- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Netflix (NFLX) Valuation: Is the Stock’s Growth Potential Accurately Reflected in its Current Price?

Reviewed by Simply Wall St

Netflix (NFLX) shares have drifted slightly higher this week, returning just over 1% in the last day and roughly 4% over the past week. The stock’s momentum has cooled a bit over the past month, with a 7% dip from earlier highs.

See our latest analysis for Netflix.

Netflix's share price jumped to $1,136.44, and while recent momentum has eased from last month’s highs, the year-to-date share price return still sits at an impressive 28%. For long-term holders, the one-year total shareholder return of nearly 39% and a remarkable 266% over three years highlight resilient growth, even as the latest surge cools off.

If Netflix’s performance has you scanning for your next opportunity, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With Netflix shares still up strongly for the year but slipping from recent highs, the key question now is whether the stock’s solid growth is undervalued by the market or if future upside is already reflected in the price.

Most Popular Narrative: 15.8% Undervalued

According to the most widely followed narrative, Netflix's fair value is estimated to be significantly above its recent closing price, fueling debate over whether the market is fully appreciating the company's growth levers and future profit potential.

The wider rollout and promising early metrics of Netflix's proprietary ad tech stack enable global expansion and increased monetization of the ad-supported tier. This positions Netflix to significantly accelerate ad revenues and improve margin leverage with scale as more advertising demand shifts to streaming.

Want to see what’s powering this attractive valuation? One crucial assumption hides in plain sight: analysts are betting on a combination of faster revenue growth and fatter margins to reshape Netflix's future earnings. Find out the bold financial leaps that support this price target.

Result: Fair Value of $1,350 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and surging content costs could pressure Netflix’s growth and margins. This may challenge the optimistic assumptions behind current valuations.

Find out about the key risks to this Netflix narrative.

Another View: Market Valuation Signals Caution

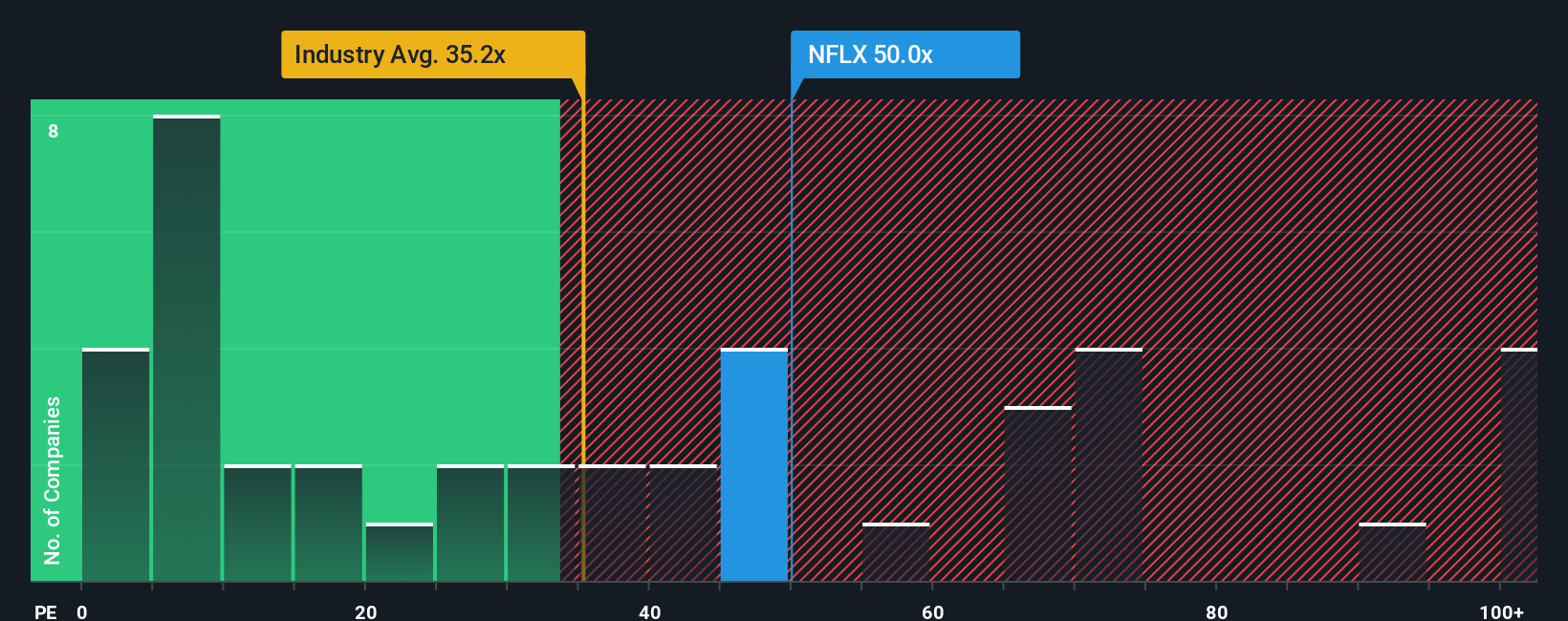

While analysts’ forecasts suggest Netflix is undervalued, the stock is trading at a steep 46.2x earnings. This figure is much higher than the industry’s 22.8x and above its own fair ratio of 36.3x. This sizable premium means investors face real valuation risk if growth expectations slip. Could the market be running ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Netflix Narrative

If you have a different perspective or want to dig into the numbers yourself, it's quick and easy to shape your own Netflix thesis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Netflix.

Looking for more ways to grow your portfolio?

Don’t let these opportunities pass you by. Put the odds on your side and confidently scan today’s markets for tomorrow’s winners with Simply Wall Street's expertly curated ideas.

- Unlock the untapped potential of overlooked companies by checking out these 3564 penny stocks with strong financials poised for powerful turnarounds and breakout performance.

- Secure steady passive income. Explore these 15 dividend stocks with yields > 3% delivering reliable yields and robust fundamentals for income-focused portfolios.

- Jump ahead of market trends and seize first-mover advantage by reviewing these 27 quantum computing stocks changing the game in advanced computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives