- United States

- /

- Pharma

- /

- NasdaqGS:NMRA

Promising Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As December trading begins, major U.S. stock indexes have pulled back, with big tech and cryptocurrency-tied shares experiencing declines amid a risk-off sentiment. Despite the broader market volatility, penny stocks continue to attract attention for their potential to offer growth opportunities at lower price points. Although the term "penny stocks" may seem outdated, these investments often represent smaller or newer companies that can provide significant value when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Here Group (HERE) | $3.08 | $258.87M | ✅ 3 ⚠️ 1 View Analysis > |

| Dingdong (Cayman) (DDL) | $1.72 | $368.6M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.85 | $669.08M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8624 | $147.49M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.25 | $546.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.26 | $1.36B | ✅ 5 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.96 | $249.94M | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (CINT) | $4.52 | $584.17M | ✅ 5 ⚠️ 0 View Analysis > |

| BAB (BABB) | $0.83 | $6.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.92 | $88.81M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 350 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Caesarstone (CSTE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Caesarstone Ltd. designs, develops, manufactures, and sells engineered stone and porcelain products globally under various brands with a market cap of $64.62 million.

Operations: The company's revenue from Building Products amounts to $400.66 million.

Market Cap: $64.62M

Caesarstone Ltd., with a market cap of US$64.62 million, faces challenges typical for penny stocks, such as high volatility and unprofitability. Its recent strategic restructuring plan includes closing a manufacturing facility in Israel and reducing headcount by 200 employees to enhance competitiveness and profitability. Despite negative operating cash flow and declining earnings over the past five years, Caesarstone maintains more cash than total debt, providing some financial stability. The company recently launched Lioli Porcelain surfaces, showcasing innovation in product offerings amidst ongoing efforts to optimize operations and improve future financial performance.

- Click here to discover the nuances of Caesarstone with our detailed analytical financial health report.

- Explore Caesarstone's analyst forecasts in our growth report.

Neumora Therapeutics (NMRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Neumora Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing treatments for brain diseases, neuropsychiatric disorders, and neurodegenerative diseases in the United States, with a market cap of approximately $404.36 million.

Operations: Currently, there are no reported revenue segments for Neumora Therapeutics.

Market Cap: $404.36M

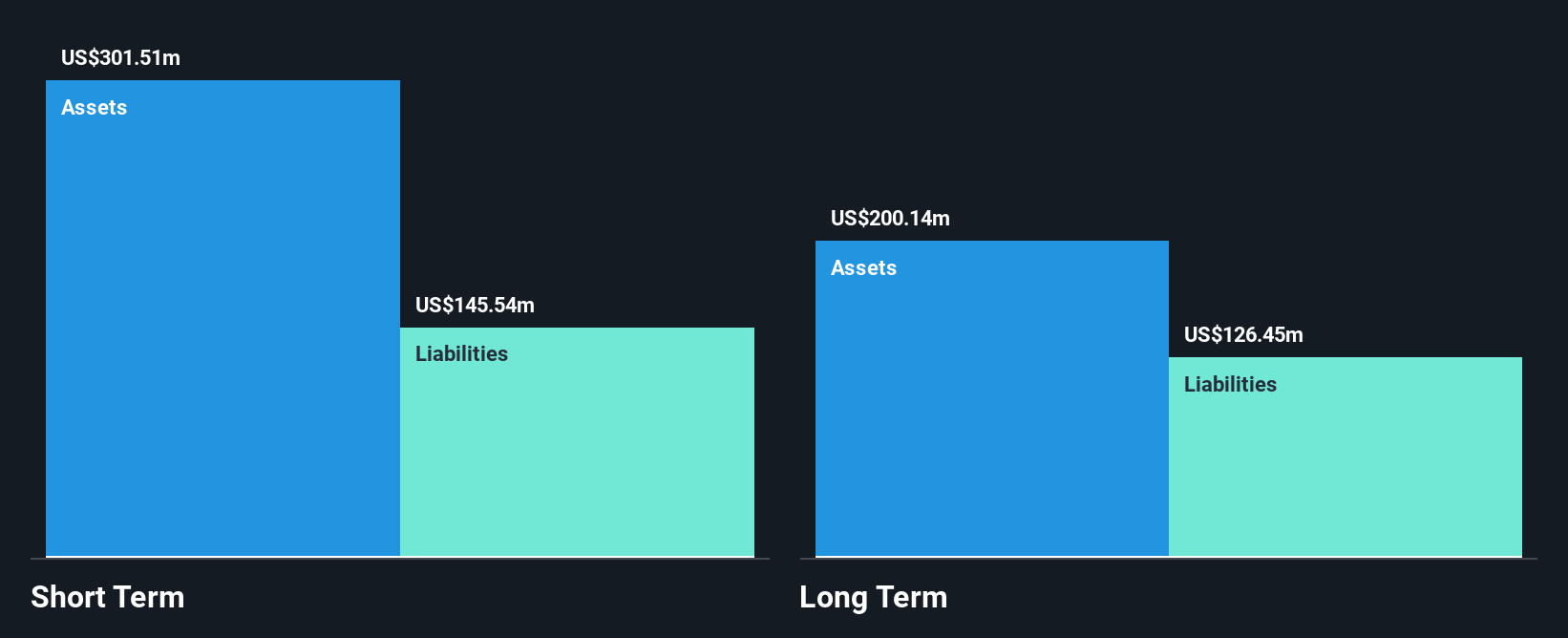

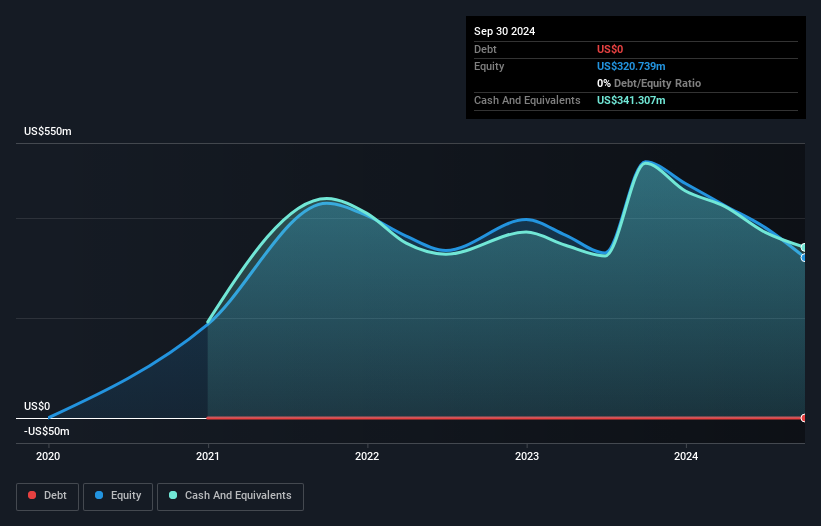

Neumora Therapeutics, with a market cap of US$404.36 million, is a pre-revenue biopharmaceutical company working on innovative treatments for brain diseases. Despite its unprofitability and negative return on equity, Neumora's financial health is bolstered by short-term assets exceeding liabilities and more cash than debt. Recent developments include the initiation of Phase 1 studies for NMRA-898 and positive preclinical data for NMRA-215, indicating potential breakthroughs in treating schizophrenia and neurodegenerative conditions. However, high share price volatility remains a concern as the company navigates its early-stage clinical trials without significant revenue streams yet established.

- Get an in-depth perspective on Neumora Therapeutics' performance by reading our balance sheet health report here.

- Evaluate Neumora Therapeutics' prospects by accessing our earnings growth report.

trivago (TRVG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: trivago N.V. operates a hotel and accommodation search platform across various countries including the United States, Germany, and Japan, with a market cap of approximately $223.61 million.

Operations: The company's revenue is derived from three main geographical segments: €194.04 million from the Americas, €109.30 million from the Rest of World, and €215.62 million from Developed Europe.

Market Cap: $223.61M

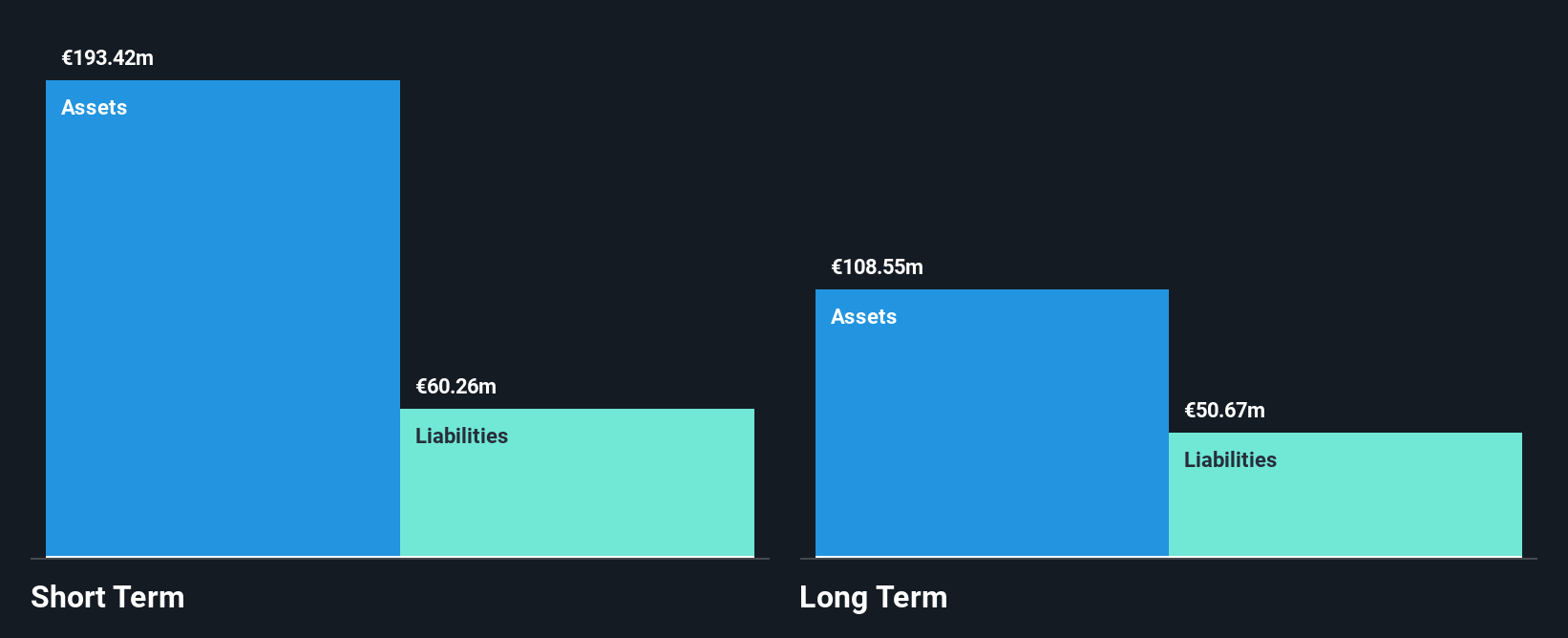

trivago N.V., with a market cap of approximately $223.61 million, has demonstrated a significant turnaround by becoming profitable this year, reporting a net income of €11.03 million in Q3 2025 compared to a loss the previous year. The company anticipates continued revenue growth in the mid-teens percentage for both Q4 2025 and throughout 2026. Despite low return on equity at 0.9%, trivago's financial stability is supported by no debt and short-term assets exceeding liabilities, providing a solid foundation for potential growth within its industry segment while trading below estimated fair value enhances its appeal as an investment opportunity.

- Take a closer look at trivago's potential here in our financial health report.

- Examine trivago's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Discover the full array of 350 US Penny Stocks right here.

- Searching for a Fresh Perspective? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neumora Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NMRA

Neumora Therapeutics

A clinical-stage biopharmaceutical company, engages in developing therapeutic treatments for brain diseases, neuropsychiatric disorders, and neurodegenerative diseases in the United States.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

The "Rare Disease Monopoly" – Commercial Execution Play

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026