- United States

- /

- Entertainment

- /

- NasdaqGS:IQ

iQIYI (NasdaqGS:IQ): Assessing Valuation After Revenue Drop and Return to Net Loss

Reviewed by Simply Wall St

iQIYI (NasdaqGS:IQ) announced third quarter results showing a decline in revenue from last year and a net loss. This marks a reversal from the company’s previous profitability. Investors are weighing the implications for future growth and stability.

See our latest analysis for iQIYI.

After peaking earlier in the year, iQIYI’s share price momentum has been fading, with a 9.5% drop over the past month and a 22.9% decline in the last quarter. The company’s one-year total shareholder return of -7.5% reflects ongoing challenges, which points to investor caution about sustained profitability and growth potential.

If shifts in streaming trends have you thinking broader, consider using our screener to discover fast growing stocks with high insider ownership.

That raises the question for investors: is iQIYI now undervalued after its sharp decline, or is the market already factoring in weaker performance and limited growth ahead?

Most Popular Narrative: 10% Undervalued

With a current fair value of $2.33 set against a last close of $2.09, the valuation narrative suggests iQIYI might be trading below its projected worth. This latest perspective rests on shifting growth and profit assumptions that underpin the narrative’s core expectations.

“Rapid adoption of AI across content creation, recommendation, and advertising optimization is driving operational efficiencies, lowering production costs, reducing churn, and enabling higher ad conversion rates. These developments support both net margins and future earnings growth.”

What is fueling this uptick in fair value? The story is built on a controversial combination: ambitious margin expansion, a pivot to new content-driven revenue streams, and optimistic forecasts for international growth. See which bold projections tip the balance in the full narrative.

Result: Fair Value of $2.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent content costs and intense competition could dampen earnings momentum, which may make long-term profitability less certain for iQIYI shareholders.

Find out about the key risks to this iQIYI narrative.

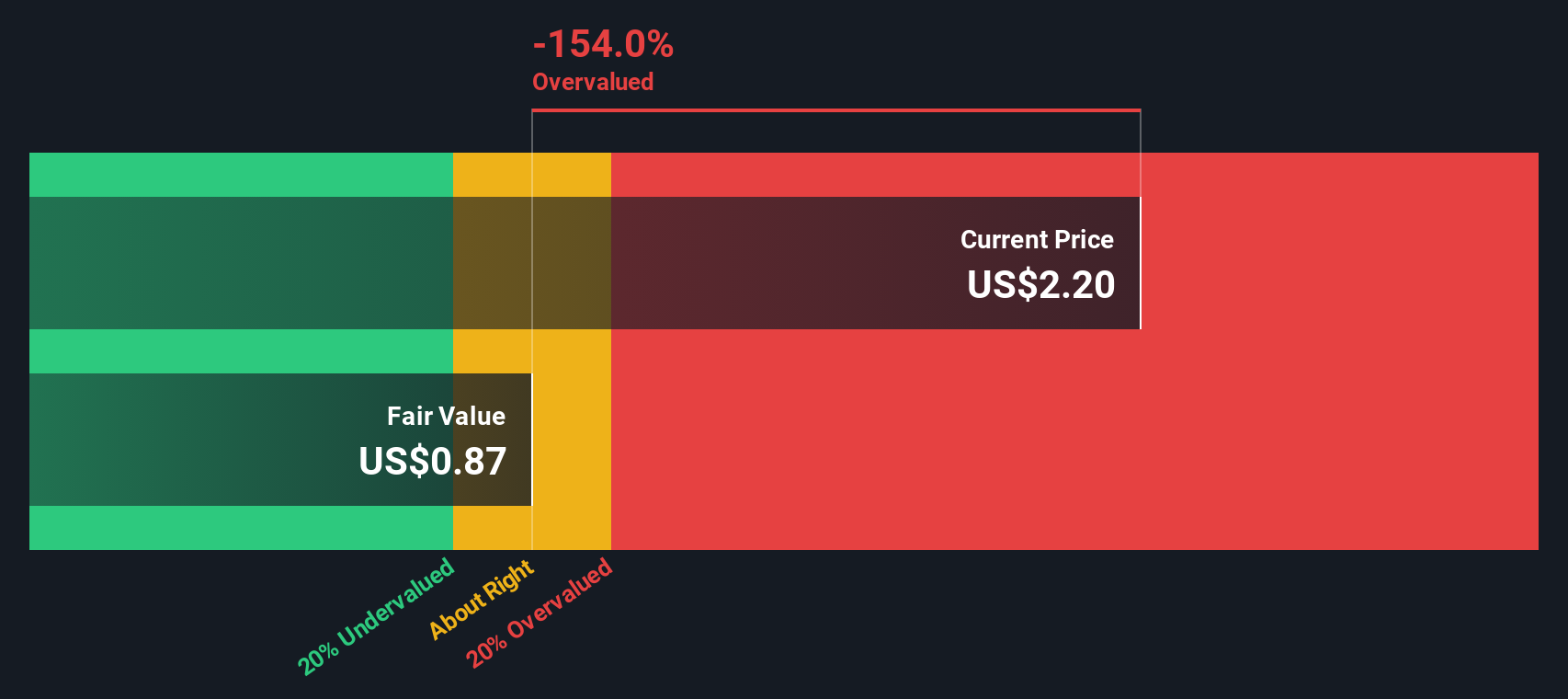

Another View: Discounted Cash Flow Estimate

While the fair value estimate highlights iQIYI as undervalued based on growth and margin projections, our SWS DCF model presents a different perspective. According to this approach, iQIYI’s shares may actually be trading above their current fair value, which suggests the market could be more cautious about future cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out iQIYI for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own iQIYI Narrative

Not convinced by the outlook above, or want to dig deeper into the data yourself? You can build your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding iQIYI.

Looking for more investment ideas?

Smart investors stay ahead by broadening their opportunities. Take action now and see what you could be missing with these powerful stock ideas matched to today’s trends:

- Unlock steady income potential as you pursue these 14 dividend stocks with yields > 3%, which boasts robust yields and a track record of rewarding shareholders.

- Harness the power of artificial intelligence in your portfolio by evaluating these 25 AI penny stocks, which are at the forefront of tomorrow’s breakthroughs.

- Access hidden value opportunities with these 928 undervalued stocks based on cash flows, which offer compelling fundamentals for investors seeking long-term upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iQIYI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IQ

iQIYI

Through its subsidiaries, provides online entertainment video services in the People’s Republic of China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026