- United States

- /

- Media

- /

- NasdaqGS:SBGI

Does Sinclair's Recent 19.7% Rally Signal a Shift in Value for 2025?

Reviewed by Bailey Pemberton

- Wondering if Sinclair stock could be a hidden value opportunity? You are not alone. We are here to help you cut through the noise with a focus on what really matters for long-term investors.

- Sinclair’s share price has increased 19.7% over the last month. However, it is still down 7.2% year-to-date and 8.1% over the past 12 months. This performance has caught the attention of both bargain hunters and risk-watchers.

- Many investors are pointing to the company's recent push into local sports broadcasting and media tech partnerships as key catalysts behind the recent rally. Headlines have highlighted Sinclair’s strategic moves in a shifting media landscape, sparking renewed debate about its future potential and risks.

- If you look at the numbers, Sinclair currently scores a 3 out of 6 on our undervaluation checklist. This means it passes half of our key valuation checks. In the next sections, we will dive into these valuation methods. Be sure to stick around for our view on an even smarter way to understand value at the end.

Approach 1: Sinclair Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today's value. This method helps investors judge whether a stock is trading above or below its intrinsic worth.

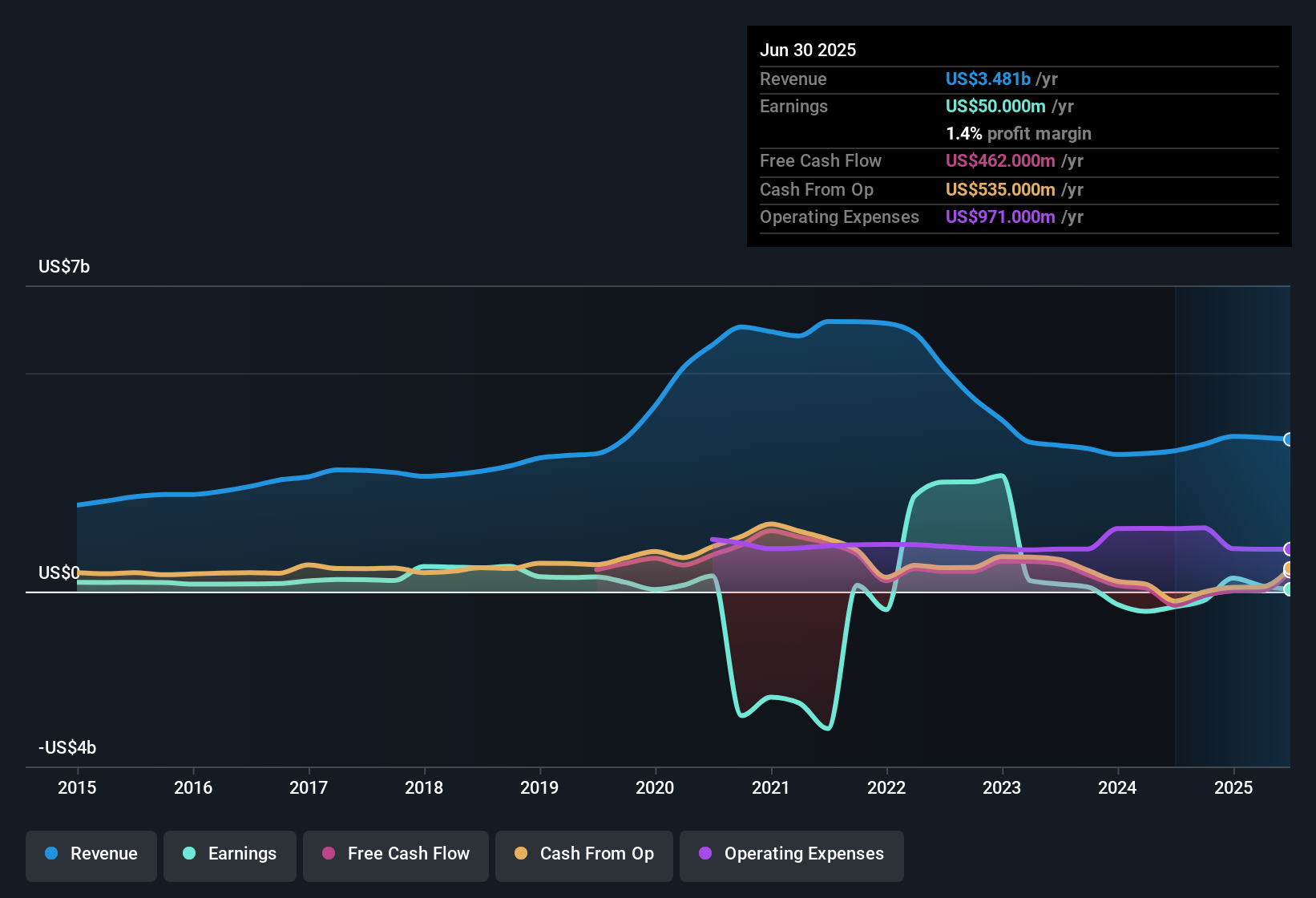

For Sinclair, the current Free Cash Flow stands at $201.4 million. Analyst forecasts extend out to 2027, projecting a Free Cash Flow of $73.6 million by the end of that year. Beyond those five years, Simply Wall St extrapolates further cash flow estimates. Projections suggest a moderate decline and then stabilization, reaching an expected $44.7 million by 2035.

