- United States

- /

- Media

- /

- NasdaqGS:FOXA

Are Analyst Expectations for FOXA Reflecting True Stability in the Shifting U.S. Media Landscape?

Reviewed by Sasha Jovanovic

- Fox (NASDAQ:FOXA), a leading cable news and media network, reported earnings before the bell this past Thursday, following a previous quarter in which it surpassed analysts’ revenue estimates by 5.5% with US$3.29 billion in revenue, up 6.3% year over year.

- Analysts have largely reconfirmed their expectations heading into the report, suggesting expectations for continued stability as Fox faces the evolving landscape of U.S. media consumption.

- With recent attention on Fox's prior revenue beat and analyst confidence, we'll explore how this influences the company's investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Fox Investment Narrative Recap

To own Fox stock today, you’d need to have conviction in its ability to maintain robust advertising and affiliate revenues as U.S. viewing habits evolve, while also recognizing that cable and broadcast TV are facing secular headwinds. The recent earnings news, reflecting a stable outlook and positive momentum from last quarter’s revenue beat, supports the near-term catalyst of resilient political and sports-driven advertising, but does not materially alter the biggest risk: a continued shift toward streaming among younger audiences.

Among recent developments, Fox’s launch of the FOX One streaming bundle stands out. This direct-to-consumer offering is especially relevant amid concerns about linear TV declines and demonstrates a visible effort to address potential pressure on core revenues, though its scale relative to streaming competitors remains an open question for the company’s growth trajectory and competitive positioning.

Yet, in contrast, investors should be aware of the risk if younger, cordless audiences shift away from Fox’s traditional platforms and...

Read the full narrative on Fox (it's free!)

Fox's outlook anticipates $16.4 billion in revenue and $1.9 billion in earnings by 2028. This reflects a 0.3% annual decline in revenue and a $0.4 billion decrease in earnings from the current $2.3 billion.

Uncover how Fox's forecasts yield a $62.97 fair value, a 3% upside to its current price.

Exploring Other Perspectives

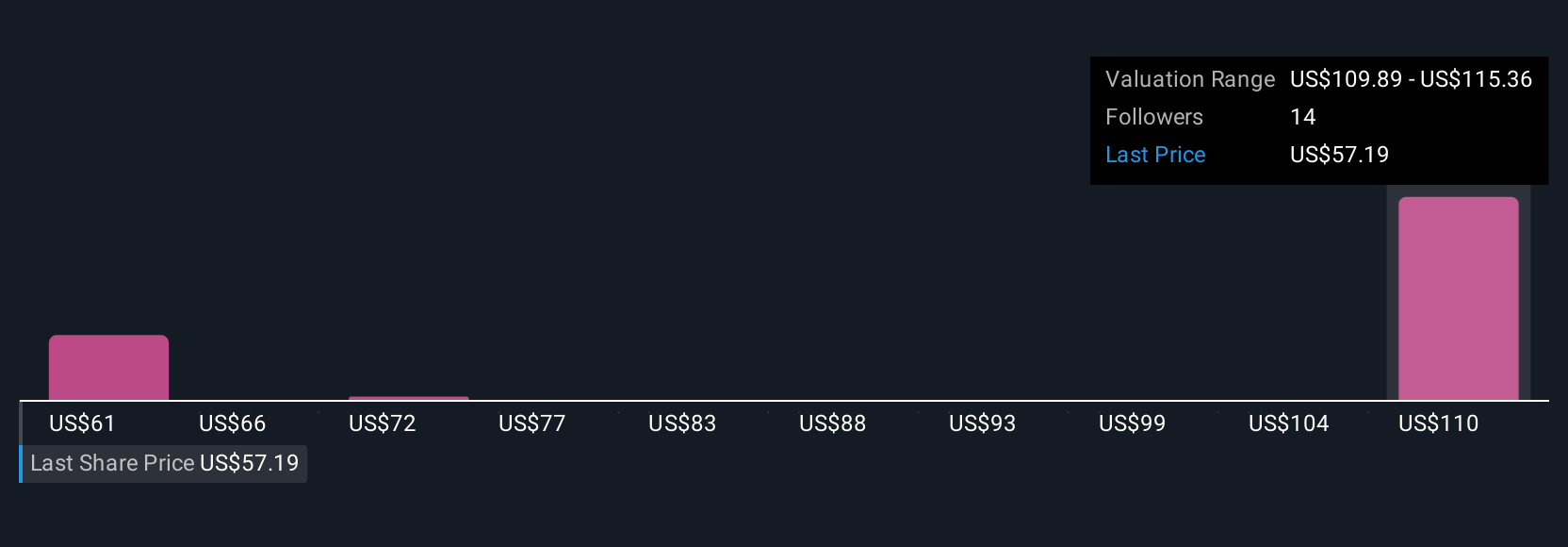

Simply Wall St Community members currently estimate Fox’s fair value in a wide range from US$62.97 to US$111.01, with three unique perspectives. With the company’s long-term earnings outlook facing challenges from changing consumer habits, it’s worth considering several independent views on future performance.

Explore 3 other fair value estimates on Fox - why the stock might be worth as much as 82% more than the current price!

Build Your Own Fox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fox research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fox's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXA

Fox

Operates as a news, sports, and entertainment company in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives