- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Does Meta’s AI Expansion Signal a Chance for Investors Amid Recent Share Price Dip?

Reviewed by Bailey Pemberton

- Ever found yourself wondering if Meta Platforms is trading at a bargain or riding too high? If you have, you are definitely not alone, especially with the stock making headlines lately.

- After a stellar three-year run with an eye-popping 456.5% return, Meta’s shares have cooled a bit. The stock is down 0.9% over the last week and off 10.4% this month, though it remains up 5.4% year-to-date.

- Recent news about Meta’s expansion into artificial intelligence partnerships and renewed regulatory scrutiny has been driving both excitement and caution among investors. These developments are shifting perceptions of Meta’s growth prospects and risk profile, which helps explain some of the stock’s latest moves.

- With a value score of 5 out of 6, Meta certainly passes most checks for undervaluation. As we unpack the numbers, we will not just look at conventional approaches, but also share an even sharper way to judge value before we wrap up.

Find out why Meta Platforms's 8.7% return over the last year is lagging behind its peers.

Approach 1: Meta Platforms Discounted Cash Flow (DCF) Analysis

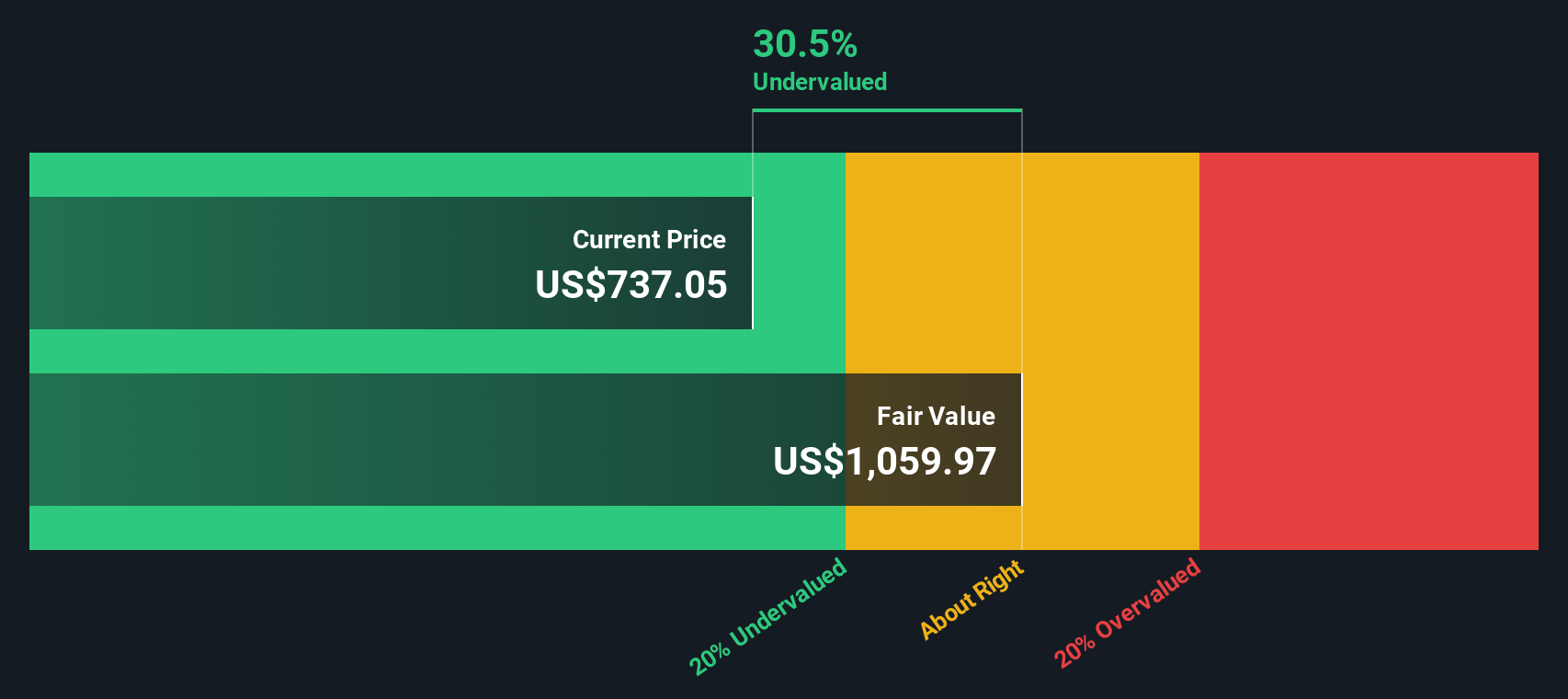

The Discounted Cash Flow (DCF) model provides a forward-looking estimate of a company’s worth by extrapolating future cash flows and discounting them back to today’s value. It is widely used by investors to assess whether a stock trades below, at, or above its intrinsic value.

