- United States

- /

- Media

- /

- NasdaqGS:SATS

EchoStar (SATS) Valuation Reassessed After SpaceX Stake Jumps in Value on Planned Secondary Share Sale

Reviewed by Simply Wall St

EchoStar (SATS) is back on traders radar after gaining about 12% as SpaceX moves toward a secondary share sale at a sharply higher valuation, instantly making the EchoStar stake materially more valuable.

See our latest analysis for EchoStar.

The latest pop builds on a powerful run, with the share price up sharply year to date and a strong 1 year total shareholder return. This suggests momentum is clearly building as the market reassesses EchoStar’s upside from its SpaceX exposure and balance sheet moves.

If this type of re rating story interests you, it might be worth seeing which other space linked names are showing up in aerospace and defense stocks right now.

But after such a rapid rerating, with EchoStar trading slightly above the average analyst target yet still screening as deeply discounted on some intrinsic metrics, is there still a genuine buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 2.7% Overvalued

EchoStar's most followed narrative pegs fair value just below the latest 82.0 close, implying the recent surge may be slightly ahead of fundamentals.

Success in monetizing EchoStar's substantial spectrum assets, either through launching lucrative new services, entering wholesale partnerships with global carriers, or potential spectrum sales/leases, could unlock significant one time gains or ongoing income, materially strengthening the balance sheet and supporting medium term earnings.

Curious how modest revenue expectations still map to a rich long term earnings profile and a double digit profit margin shift? Want to see which assumptions drive that leap from today’s losses to future normalized earnings power, and how a single valuation multiple ties it all together? The full narrative lays out the exact growth, margin and discount rate puzzle pieces behind that fair value call.

Result: Fair Value of $79.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory uncertainty around key spectrum licenses and EchoStar’s heavy near term debt maturities could quickly derail the upbeat long term earnings narrative.

Find out about the key risks to this EchoStar narrative.

Another Angle on Valuation

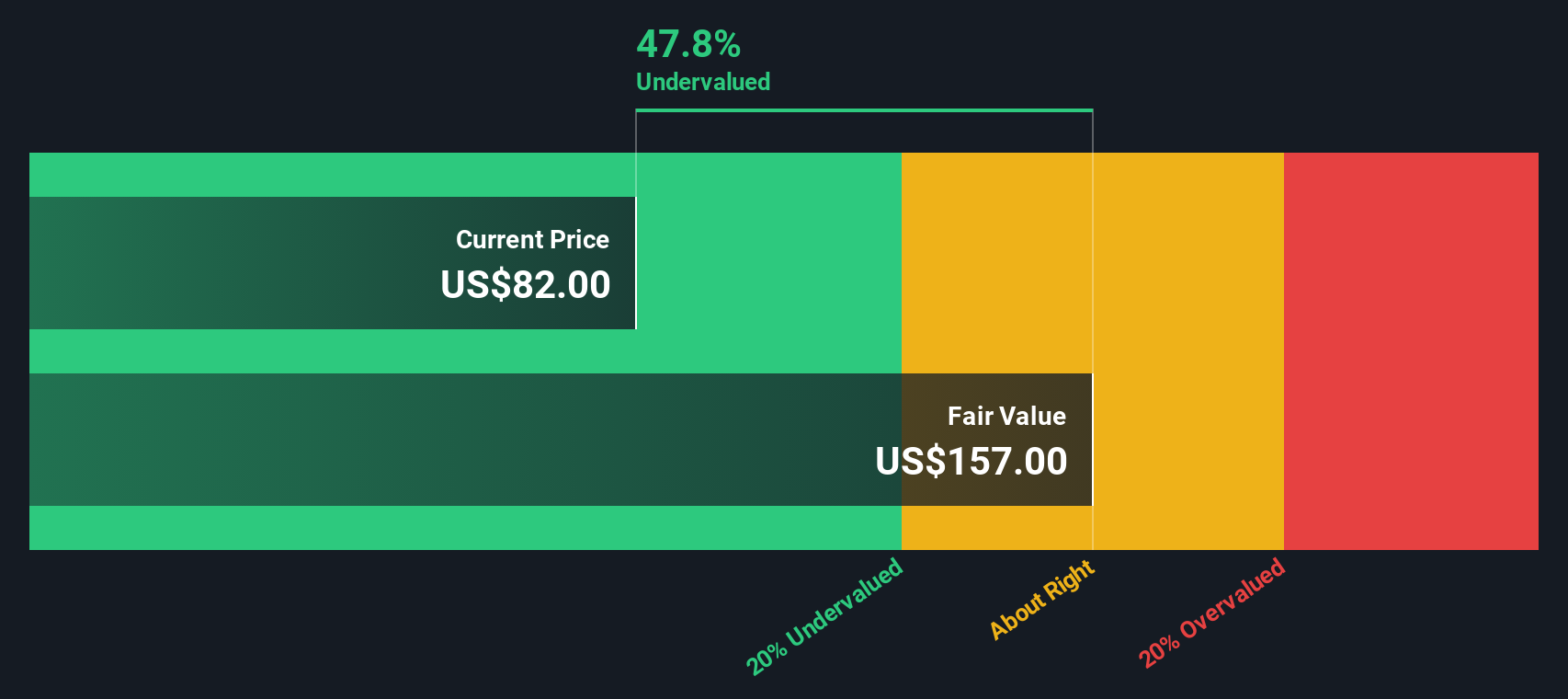

While the leading narrative sees EchoStar as slightly overvalued around $82, our SWS DCF model paints a very different picture. It indicates fair value nearer $157 and the stock trading at about a 48% discount. Is the market overreacting to near term risk, or underestimating long term cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own EchoStar Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your EchoStar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more high conviction investment ideas?

Do not stop at EchoStar. Your next winning theme could be waiting in the Simply Wall St screener, where fresh ideas appear before the wider market reacts.

- Tap into early stage growth potential by hunting for resilient upstarts using these 3573 penny stocks with strong financials with balance sheets that can support real expansion, not just hype.

- Position yourself for the next productivity boom by targeting companies in these 26 AI penny stocks that pair cutting edge innovation with scalable business models and growing demand.

- Lock in tomorrow’s bargains today by scanning these 911 undervalued stocks based on cash flows where discounted cash flows highlight quality names the market has not fully appreciated yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EchoStar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SATS

EchoStar

Provides networking technologies and services in the United States and internationally.

Fair value with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026