- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

Is ARK’s Ongoing Roku (ROKU) Stake Cut Testing Investor Conviction In Its Platform Monetization?

Reviewed by Sasha Jovanovic

- In recent days, ARK Invest’s ARK Innovation ETF reduced its Roku stake for a second consecutive session, selling 181,303 shares worth about US$17.5 million, alongside ongoing insider sales that have drawn increased attention from investors.

- This renewed selling by a high-profile institutional holder has become a focal point for market watchers, who are weighing it against Roku’s improving profitability, expanding ad-supported streaming offerings, and deeper content partnerships such as free Formula E coverage on The Roku Channel.

- We’ll now examine how ARK Invest’s continued stake reduction and insider selling color Roku’s investment narrative, especially around platform monetization.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Roku Investment Narrative Recap

To own Roku, you generally have to believe its ad-funded streaming platform can keep scaling as TV viewing and ad budgets shift toward connected TV. The latest ARK Invest selling and modest insider sales may add short term sentiment noise but do not fundamentally alter the near term catalyst of improving profitability, while competitive pressure from larger ecosystem players remains a key risk to watch.

In that context, Roku’s free Formula E coverage on The Roku Channel stands out, reinforcing the push into ad-supported live sports that ties directly into its platform monetization story. If this kind of engagement continues to grow, it could help offset ad market cyclicality and support Roku’s efforts to deepen relationships with brands and content partners.

Yet beneath Roku’s growing ad supported offerings, investors should also be aware of rising competition in smart TV operating systems and how it could...

Read the full narrative on Roku (it's free!)

Roku's narrative projects $6.1 billion revenue and $372.1 million earnings by 2028. This requires 11.4% yearly revenue growth and about a $433.6 million earnings increase from -$61.5 million today.

Uncover how Roku's forecasts yield a $110.88 fair value, a 9% upside to its current price.

Exploring Other Perspectives

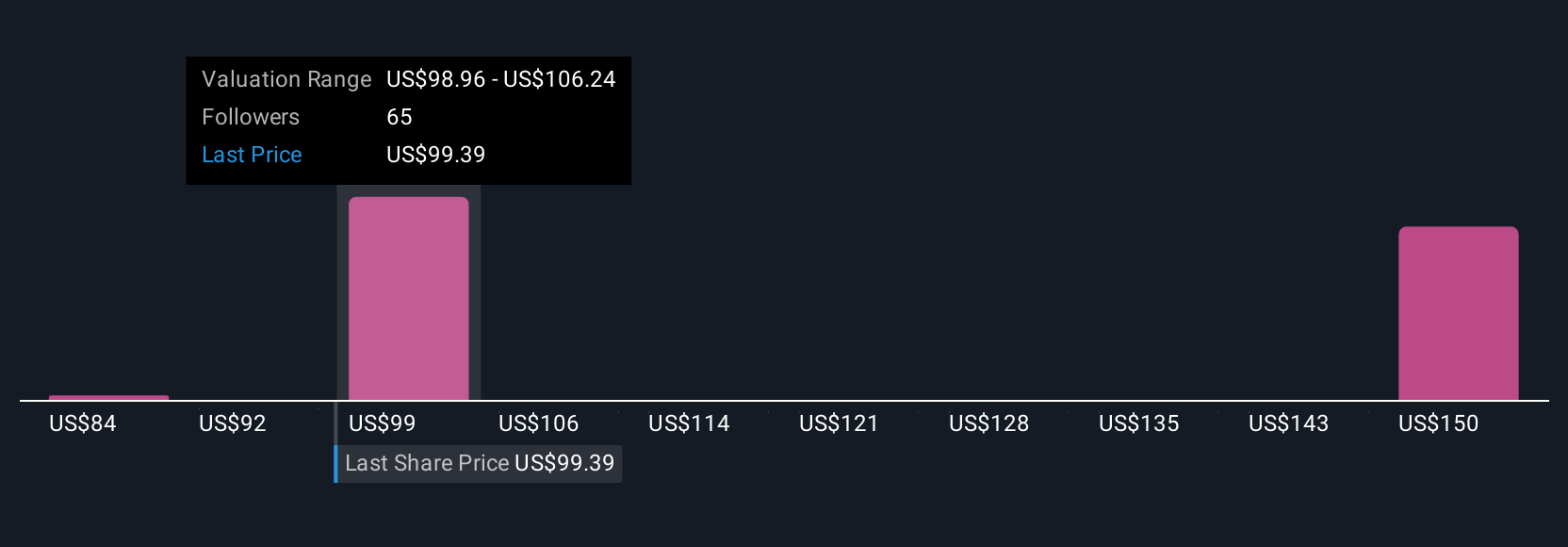

Ten fair value estimates from the Simply Wall St Community span roughly US$84.75 to US$168.55, showing how differently individual investors view Roku’s potential. As you weigh those views, remember Roku’s reliance on advertising makes its trajectory tightly linked to the health of the ad market and the success of newer monetization initiatives.

Explore 10 other fair value estimates on Roku - why the stock might be worth 17% less than the current price!

Build Your Own Roku Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roku research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Roku research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roku's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

This one is all about the tax benefits

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026