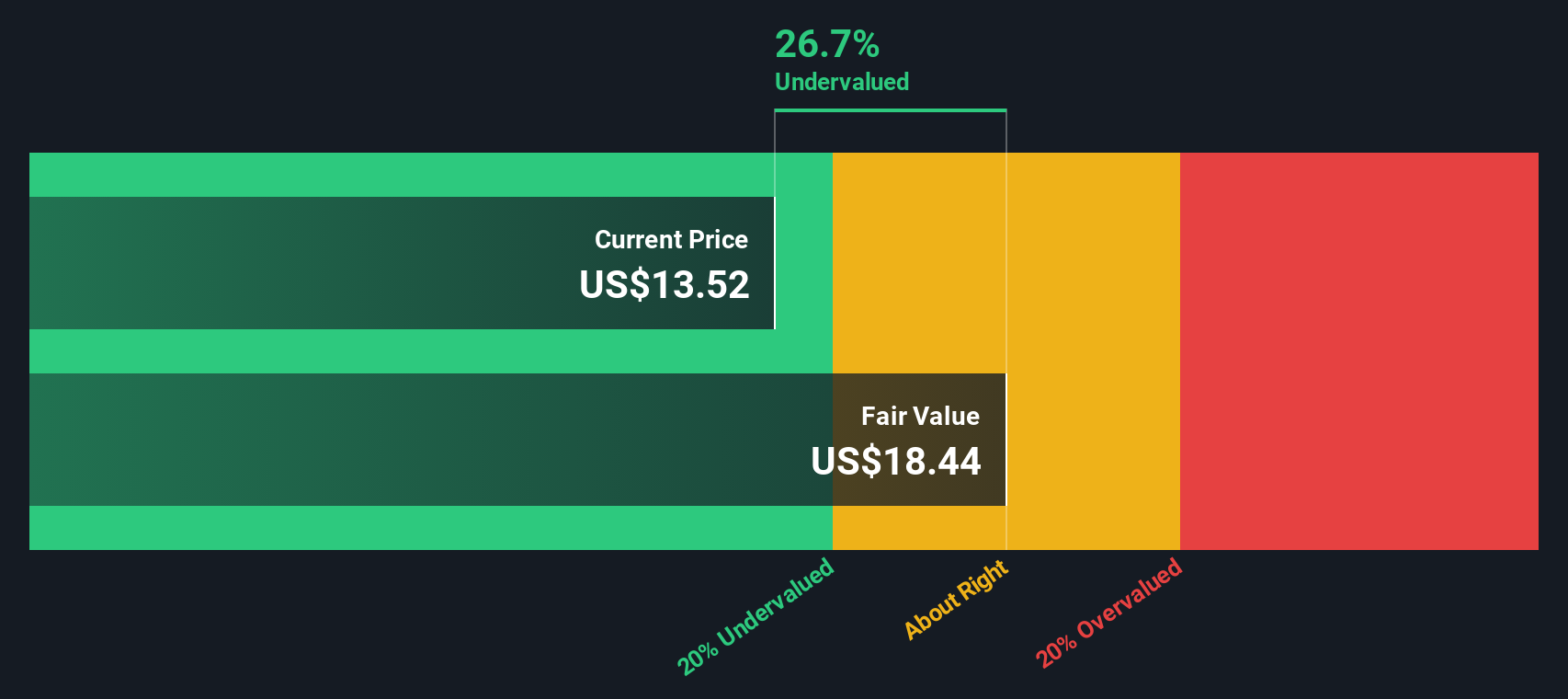

Using these projections, the DCF model calculates Sinclair's intrinsic fair value to be $9.26 per share. Compared to the current share price, this implies the stock is trading at a premium, with the DCF suggesting it is 70.1% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sinclair may be overvalued by 70.1%. Discover 921 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Sinclair Price vs Sales

For evaluating companies in industries like media, where earnings can be volatile or negative, the Price-to-Sales (P/S) ratio is often the preferred valuation metric. The P/S ratio is particularly useful here because it focuses on revenue, which tends to be more stable and less susceptible to accounting adjustments than earnings.