According to the DCF analysis for Meta Platforms, the company's latest twelve months Free Cash Flow stands at $58.8 Billion. Analysts project steady growth in Meta’s cash generation, estimating annual free cash flow to reach $97.0 Billion by 2029, with further increases based on longer-term models. The next five years rely on direct analyst estimates, and Simply Wall St extends the forecast out ten years to capture the longer-term picture. This produces a valuation that incorporates both near-term and mid-term outlooks.

When these projections are discounted back to the present, Meta’s estimated intrinsic value comes out to $1,081 per share. With the DCF model indicating the stock is trading at a 41.6% discount to its calculated value, Meta appears significantly undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Meta Platforms is undervalued by 41.6%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: Meta Platforms Price vs Earnings

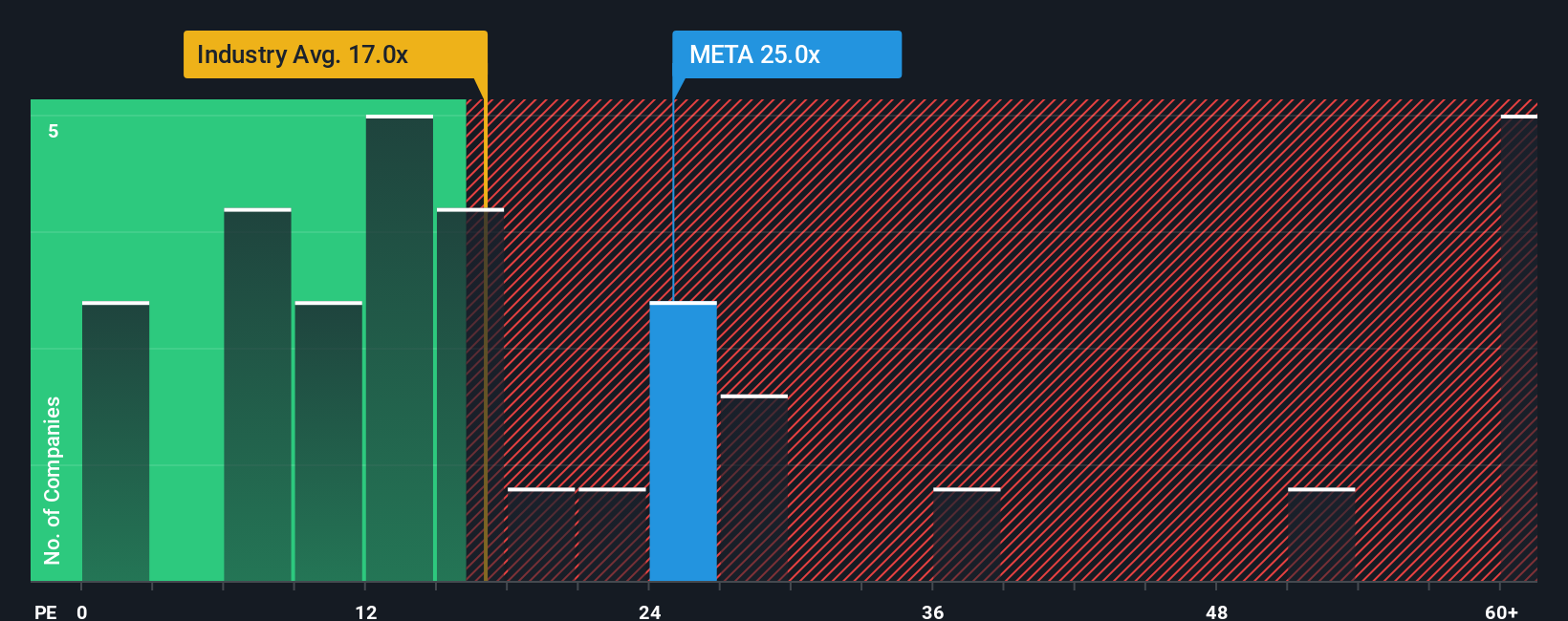

The Price-to-Earnings (PE) ratio is a trusted way to value profitable companies like Meta Platforms because it reflects what investors are willing to pay today for a dollar of earnings. For companies generating steady profits, like Meta, the PE provides a direct link between market expectations and current performance.

Growth expectations and risks can shift what counts as a “normal” or “fair” PE ratio. Faster-growing companies or those considered less risky often command higher multiples, while slower or more volatile firms usually see lower ones.

Meta Platforms currently trades at a PE ratio of 27.2x. For context, the Interactive Media and Services industry sits at an average PE of 17.7x, while Meta’s peer group averages 36.3x. Clearly, Meta is more expensive than the broader industry, but trades at a notable discount to its direct peers.

This is where the “Fair Ratio” from Simply Wall St comes in. For Meta, the Fair Ratio is 40.2x. Unlike industry averages or peer comparisons, the Fair Ratio incorporates Meta’s individual earnings growth, profit margins, business risks, industry, and size to more accurately reflect its unique profile.

Since Meta’s current PE of 27.2x is well below the Fair Ratio of 40.2x, this signals the stock is undervalued using this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Meta Platforms Narrative

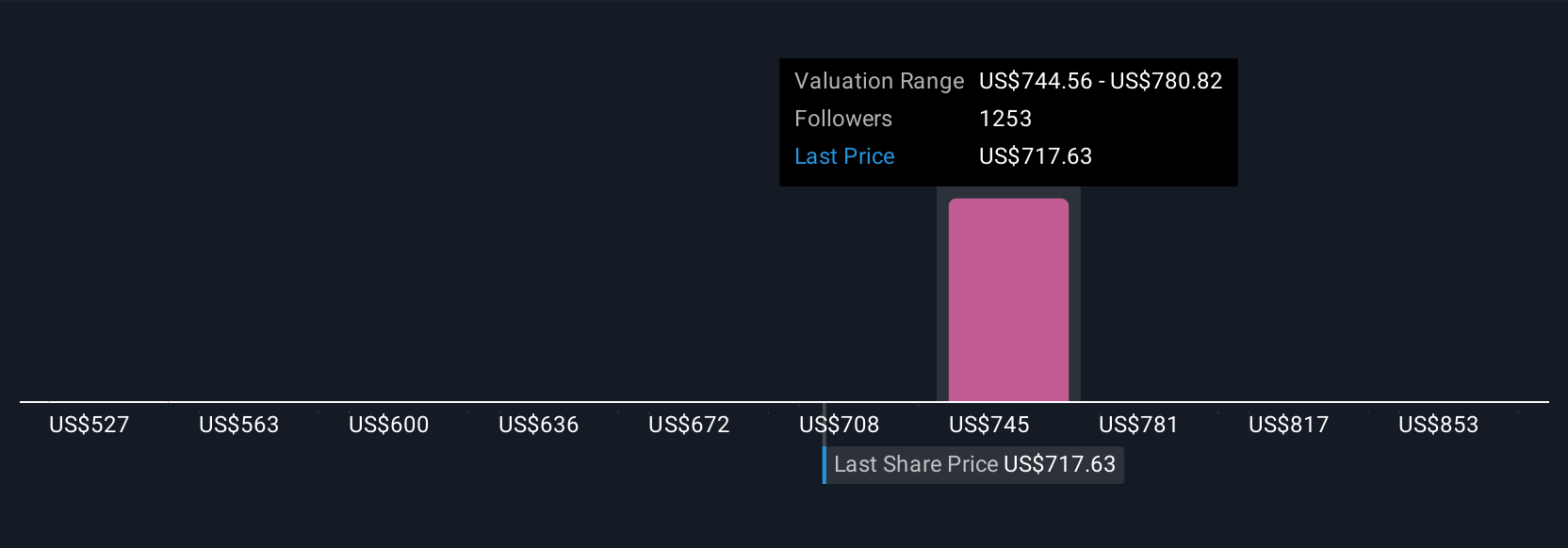

Earlier, we mentioned a more powerful way to make investment decisions. Let’s introduce you to Narratives, a dynamic approach where you combine your view of Meta Platforms’ story with a financial forecast and a fair value that matches your assumptions.

A Narrative goes beyond the numbers, allowing you to spell out why you think Meta will succeed (or struggle), and then linking your conviction directly to growth, margins, risks, and a resulting fair value. This empowers you to see exactly how your beliefs stack up against both the current share price and hundreds of other investors’ perspectives.

Best of all, Narratives are easy to create or explore within the Community page on Simply Wall St, where millions of investors share their own takes and models. You can compare, adjust, or challenge your thinking in real time.

When new news or earnings drop, Narratives update automatically, helping you stay ahead and decide if it’s time to buy, sell, or hold. For Meta Platforms, you’ll find upbeat Narratives assuming over $1,086 per share on faster AI-driven ad growth, while more cautious perspectives see fair value closer to $658, underscoring how your view of the story can change everything.

For Meta Platforms, however, we'll make it really easy for you with previews of two leading Meta Platforms Narratives:

Fair Value: $848.43

Current Price is 25.5% below fair value

Revenue Growth Rate: 15.8%

- Meta’s AI-powered ad targeting, ecosystem advantage, and new revenue streams in messaging are expected to drive strong revenue growth and enhanced monetization.

- Analysts forecast annual revenue growth of 15.8% for the next three years, with earnings per share rising to $36.14 by 2028. Fair value is estimated at $848.43, 25.5% above the current price.

- Key risks include heavy investment in AI and metaverse initiatives, regulatory headwinds, and challenges in monetizing new ventures. Long-term prospects remain strong if execution succeeds.

Fair Value: $538.09

Current Price is 17.4% above fair value

Revenue Growth Rate: 10.5%

- Meta’s ability to maintain its social dominance rests on AI innovation, cost leadership in AR/VR hardware, and continued ad revenue growth, but heavy investments and diversification risks are rising.

- Revenue from AR/VR and the Threads app is set to diversify the portfolio, but monetization and cost control remain key hurdles as the company wagers big on new technology trends.

- Bears highlight execution risk, ongoing regulatory scrutiny, dependence on advertising, and a current price exceeding the calculated fair value by 17.4%.

Do you think there's more to the story for Meta Platforms? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives