- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:IAC

IAC (IAC) Turnaround Narrative Faces Test as Losses Deepen, Value Gap Widens

Reviewed by Simply Wall St

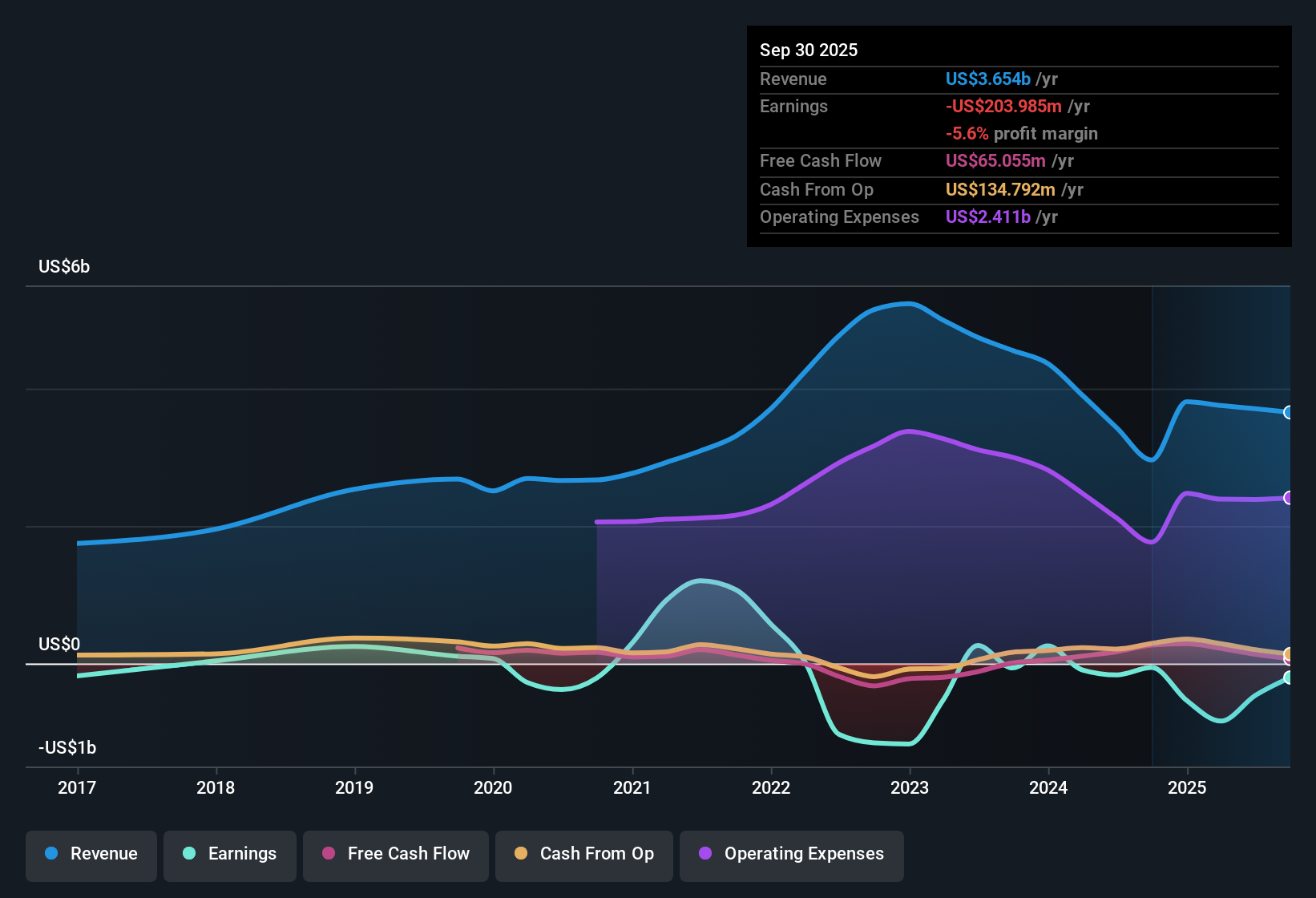

IAC (IAC) posted another unprofitable year as losses accelerated by 35.7% per year over the last five years, with revenue expected to decline by 11.2% annually for the next three years. Despite the challenging recent performance, earnings are forecast to rebound strongly by 69.09% per year, and the company is expected to turn profitable within three years, even as the share price sits at $32, below the estimated fair value of $36.08.

See our full analysis for IAC.The next section will explore how these headline results compare with the market’s prevailing narratives. Some views may be reinforced, while others could face a rethink.

See what the community is saying about IAC

Margin Expansion Targets Defy Shrinking Revenue

- Analysts expect profit margins to rise from -12.9% now to 3.4% in three years, even as revenue is forecast to fall by 12.5% each year during the same period.

- Consensus narrative sees this margin turnaround as credible thanks to several catalysts:

- IAC's People Inc. is broadening its ad reach beyond Google, leaning into channels like Apple News and YouTube, which could help offset traffic headwinds driven by shifts in Google algorithms.

- Proprietary ad tech, such as D/Cipher+, aims to monetize first-party data, supporting better digital ad pricing and higher margins even as legacy print revenue continues to decline.

- Consensus narrative also notes that heavy investment in product and technology remains a razor's edge. If digital pivots stall or do not yield expected returns, the anticipated margin recovery could fail to materialize, raising the risk that margins stay negative for longer than projected.

- The balanced view recognizes both the upside from digital execution and the pressure from market competition.

📊 Read the full IAC Consensus Narrative.

Share Count Set for Rapid Decline

- Analysts project that shares outstanding will fall by 7.0% per year for the next three years, which is an unusually brisk pace of buybacks relative to sector norms.

- According to the consensus narrative, management's strategic focus on opportunistic M&A deals and capital allocation could magnify future earnings per share growth:

- Unlocking value from assets like MGM and private holdings may enable both organic and inorganic earnings upside, amplifying the impact of any profit recovery on a per-share basis.

- Still, the consensus cautions that heavy brand dependence means an underperforming key platform could materially offset the benefit of fewer shares or asset sales.

Discounted Valuation Versus Peers

- IAC trades at a Price-to-Sales ratio of 0.7x, which is meaningfully below both the US Interactive Media industry average (1.4x) and the peer group average (1.9x), with the current share price at $32 compared to a DCF fair value of $36.08 and a consensus analyst price target of $48.15.

- Consensus narrative highlights that the discounted valuation offers room for rerating if margin expansion and digital growth play out:

- Bulls point to diversified channels and proprietary data as ingredients for a multiple expansion, while others note that a future PE of 47.6x on 2028 earnings expectations already bakes in a fair amount of optimism compared to the sector average of 16.9x.

- The tension lies in whether the digital transformation offsets risks of shrinking print and dependence on Google traffic fast enough to justify a valuation catch-up.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for IAC on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something new in the numbers? Share your take and shape your own story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding IAC.

See What Else Is Out There

IAC faces declining revenues and ongoing losses. Margin recovery will depend on a risky digital pivot, while the company continues to experience pressure from market competition.

If you want steadier performance from your investments, check out stable growth stocks screener (2077 results) to discover companies with consistent growth and stability across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IAC

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives