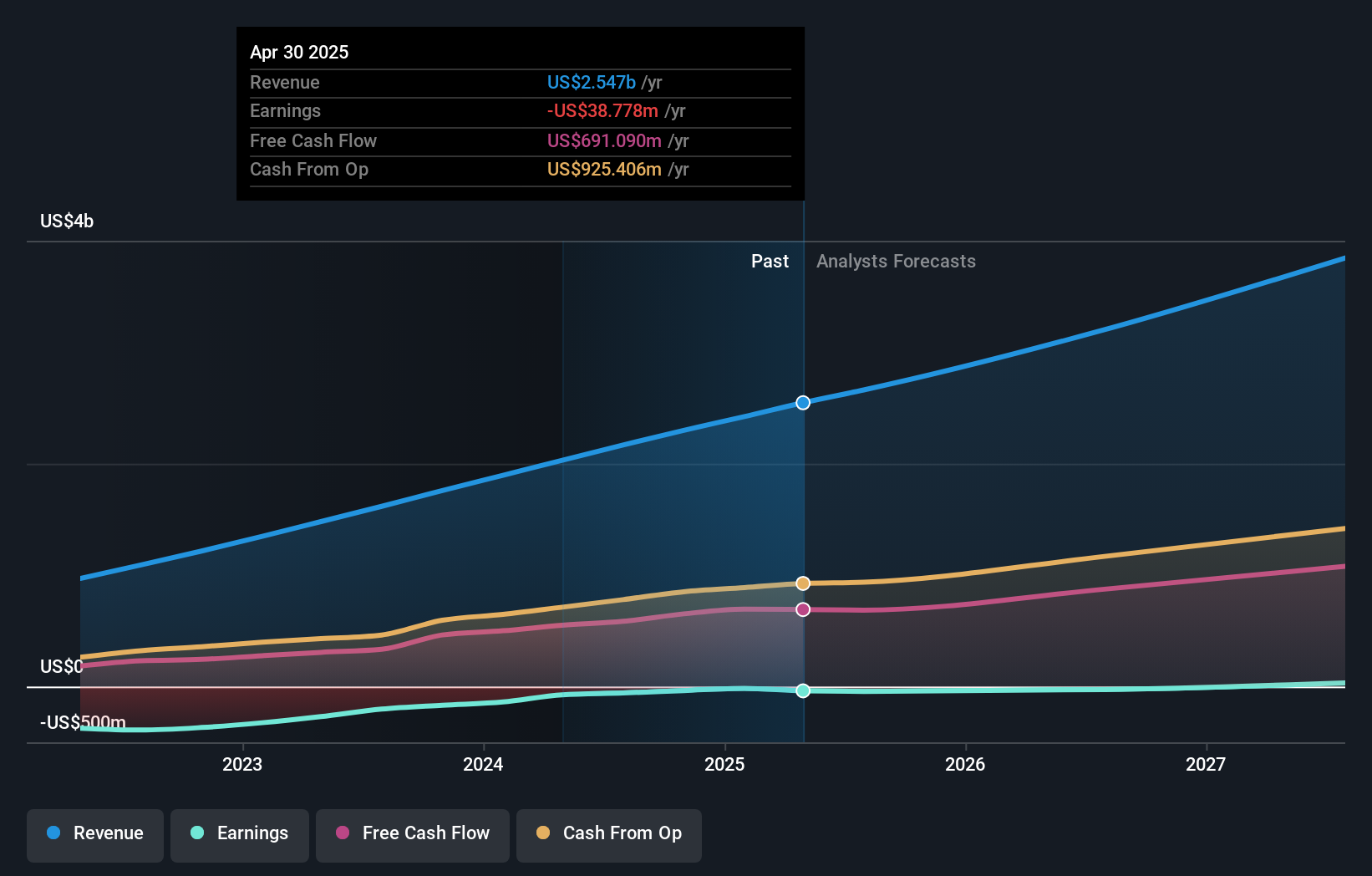

Zscaler's revenue is forecast to grow at 17.7% annually, outpacing the US market's 8.8%. With a projected earnings growth of 45.02% per year, Zscaler aims to become profitable within three years, reflecting robust future potential. The company's R&D expenses are significant, contributing $137 million in the latest quarter alone, highlighting its commitment to innovation and security advancements. Recent partnerships with Wipro and SecureDynamics underscore its strategic expansion in cybersecurity services and AI-driven platforms like Cyber X-Ray for optimized security investments.

- Take a closer look at Zscaler's potential here in our health report.

Understand Zscaler's track record by examining our Past report.

Turning Ideas Into Actions

- Reveal the 254 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.