- United States

- /

- Entertainment

- /

- NasdaqGS:DOYU

Even after rising 16% this past week, DouYu International Holdings (NASDAQ:DOYU) shareholders are still down 78% over the past five years

It is a pleasure to report that the DouYu International Holdings Limited (NASDAQ:DOYU) is up 85% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Indeed, the share price is down a whopping 78% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The fundamental business performance will ultimately determine if the turnaround can be sustained.

The recent uptick of 16% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for DouYu International Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

DouYu International Holdings has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

The revenue fall of 2.2% per year for five years is neither good nor terrible. But it's quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

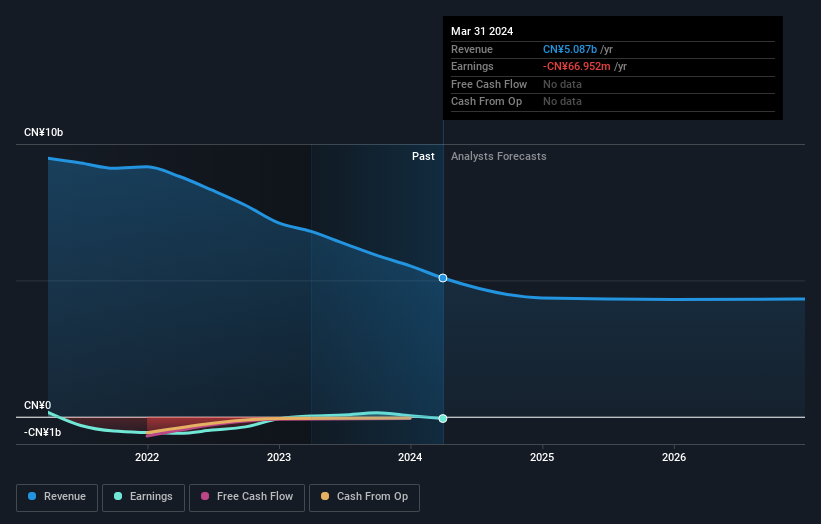

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that DouYu International Holdings shareholders have received a total shareholder return of 73% over one year. Notably the five-year annualised TSR loss of 12% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand DouYu International Holdings better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for DouYu International Holdings you should be aware of.

We will like DouYu International Holdings better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DOYU

DouYu International Holdings

Operates a platform on PC and mobile apps that provides interactive games and entertainment live streaming services in the People’s Republic of China.

Good value with adequate balance sheet.