- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BILI

Bilibili (BILI) Is Up 17.5% After Analyst Praise for AI and Gaming Restructuring Has The Bull Case Changed?

Reviewed by Simply Wall St

- Earlier this week, Bilibili attracted positive analyst commentary following operational improvements, a restructuring of its gaming division, and the integration of AI technology into its advertising operations.

- Analysts highlighted Bilibili's strengthened user engagement and leadership in professional user-generated content, estimating these changes could help the company tap new growth opportunities.

- We'll explore how renewed optimism around Bilibili's AI-driven advertising efforts may influence the company's future investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Bilibili Investment Narrative Recap

To own shares in Bilibili, you need to believe the company can maintain strong engagement among China’s Gen Z audience and convert this into sustained growth in advertising and gaming revenues. The recent positive analyst commentary, centered on operational improvements and AI-driven advertising integration, is encouraging, but does not materially change the company’s biggest near-term catalyst, growth in ad monetization, and the largest risk, which remains sensitivity to regulatory shifts or volatility in key revenue streams.

Among recent announcements, Bilibili’s Q1 2025 earnings report stands out: the company reported a sharp year-over-year narrowing of its net loss to CNY 9.1 million and improved revenue, reflecting both cost-cutting and efficiency gains. These figures offer a clearer picture of progress on profitability and resonate directly with analyst expectations around operational execution and healthier margins.

By contrast, investors should still be aware of potential shifts in regulation or abrupt changes in advertising demand, as these could ...

Read the full narrative on Bilibili (it's free!)

Bilibili's narrative projects CN¥36.3 billion in revenue and CN¥2.7 billion in earnings by 2028. This requires 10.6% yearly revenue growth and a CN¥4.0 billion increase in earnings from the current earnings of CN¥-1.3 billion.

Uncover how Bilibili's forecasts yield a $26.77 fair value, a 6% upside to its current price.

Exploring Other Perspectives

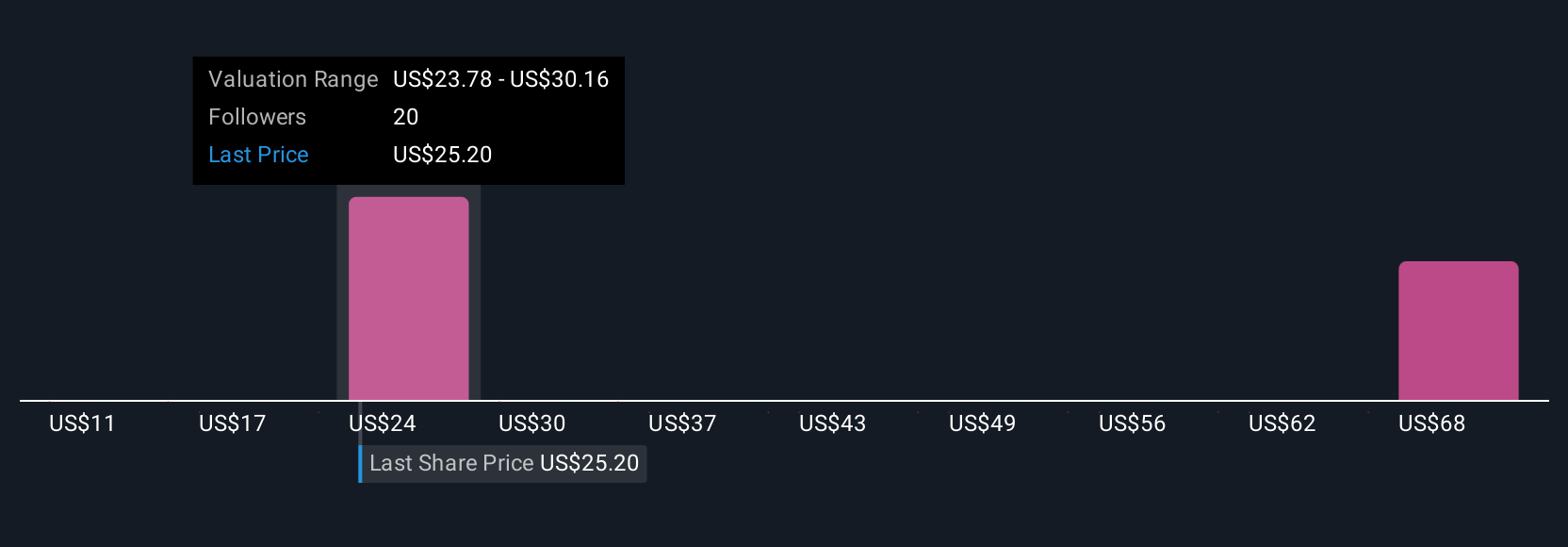

The Simply Wall St Community’s fair value opinions on Bilibili span from CN¥11 to CN¥74.79, across four different forecasts. While optimism around AI-powered advertising points to new opportunities, you may want to compare these diverse views to your own assessment of regulatory vulnerabilities and future revenue growth.

Build Your Own Bilibili Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bilibili research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Bilibili research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bilibili's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilibili might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BILI

Bilibili

Provides online entertainment services for the young generations in the People’s Republic of China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives