- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Alphabet (GOOGL): Evaluating Valuation After Gemini 3 AI Rollout and New Meta Cloud Partnership

Reviewed by Simply Wall St

Alphabet (GOOGL) has been at the center of attention this week following a series of high-profile announcements. The recent launch and integration of its Gemini 3 AI model across key platforms, combined with a cloud chip deal with Meta, has caught investors’ interest.

See our latest analysis for Alphabet.

Alphabet’s share price has soared nearly 70% year-to-date, reaching new all-time highs as excitement builds around the company’s AI breakthroughs, cloud momentum, and high-profile partnerships. Its one-year total shareholder return stands at a remarkable 87.5%, underscoring both short-term strength and sustained long-term growth.

If AI-fueled rallies have piqued your interest, it could be the perfect time to explore more tech and AI standouts. See the full list for free with See the full list for free..

But with Alphabet’s meteoric stock surge and analyst price targets barely above its current levels, the critical question emerges: is there still a buying opportunity here, or is the market already pricing in all future growth?

Most Popular Narrative: 5.8% Undervalued

According to oscargarcia, the narrative fair value of $340 suggests Alphabet could have more room to run compared to its last close of $320.18. The narrative weighs Alphabet’s future growth paths, strategic assets, and whether market sentiment is about to shift for the tech giant.

Berkshire’s stake signals that Google is viewed as a long-term compounding machine rather than an easily disrupted ad business. Berkshire’s team is indicating that AI is considered additive, not destructive, to Google’s future cash flows.

Want to know what’s fueling this above-market valuation? The narrative centers on explosive cash flow, cutting-edge AI integration, and premium profit projections not always reflected in consensus outlooks. Which financial levers are behind this confidence? Discover what really powers this $340 target and why some see Alphabet’s next chapter challenging the status quo.

Result: Fair Value of $340 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory crackdowns or unexpected weakness in digital ad spending could quickly challenge the bullish outlook and force a market reassessment.

Find out about the key risks to this Alphabet narrative.

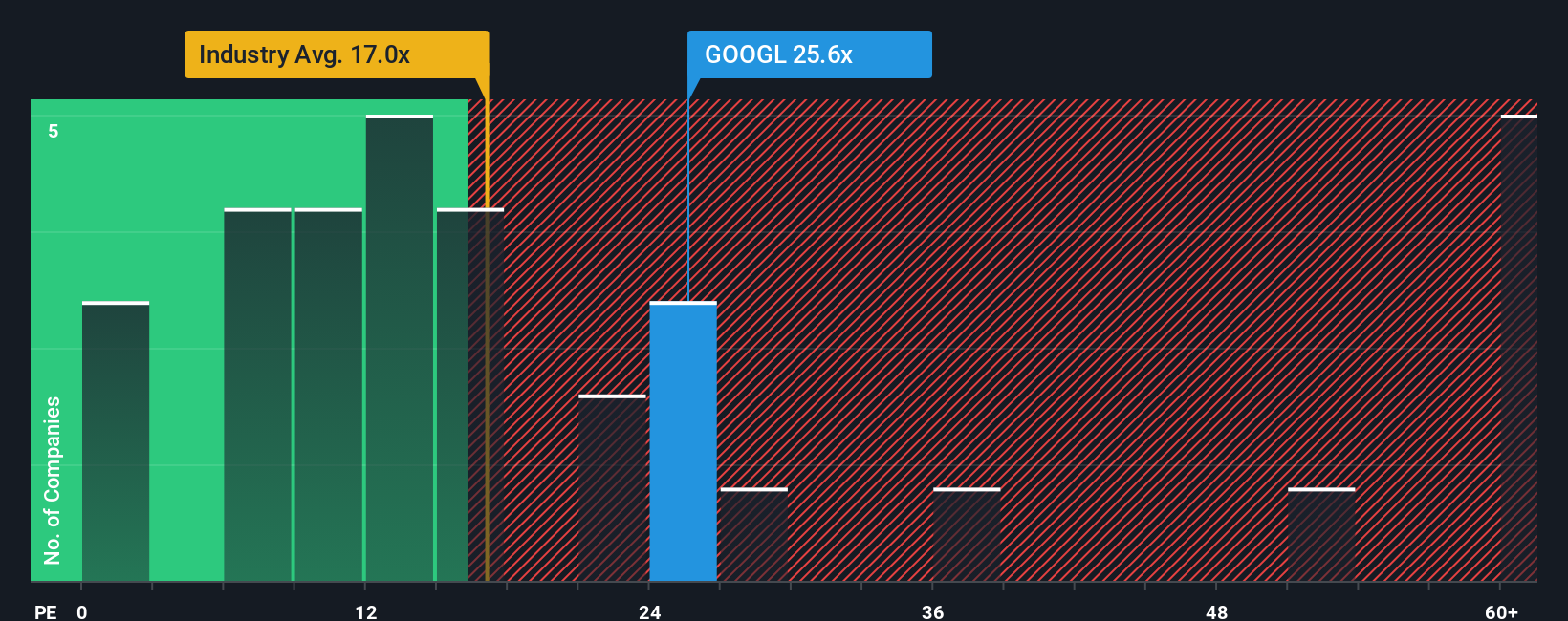

Another View: Looking Through the Lens of Multiples

Yet, when we look at Alphabet’s valuation using its price-to-earnings ratio, a different story emerges. Alphabet currently trades at 31.1 times earnings, noticeably higher than the US Interactive Media and Services industry average of 15.8 and even above its own fair ratio of 37.3. While it appears expensive relative to the sector, there is a case that the market could reward quality and growth with elevated multiples if the narrative holds. Does paying a premium here reflect strong fundamentals or create added risk for newcomers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alphabet Narrative

If you see the story taking a different turn or want to dig into the numbers on your own terms, it’s easy to create your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Alphabet.

Looking for more investment ideas?

Don’t let fresh opportunities pass you by. Use the Simply Wall Street Screener now to track market trends and spot high-potential stocks tailored to your investing strategy.

- Spot untapped opportunities in rapidly evolving healthcare technology when you check out these 30 healthcare AI stocks.

- Boost your search for strong income streams by uncovering companies offering attractive yields with these 15 dividend stocks with yields > 3%.

- Join the momentum as artificial intelligence transforms industries. Find dynamic businesses at the forefront with these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026