- United States

- /

- Media

- /

- NasdaqGS:SSP

The E.W. Scripps Company (NASDAQ:SSP) Stock Catapults 32% Though Its Price And Business Still Lag The Industry

Those holding The E.W. Scripps Company (NASDAQ:SSP) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 49% in the last year.

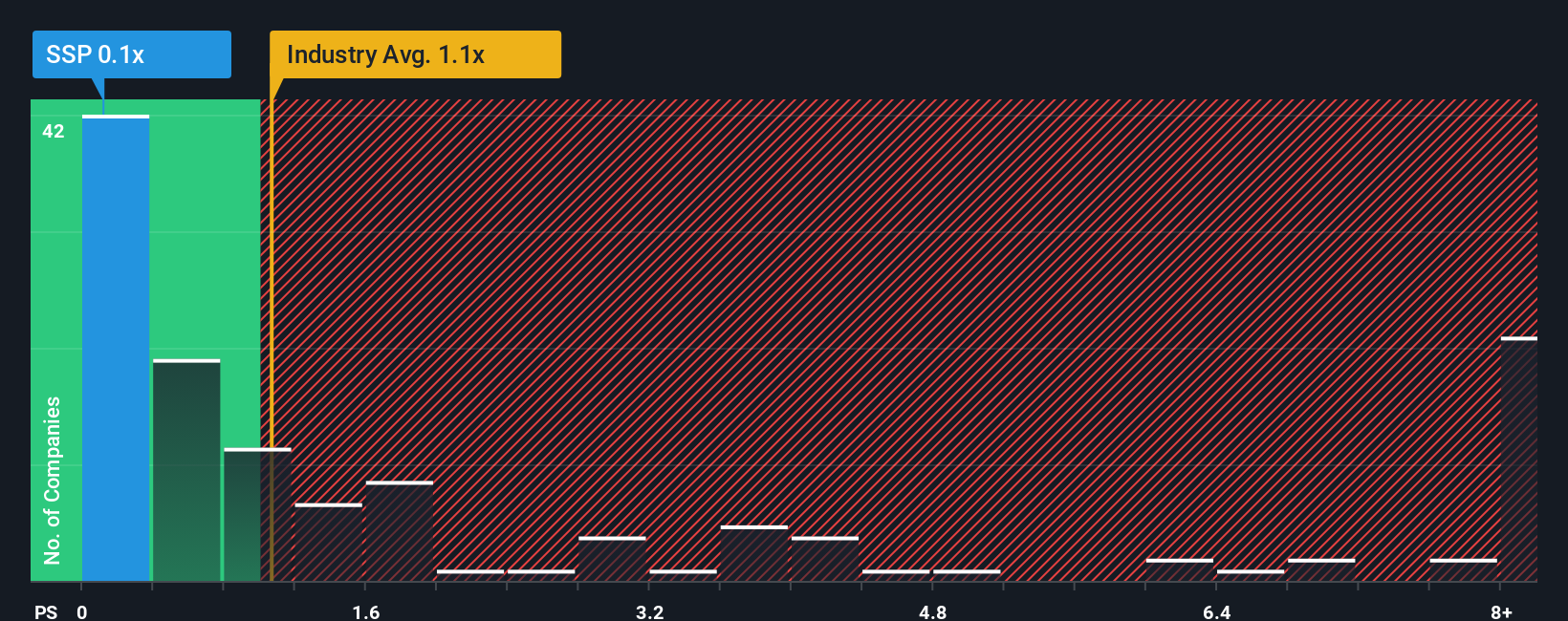

Although its price has surged higher, E.W. Scripps' price-to-sales (or "P/S") ratio of 0.1x might still make it look like a buy right now compared to the Media industry in the United States, where around half of the companies have P/S ratios above 1.1x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for E.W. Scripps

How Has E.W. Scripps Performed Recently?

While the industry has experienced revenue growth lately, E.W. Scripps' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on E.W. Scripps will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, E.W. Scripps would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 3.3% decrease to the company's top line. As a result, revenue from three years ago have also fallen 3.2% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 0.8% over the next year. That's not great when the rest of the industry is expected to grow by 3.0%.

With this information, we are not surprised that E.W. Scripps is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

The latest share price surge wasn't enough to lift E.W. Scripps' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of E.W. Scripps' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for E.W. Scripps that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if E.W. Scripps might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SSP

E.W. Scripps

Operates as a media enterprise through a portfolio of local television stations, national news, and entertainment networks in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives