- United States

- /

- Media

- /

- NasdaqGS:PARA

How Investors Are Reacting To Paramount Global (PARA) Returning to Profit and Streaming Growth

Reviewed by Simply Wall St

- Paramount Global recently reported its second quarter 2025 earnings, showing sales of US$6.85 billion and a return to profitability with net income of US$57 million after a very large loss in the same period last year.

- A standout detail from the results was the continued strength of the Paramount+ streaming segment, which reported subscriber and revenue growth despite overall industry challenges.

- We'll explore how Paramount+'s robust subscriber and revenue growth impacts the company's investment narrative and long-term transformation goals.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Paramount Global Investment Narrative Recap

To be a Paramount Global shareholder today, you need to believe in the company's ability to scale its direct-to-consumer streaming, particularly Paramount+, as the key path to long-term profitability and relevance in a rapidly evolving media industry. The second quarter 2025 results, modest revenue growth and a return to profitability, support the streaming-first strategy, but don't alleviate the biggest short-term risk: whether Paramount+ can keep outpacing larger competitors and offset declines in legacy TV revenue.

Among recent announcements, the pending closure of the Skydance transaction is highly relevant, as its completion could reshape Paramount Global’s growth prospects and content strategy. This deal aligns closely with the company's most important catalyst, the expansion of Paramount+, by potentially increasing access to new franchises and production capabilities, while investors continue to watch for tangible effects on operating income and market position.

Yet despite these encouraging developments, investors should not overlook that Paramount+ still faces fierce competition from well-capitalized rivals and...

Read the full narrative on Paramount Global (it's free!)

Paramount Global's narrative projects $29.2 billion revenue and $1.1 billion earnings by 2028. This requires a 0.6% annual revenue decline and a $6.6 billion earnings increase from -$5.5 billion today.

Uncover how Paramount Global's forecasts yield a $11.98 fair value, a 8% downside to its current price.

Exploring Other Perspectives

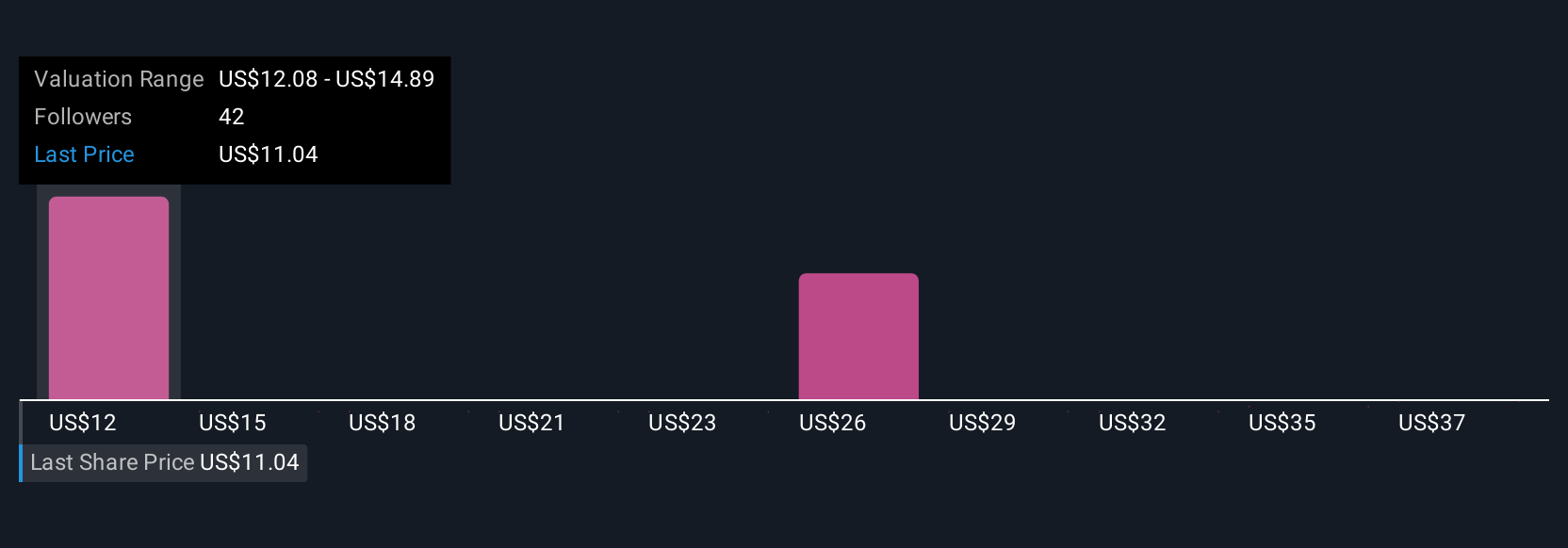

Simply Wall St Community members provided eight fair value estimates for Paramount Global, ranging widely from US$11.98 to US$48.19. While opinions differ sharply, many are watching how Paramount+'s growth and improving earnings will influence the company's ability to achieve sustained profitability and compete in streaming.

Explore 8 other fair value estimates on Paramount Global - why the stock might be worth 8% less than the current price!

Build Your Own Paramount Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paramount Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Paramount Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paramount Global's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PARA

Paramount Global

Operates as a media, streaming, and entertainment company worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives