- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:IAC

IAC (IAC): Evaluating Value After Narrower Quarterly Loss and Major Share Buyback Completion

Reviewed by Simply Wall St

IAC (IAC) posted its third quarter results, showing a significantly reduced net loss even as sales dipped from last year. The company also completed a major portion of its ongoing share buyback program, worth over $100 million.

See our latest analysis for IAC.

IAC's share price has struggled this year, reflecting a 20.5% decline year-to-date. The total shareholder return over the last year stands at -12.5%. Despite the recent buyback activity and improved quarterly loss, longer-term momentum remains muted, indicating that investors are still waiting for a clear turnaround signal.

If you're looking to broaden your investing horizons beyond media stocks, now's the perfect time to discover fast growing stocks with high insider ownership

With the stock trading well below analysts’ price targets and recent moves hinting at improving fundamentals, investors have to ask: does IAC offer hidden value at current levels, or is the market already pricing in any recovery?

Most Popular Narrative: 30% Undervalued

With IAC's narrative fair value pegged at $48.38 versus the latest close of $33.87, market expectations are notably below what the most popular outlook assumes. The current disconnect between price and narrative projections puts a spotlight on the drivers that could bridge this gap.

Revamps to core businesses and strategic capital allocation strengthen IAC's digital marketplace presence, unlock new revenue streams, and enhance resilience to market disruptions. Heavy reliance on key digital partners and brands, shrinking print revenue, and rising competition threaten growth, margins, and the sustainability of IAC's digital pivot.

What exactly powers this optimistic stance that places IAC's worth far above its share price? The narrative hinges on digital transformation plans and aggressive margin improvements, but even bolder assumptions lie just beneath the surface. Wondering which future profit milestones and growth triggers are counted on to drive this valuation hike? Click through to see the fascinating financial leaps behind the headline figure.

Result: Fair Value of $48.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in digital traffic and uncertainty regarding the successful execution of key technology initiatives could quickly challenge the bullish narrative for IAC.

Find out about the key risks to this IAC narrative.

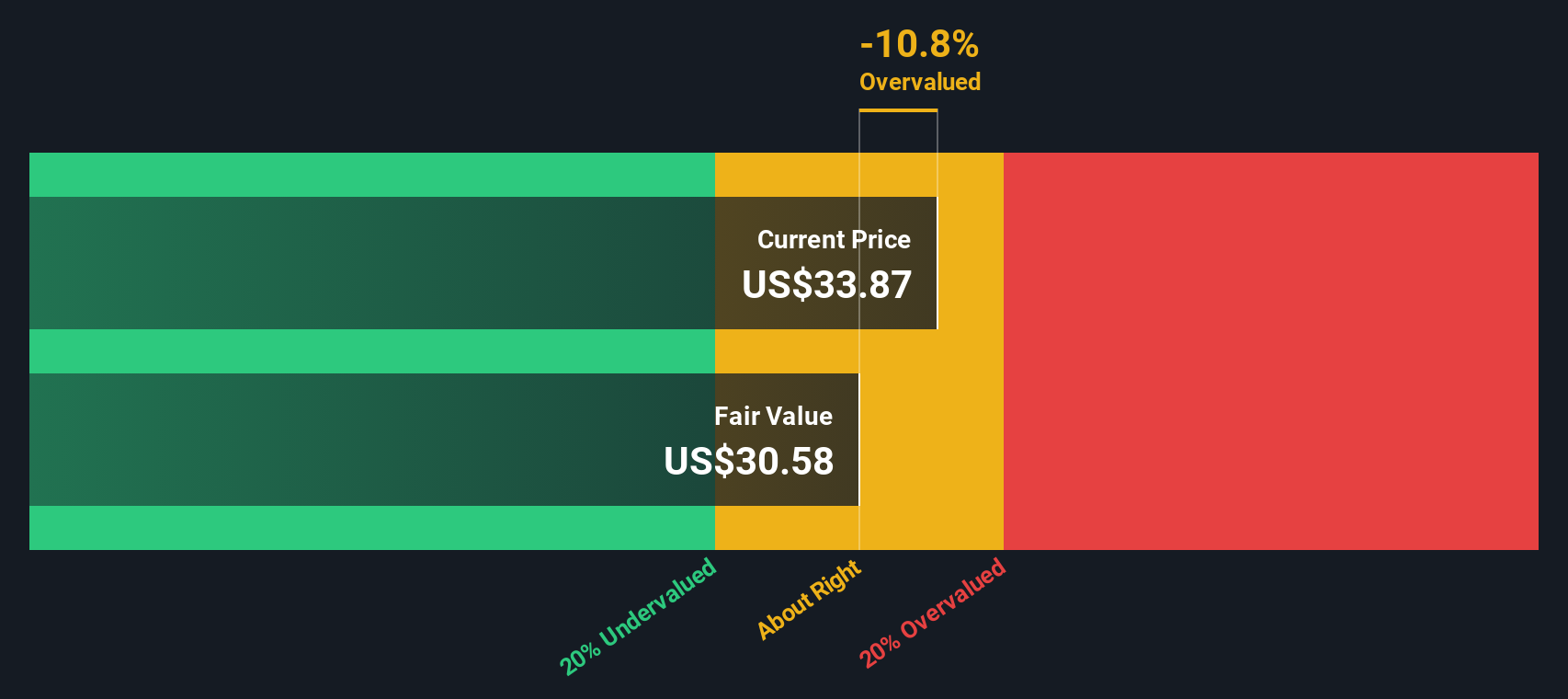

Another View: DCF Model Challenges Consensus

While the prevailing narrative points to undervaluation based on price targets and future earnings potential, our SWS DCF model offers a very different perspective. It estimates IAC’s fair value at $30.58, which is actually below the current share price. This suggests the market may be more optimistic than the fundamentals warrant. This raises a key question: which outlook will ultimately guide where the share price heads next?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out IAC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own IAC Narrative

If you see things differently or want to examine the data firsthand, you can shape your own outlook for IAC in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding IAC.

Looking for more investment ideas?

Unlock your next opportunity right now and don’t let these potential winners pass you by. The market rewards those who act on unique insights and fresh trends.

- Target stronger income by reviewing these 15 dividend stocks with yields > 3%, which offers attractive yields above 3% along with the consistent growth every investor wants in their portfolio.

- Seize the potential of tomorrow’s tech giants and get ahead of the curve with these 27 AI penny stocks, which are transforming industries through cutting-edge innovation in artificial intelligence.

- Position yourself for outperformance by scanning these 885 undervalued stocks based on cash flows, which stand out as bargains in today's market and reveal companies the crowd might have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IAC

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives