- United States

- /

- Oil and Gas

- /

- NasdaqGS:NFE

US Growth Stocks With High Insider Ownership For November 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences fluctuations, with recent declines in technology shares and a notable rebound in Bitcoin, investors are keenly observing economic indicators and the Federal Reserve's interest rate decisions. Amidst this backdrop of uncertainty and recalibration, growth companies with high insider ownership can be particularly appealing due to their potential for alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Coastal Financial (NasdaqGS:CCB) | 18% | 46.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 43.3% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

Let's uncover some gems from our specialized screener.

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services targeting young generations in China and has a market cap of approximately $7.84 billion.

Operations: The company's revenue from Internet Information Providers amounts to CN¥25.45 billion.

Insider Ownership: 20.7%

Revenue Growth Forecast: 10.8% p.a.

Bilibili's recent earnings report highlights significant revenue growth, with third-quarter revenue reaching CNY 7.31 billion, up from CNY 5.81 billion a year ago, and a reduced net loss of CNY 79.52 million compared to the previous year's larger loss. The company has announced a US$200 million share buyback program funded by existing cash reserves. While Bilibili's forecasted revenue growth of 10.8% annually exceeds the US market average, its share price remains volatile without substantial insider trading activity recently observed.

- Get an in-depth perspective on Bilibili's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Bilibili's current price could be quite moderate.

New Fortress Energy (NasdaqGS:NFE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: New Fortress Energy Inc. is an integrated gas-to-power energy infrastructure company offering energy and development services globally, with a market cap of approximately $2.63 billion.

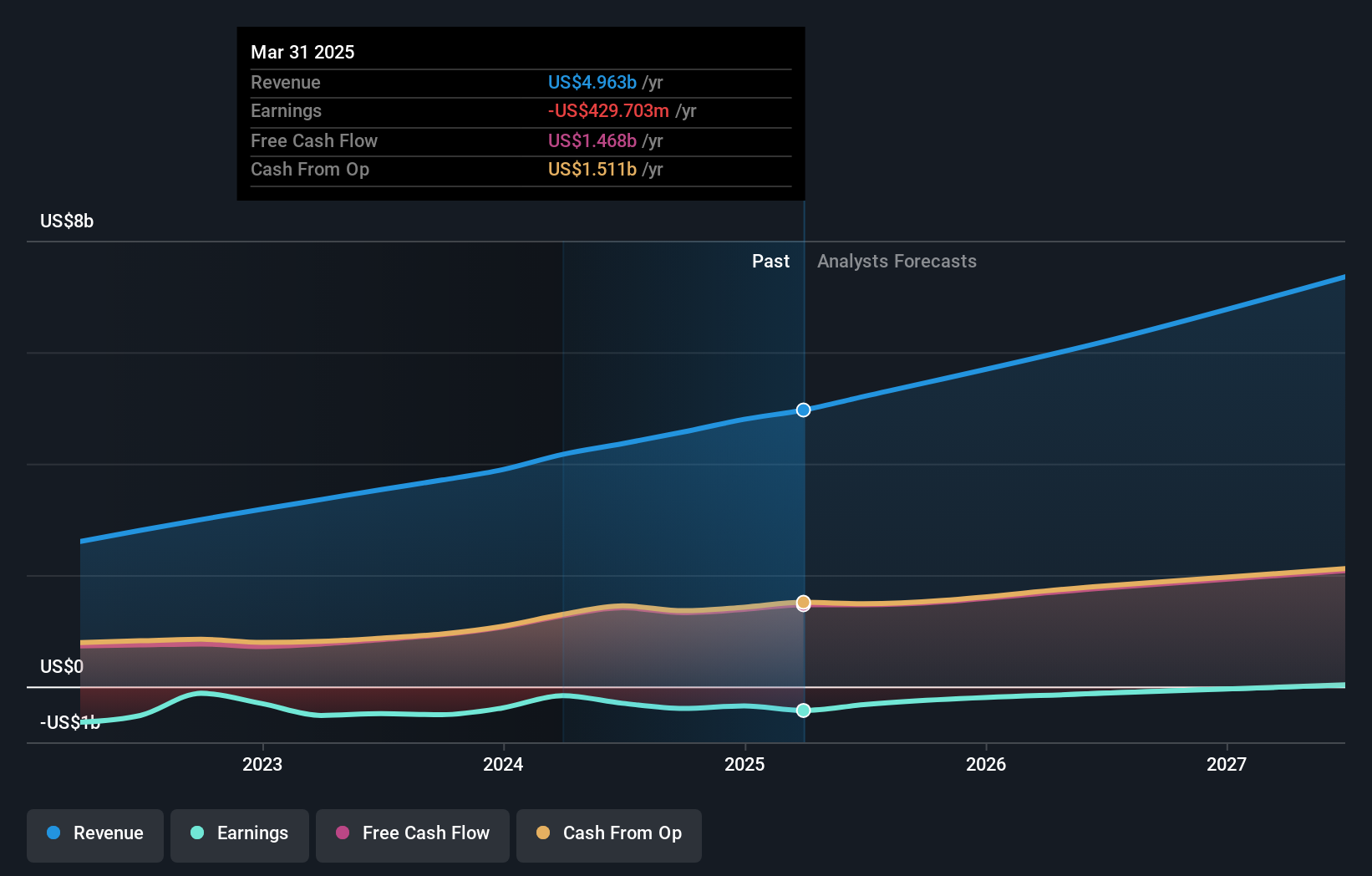

Operations: The company's revenue primarily comes from its Terminals and Infrastructure segment, generating $2.21 billion, followed by the Ships segment with $191.51 million.

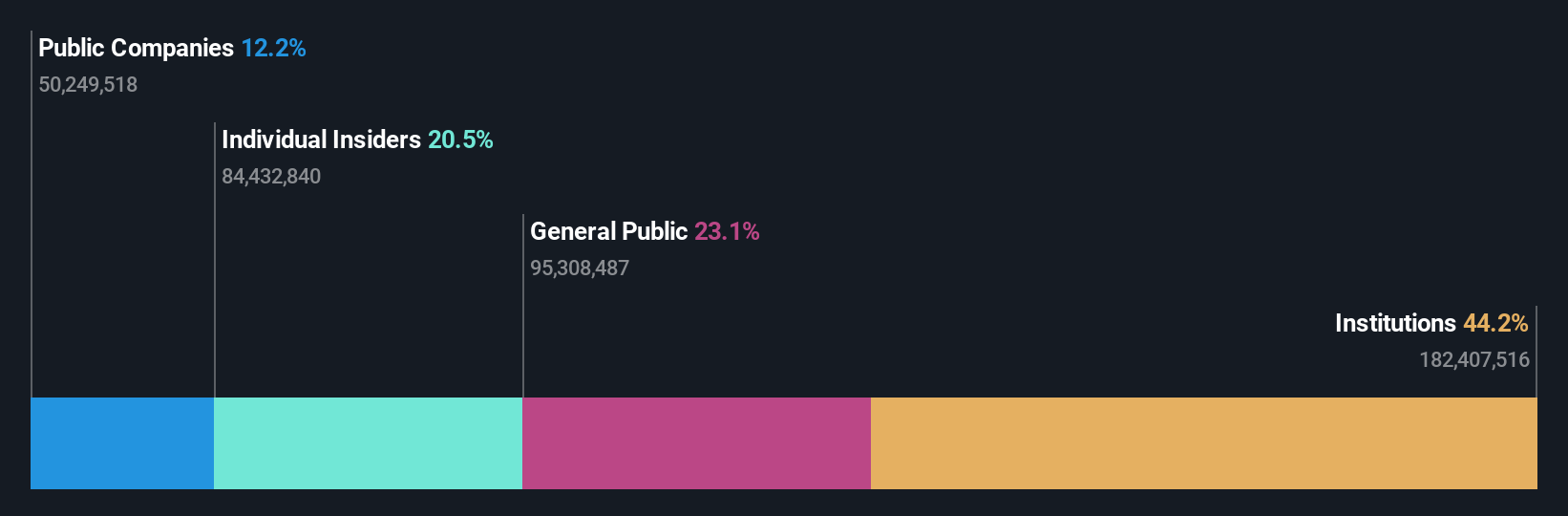

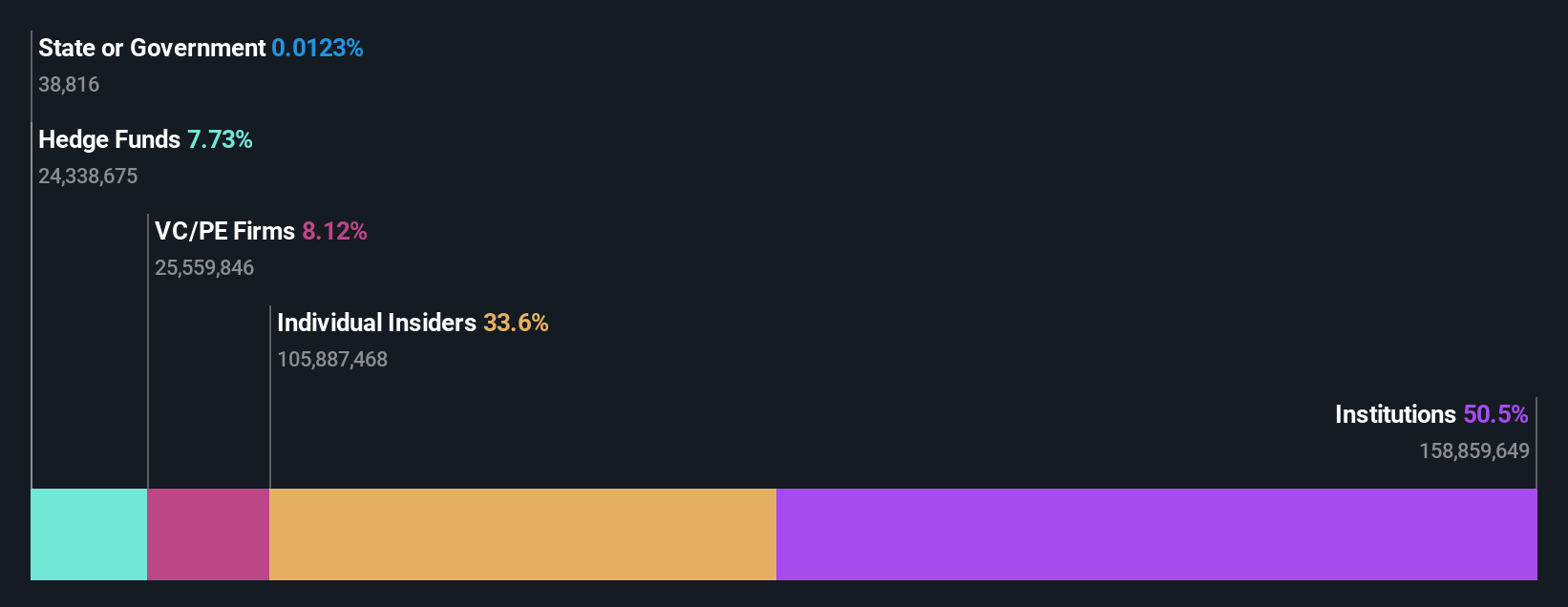

Insider Ownership: 32.6%

Revenue Growth Forecast: 20.5% p.a.

New Fortress Energy has seen substantial insider buying recently, indicating confidence in its growth prospects despite legal challenges and volatile share prices. The company completed a $2.7 billion debt financing to refinance existing bonds and extend credit facilities, enhancing liquidity by $325 million. Although revenue is forecast to grow over 20% annually, profit margins have declined from last year. Recent earnings show reduced net income amid ongoing operational challenges with Fast LNG projects impacting financial performance.

- Take a closer look at New Fortress Energy's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that New Fortress Energy is priced higher than what may be justified by its financials.

Atlassian (NasdaqGS:TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation, with a market cap of $68.35 billion, designs, develops, licenses, and maintains various software products worldwide through its subsidiaries.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $4.57 billion.

Insider Ownership: 38.5%

Revenue Growth Forecast: 15.2% p.a.

Atlassian's recent insider activity indicates more shares have been sold than bought, highlighting potential concerns despite its strong growth trajectory. The company forecasts a significant revenue increase of 16.5% to 17% for fiscal year 2025, with earnings expected to grow substantially at 58.38% annually over the next three years, surpassing market averages. Atlassian has also initiated a $1.5 billion share buyback program, signaling confidence in its valuation and long-term strategy amidst evolving leadership dynamics.

- Navigate through the intricacies of Atlassian with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Atlassian implies its share price may be lower than expected.

Key Takeaways

- Get an in-depth perspective on all 209 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if New Fortress Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFE

New Fortress Energy

Operates as an integrated gas-to-power energy infrastructure company that provides energy and development services to end-users worldwide.

Medium-low with reasonable growth potential.