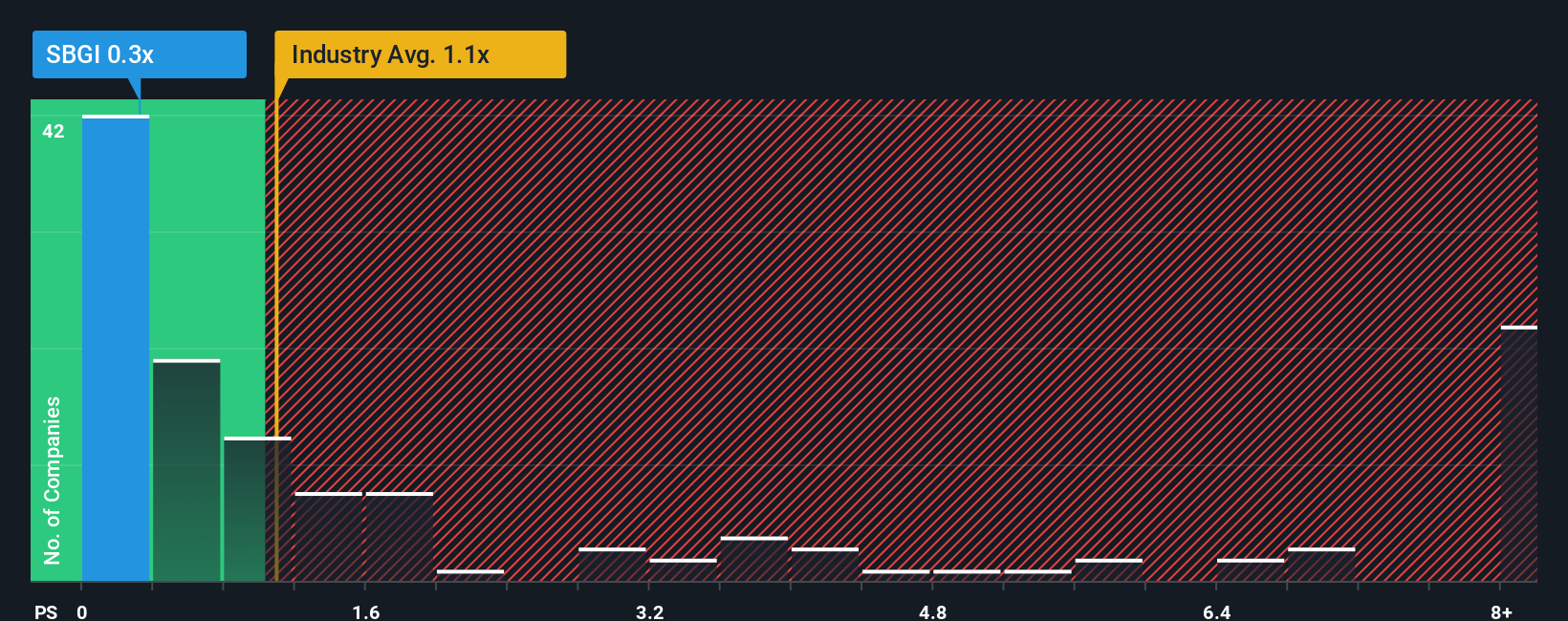

Sinclair currently trades at a P/S ratio of 0.33x. For context, the average P/S ratio in the media industry is 1.09x, and Sinclair's peers have an even higher average at 1.78x. This means Sinclair’s shares are priced at a significant discount to both the industry and peers when measured on a revenue basis.

To get a sense of what a “fair” multiple should be, we look at Simply Wall St's Fair Ratio, a proprietary assessment that considers not only industry averages, but also growth expectations, profit margins, company risks, and market cap. For Sinclair, the Fair Ratio sits at 0.76x. This approach offers more nuance than simply looking at average multiples, because it tailors the benchmark to Sinclair’s unique circumstances.

Comparing Sinclair’s actual P/S ratio of 0.33x to its Fair Ratio of 0.76x suggests the stock is attractively undervalued on a sales basis and well below what would be considered reasonable for its business profile.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1438 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sinclair Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a straightforward tool that lets you create and share your own story about Sinclair, connecting your perspective on the company's business drivers to a transparent set of financial forecasts, such as your fair value estimate, revenue, earnings, and margin assumptions.

Narratives link the company’s story to the numbers, making it easy to see how your outlook translates into a potential fair value and compare that to the current share price to make investment decisions. This feature is accessible directly on Simply Wall St’s Community page, where millions of investors contribute and update their Narratives in response to new news, company results, or industry shifts.

With Narratives, forecasts and fair values are updated automatically when new information emerges, so your story always stays relevant. For example, some Sinclair investors focus on optimistic growth in digital and local sports, giving a high fair value near $27.00, while others warn about lasting TV declines and put their estimate closer to $8.50.

By creating or following Narratives, you gain a living view of the stock’s potential based on real assumptions and prepared to evolve as the story does.

Do you think there's more to the story for Sinclair? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBGI

Sinclair

A media company, provides content on local television stations and digital platforms in the United States.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.