- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:IAC

Can IAC's (IAC) Strategy Adapt to Regulatory Headwinds and Shifting Digital Media Dynamics?

Reviewed by Sasha Jovanovic

- IAC recently reported quarterly financial results showing an 8.1% year-on-year revenue decline, missing analysts' revenue and EPS estimates for the period.

- Regulatory scrutiny of AI-generated content and the transition away from third-party cookies have particularly challenged IAC’s digital media and marketing effectiveness.

- We'll examine how these operating headwinds and regulatory pressures now impact IAC's investment narrative and growth assumptions.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

IAC Investment Narrative Recap

To be a shareholder in IAC, you need to believe in the company’s ability to rebound through digital innovation and diversification of its online platforms. The recent earnings miss reinforces near-term uncertainty, highlighting both the pressure on digital ad monetization and the growing impact of regulatory hurdles, which are now the most meaningful short-term risks to the business. For now, these risks appear to outweigh any immediate catalysts, especially as traffic and ad effectiveness remain under strain. Of the recent developments, IAC’s decision to distribute all Angi shares to its stockholders stands out. This move directly alters the company's portfolio mix and could sharpen management’s focus on core digital publishing and marketplace businesses, an area particularly exposed to the advertising and content challenges now front and center. By contrast, investors should be aware that IAC’s reliance on session-driven revenue, especially from Google search, means that further disruption in organic traffic remains a critical factor...

Read the full narrative on IAC (it's free!)

IAC's outlook anticipates $2.5 billion in revenue and $85.5 million in earnings by 2028. This projection reflects a 12.5% annual revenue decline and a $565.4 million increase in earnings from the current earnings of -$479.9 million.

Uncover how IAC's forecasts yield a $45.62 fair value, a 28% upside to its current price.

Exploring Other Perspectives

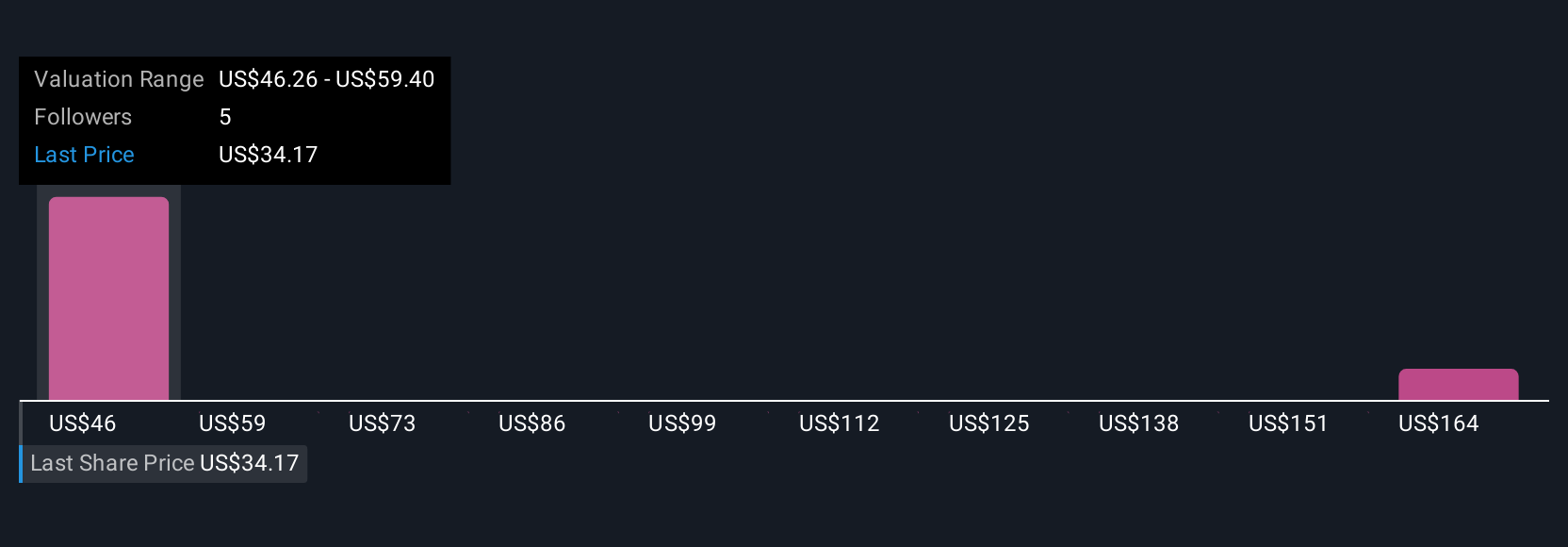

Community fair value estimates for IAC range widely from US$45.62 to US$177.63, with just three participant views in the Simply Wall St Community. Against this breadth of opinion, the risk of structural traffic and revenue decline tied to search engine changes may weigh on sentiment for many market participants.

Explore 3 other fair value estimates on IAC - why the stock might be worth just $45.62!

Build Your Own IAC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IAC research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free IAC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IAC's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IAC

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026