- United States

- /

- Media

- /

- NasdaqGS:SATS

AT&T’s Nationwide 5G Rollout Using EchoStar Spectrum Might Change The Case For Investing In EchoStar (SATS)

Reviewed by Sasha Jovanovic

- AT&T recently announced the nationwide deployment of mid-band spectrum acquired from EchoStar, accelerating 5G rollout and boosting download speeds by up to 80% across nearly 23,000 cell sites in over 5,300 cities.

- This rapid integration underscores EchoStar’s critical role as a spectrum provider and highlights its impact on advancing U.S. wireless infrastructure and connectivity.

- We'll explore how AT&T’s coast-to-coast rollout using EchoStar spectrum may influence EchoStar's investment narrative and perceived long-term value.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

EchoStar Investment Narrative Recap

For EchoStar shareholders, the core investment thesis centers on unlocking value from its spectrum assets and satellite technologies amid a shift toward integrated terrestrial and non-terrestrial 5G connectivity. The recent nationwide rollout of EchoStar’s mid-band spectrum by AT&T is a showcase of EchoStar’s importance, yet it does not materially resolve the most immediate challenges, liquidity pressures and near-term debt maturities remain the pivotal risks facing the business.

Among recent company announcements, the August 2025 definitive agreement to sell 3.45 GHz and 600 MHz spectrum licenses to AT&T for approximately US$23 billion closely ties to this news event. While this brought EchoStar a substantial inflow of capital, the sustainability of these proceeds as a short-term catalyst is offset by the company’s ongoing negative free cash flow, debt obligations, and unprofitable operations.

By contrast, investors should also be aware that EchoStar’s financial stability remains sensitive to unresolved debt maturities and tightening liquidity...

Read the full narrative on EchoStar (it's free!)

EchoStar's narrative projects $16.0 billion revenue and $1.6 billion earnings by 2028. This requires 1.3% yearly revenue growth and a $1.9 billion increase in earnings from current earnings of -$315.4 million.

Uncover how EchoStar's forecasts yield a $79.83 fair value, a 9% upside to its current price.

Exploring Other Perspectives

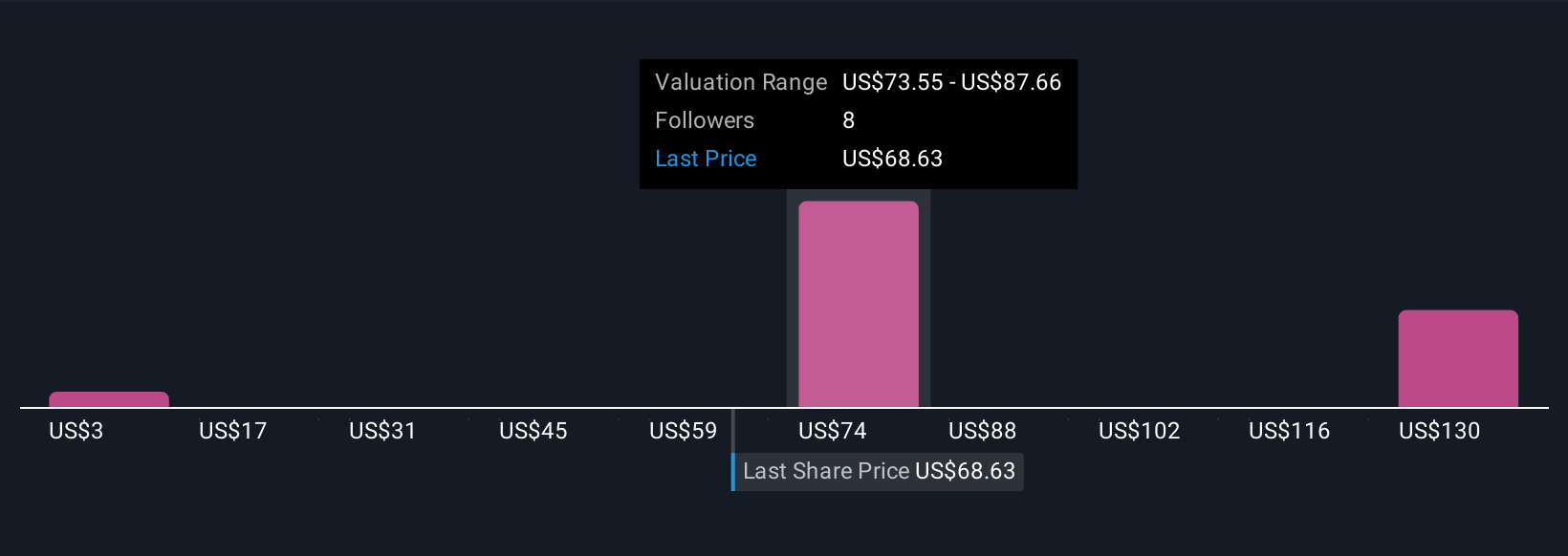

Five different private investor estimates from the Simply Wall St Community value EchoStar between US$2.98 and US$149.62 per share. While the recent spectrum deal caught the market’s attention, tightening liquidity and large near-term debt obligations may shape the company’s outcomes in ways that traditional fair value models do not fully reflect.

Explore 5 other fair value estimates on EchoStar - why the stock might be worth less than half the current price!

Build Your Own EchoStar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EchoStar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free EchoStar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EchoStar's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EchoStar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SATS

EchoStar

Provides networking technologies and services in the United States and internationally.

Fair value with very low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026