- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Alphabet (GOOGL): Valuation Check After Gemini AI Wins and Growing TPU Demand

Reviewed by Simply Wall St

Alphabet (GOOGL) stock is riding a powerful AI wave right now, but the story actually starts with a lawsuit challenging parts of its hardware ecosystem. From there, the investment case gets surprisingly interesting.

See our latest analysis for Alphabet.

Zooming out from the Nest lawsuit, Alphabet’s recent story has been dominated by AI wins, from Gemini driving higher search engagement to rising demand for its tensor processing unit chips. That backdrop has helped power a roughly 66 percent year to date share price return and a near 80 percent one year total shareholder return, suggesting momentum is still firmly building rather than fading.

If you want to see what else is benefiting from the same AI tailwinds, this is a good moment to explore high growth tech and AI names through high growth tech and AI stocks.

After an 80 percent one year total return and a valuation hovering just below Wall Street targets, investors face a tougher question: Is Alphabet still mispriced for an AI supercycle, or are markets already discounting years of future growth?

Most Popular Narrative Narrative: 7.7% Undervalued

According to oscargarcia, the narrative fair value of $340 sits above Alphabet’s last close of $313.79, framing the stock as still mispriced in an AI driven rerating.

Alphabet is a compounding machine hiding under an ad empire. With AI monetization finally catching fire, Cloud turning profitable, and more YouTube monetization coming, this isn’t just a “big tech stock”, it is an innovation platform priced like a mature business.

Want to see the engine behind that higher future valuation multiple, from revenue growth to margins and long term profit assumptions? The full narrative lays out the playbook.

Result: Fair Value of $340.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could wobble if regulators force structural changes to Google’s ad business, or if AI powered rivals start eroding core search economics.

Find out about the key risks to this Alphabet narrative.

Another Lens on Valuation

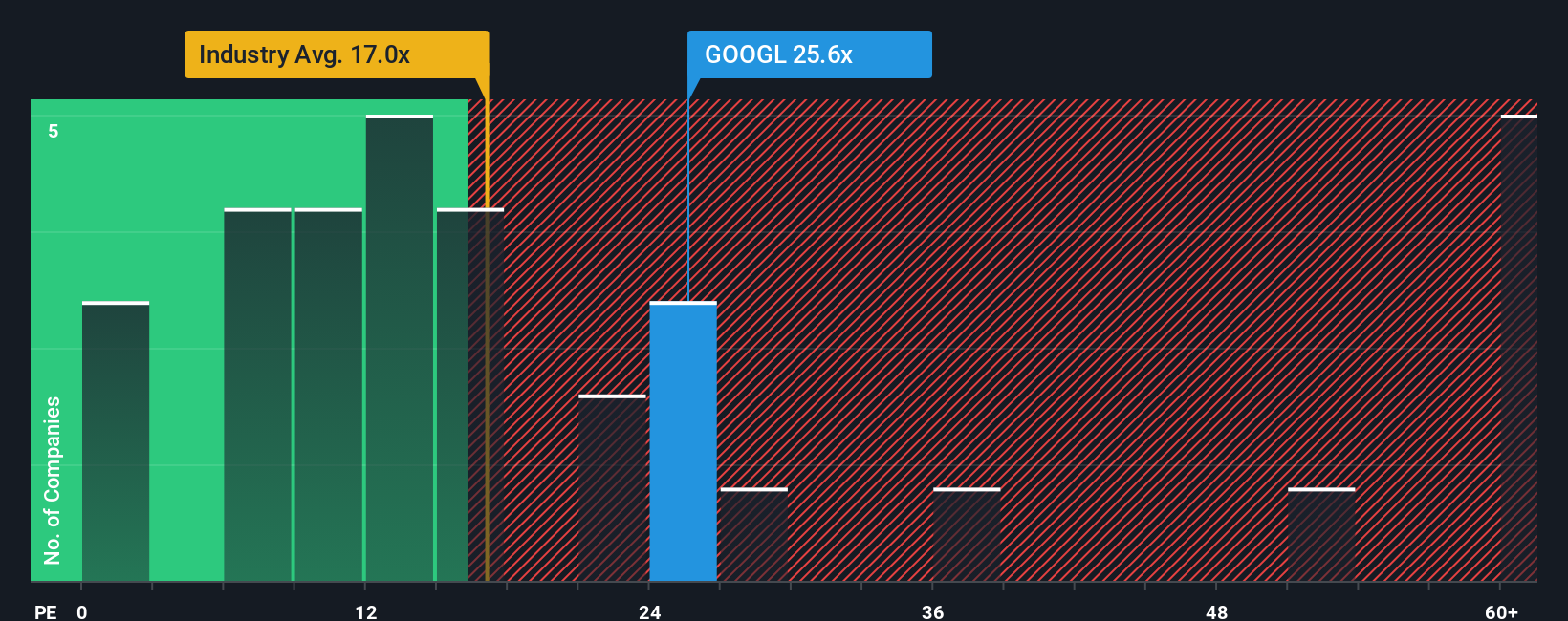

While the narrative points to Alphabet being 7.7 percent undervalued, today’s pricing tells a tougher story. At 30.5 times earnings versus 17.8 times for the US interactive media industry and a 51.1 times peer average, investors are already paying up for quality. A fair ratio closer to 37.5 times suggests more re rating than deep discount. With earnings growing but not explosively, how much multiple expansion is really left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alphabet Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Alphabet.

Ready for your next investing move?

Before you stop at Alphabet, lock in your next smart idea on Simply Wall Street’s screener so you are not chasing yesterday’s winners later.

- Capture potential multi baggers early by targeting unconventional opportunities through these 3580 penny stocks with strong financials that still show solid underlying financial strength.

- Position yourself at the front of the AI wave by focusing on innovators powering the next generation of intelligence with these 27 AI penny stocks.

- Lock in better risk reward trade offs by zeroing in on quality businesses trading below their cash flow potential through these 903 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026