- United States

- /

- