- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRIP

Tripadvisor’s (TRIP) AI Push and Cost Cuts Might Change the Case for Long-Term Investors

Reviewed by Sasha Jovanovic

- Tripadvisor recently reported third-quarter 2025 results, highlighting sales of US$553 million and net income of US$53 million, alongside a full-year revenue growth outlook of 3% to 4% and a major cost-cutting initiative.

- The company also announced board changes and is planning to launch an AI-native product while commencing a strategic review of its portfolio business, TheFork.

- We’ll examine how Tripadvisor’s cost-cutting measures and AI product plans could influence its long-term investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Tripadvisor Investment Narrative Recap

To be a Tripadvisor shareholder, you need to believe in the company’s ability to grow its travel experiences and core platform even as it faces competition and organic traffic pressures. The latest quarterly earnings showed improved profitability and an $85 million cost-cutting plan, but with Q4 revenue expected to be flat, the most important short-term catalyst remains executing these cuts without hurting user growth, while the biggest risk continues to be declining free traffic acquisition. For now, the recent results do not materially change either the main catalyst or risk.

Of all the latest announcements, Tripadvisor’s plan to launch an AI-native product stands out, as it is directly linked with the company’s efforts to boost user engagement and operational efficiency, key areas for supporting growth and offsetting competitive and traffic-related risks. Rolling out such a tool could potentially assist in shifting more customers to higher-value segments and away from costly paid channels, which aligns closely with the catalysts investors are closely tracking.

But against these ambitious technology efforts, investors should not overlook the sustained risk posed by...

Read the full narrative on Tripadvisor (it's free!)

Tripadvisor's narrative projects $2.3 billion in revenue and $144.6 million in earnings by 2028. This requires 7.1% yearly revenue growth and a $79.6 million increase in earnings from $65.0 million today.

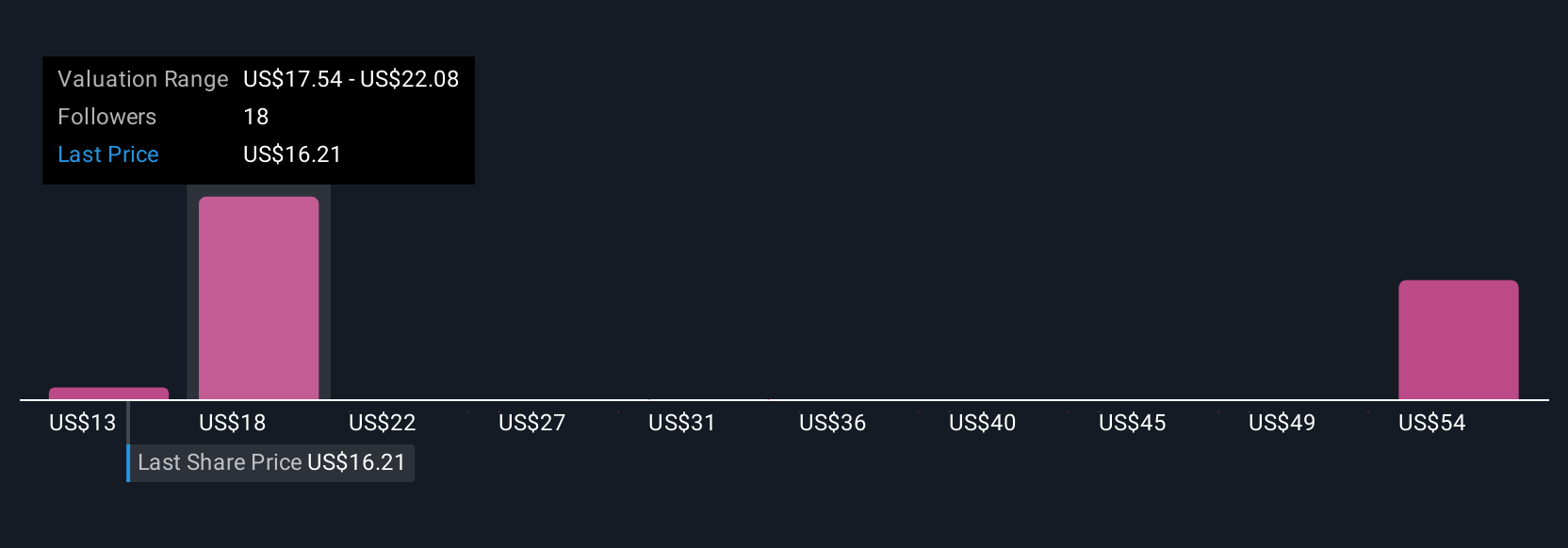

Uncover how Tripadvisor's forecasts yield a $18.16 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Seven estimates from the Simply Wall St Community put Tripadvisor’s fair value between US$13.50 and US$35.29. While new AI initiatives aim to reduce reliance on paid traffic, opinions still vary widely on how much they can offset core platform headwinds, take a look at several community viewpoints for a fuller picture.

Explore 7 other fair value estimates on Tripadvisor - why the stock might be worth over 2x more than the current price!

Build Your Own Tripadvisor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tripadvisor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tripadvisor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tripadvisor's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tripadvisor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIP

Tripadvisor

TripAdvisor, Inc., an online travel company, engages in the provision of travel guidance products and services worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives