- United States

- /

- Entertainment

- /

- NasdaqGS:IQ

Will "The Blooming Journey" Season 2’s Tourism Impact Change iQIYI's (IQ) Content Innovation Narrative?

Reviewed by Sasha Jovanovic

- iQIYI premiered "The Blooming Journey" Season 2 on October 24, 2025, continuing its focus on premium, travel-themed reality entertainment with a diverse celebrity cast and meaningful storytelling across several Chinese destinations.

- A significant highlight is the show’s impact on travel patterns, as real-world tourism surged at featured locations, illustrating how iQIYI’s original content influences both digital engagement and consumer behavior offline.

- We’ll explore how this combination of audience excitement and tangible cultural impact strengthens iQIYI’s investment narrative around original content innovation.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

iQIYI Investment Narrative Recap

To be a shareholder of iQIYI, you need to believe in its ability to continually deliver standout original content that converts viewership into revenue, despite recent volatility. The successful launch of "The Blooming Journey" Season 2 may build short-term momentum with audiences and advertisers, but the ongoing risk of revenue swings driven by content cycles and macro conditions remains material and has not been fully resolved by this event.

Of the recent company moves, iQIYI's collaboration with KADOKAWA Corporation to globally distribute the animated series "The Fated Magical Princess" is most relevant. This partnership highlights the company's focus on expanding original IP across international markets, which could complement domestic content successes by opening fresh revenue streams and potentially stabilizing growth beyond China's market cycles.

Yet, despite this international push, investors should be mindful of the impact uneven content performance and shifting demand patterns could have on...

Read the full narrative on iQIYI (it's free!)

iQIYI's narrative projects CN¥29.2 billion revenue and CN¥1.3 billion earnings by 2028. This requires 1.8% yearly revenue growth and a CN¥1.2 billion increase in earnings from CN¥88.5 million currently.

Uncover how iQIYI's forecasts yield a $2.44 fair value, a 11% upside to its current price.

Exploring Other Perspectives

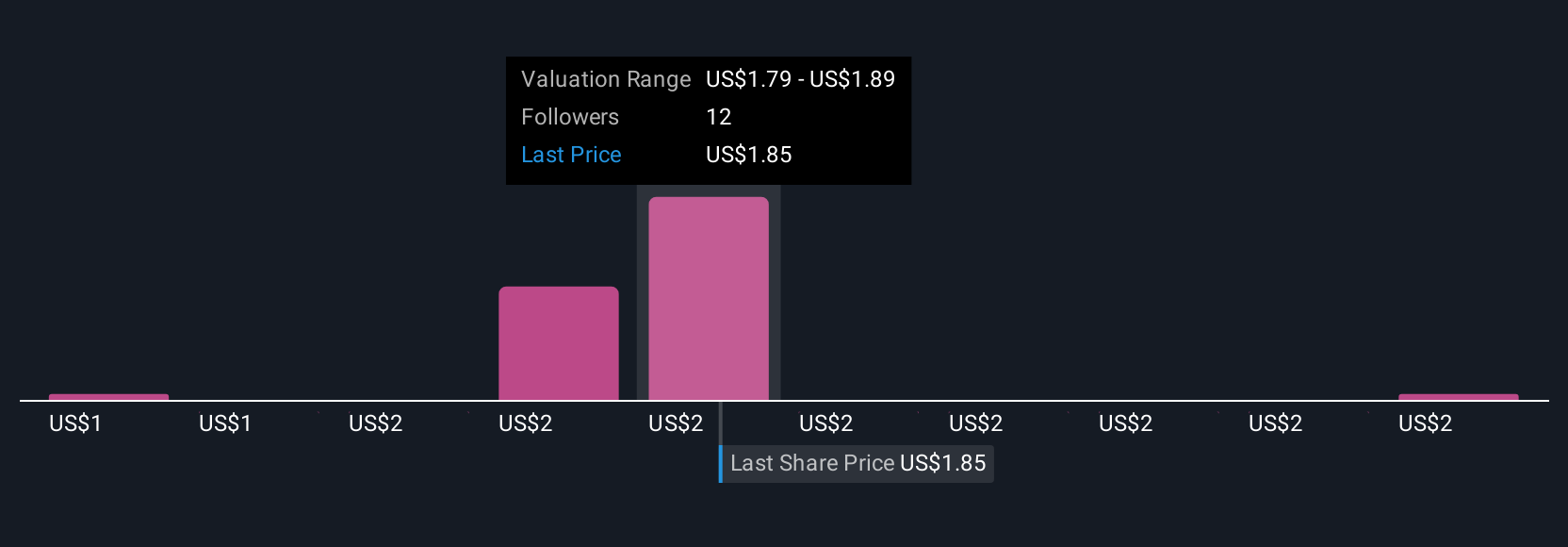

The Simply Wall St Community produced five fair value estimates for iQIYI’s share price, ranging from CN¥0.87 to CN¥3.34. While many see opportunity from expanding original content across markets, opinions vary widely on how persistent revenue volatility may influence the company’s results, explore these viewpoints for a more rounded picture.

Explore 5 other fair value estimates on iQIYI - why the stock might be worth less than half the current price!

Build Your Own iQIYI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your iQIYI research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free iQIYI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate iQIYI's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iQIYI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IQ

iQIYI

Through its subsidiaries, provides online entertainment video services in the People’s Republic of China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives