- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TBLA

Taboola (TBLA): Evaluating Valuation Following Earnings Beat, Upgraded Outlook, and Platform Growth

Reviewed by Simply Wall St

Taboola.com (TBLA) posted quarterly earnings and revenue that topped expectations, reversing last year's loss with profits instead. Management also raised its outlook for the full year, citing ongoing operational momentum.

See our latest analysis for Taboola.com.

Fueled by its earnings surprise, raised outlook, and ongoing share buybacks, Taboola.com has caught investors’ attention lately. The stock rallied with a 22.65% 1-month share price return, adding to a robust 10.82% total shareholder return over the past year. With momentum building off operational milestones and renewed optimism, Taboola’s performance suggests improving market confidence after a difficult stretch in prior years.

Curious what else might be on the move right now? This could be a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares up sharply and fresh guidance pointing higher, the key question now is whether Taboola.com is still undervalued at current levels or if the recent run means future growth is already reflected in the price.

Most Popular Narrative: 13.4% Undervalued

With Taboola.com closing at $3.79 and the narrative fair value set at $4.38, analysts currently view the stock as holding more upside than downside at current prices. This valuation reflects confidence that strong recent execution and fresh product launches can spark further gains.

The launch of Realize, Taboola's new performance advertising platform, is enabling entry into a much larger pool of display and social ad budgets. This positions the company to capture incremental revenue growth outside of traditional native ad formats. This is expected to materially expand the addressable market and drive a return to double-digit revenue growth in the coming years.

Want the numbers behind these bold claims? The key narrative hinges on a shift to new advertising channels and a jump in both top-line growth and profit margins. Curious which aggressive forecasts could power this evaluation? Dive deeper to discover the projections that set this price target apart.

Result: Fair Value of $4.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including uncertainty around broader adoption of the Realize platform and heightened competition from larger tech incumbents. These factors could limit future growth.

Find out about the key risks to this Taboola.com narrative.

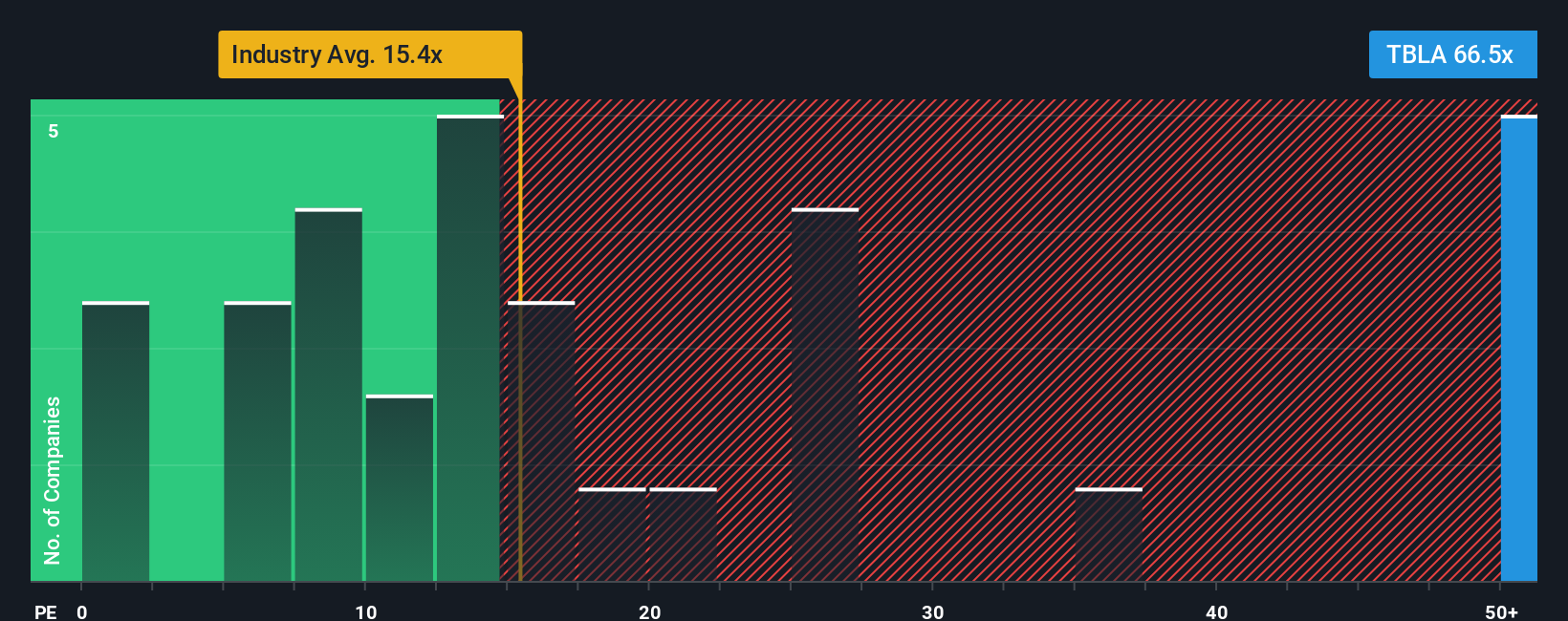

Another View: Multiples Based Risks

While the narrative and fair value models point to upside, Taboola.com’s current valuation looks stretched when using its price-to-earnings ratio. At 44.4x, the ratio is well above the industry average of 17x and the fair ratio of 14.2x. This suggests the stock may be priced for more growth than it has recently delivered, raising questions about whether expectations have run ahead of results. Is the market pricing in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Taboola.com Narrative

If you prefer your own take or want to dig deeper into Taboola.com’s data, you can easily build and test your own view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Taboola.com.

Looking for More Investment Ideas?

Expand your investing toolkit and get ahead of market trends. Here is where you could find tomorrow’s top performers before the crowd catches on.

- Spot untapped value when you analyze these 881 undervalued stocks based on cash flows offering real potential based on healthy cash flows and overlooked fundamentals.

- Accelerate your wealth by focusing on steady payouts with these 16 dividend stocks with yields > 3% consistently rewarding investors with yields above 3%.

- Ride the wave of AI-driven innovation by targeting these 25 AI penny stocks that are disrupting entire industries with smarter technology and robust growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taboola.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBLA

Taboola.com

Operates an artificial intelligence-based algorithmic engine platform in Israel, the United States, the United Kingdom, Germany, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives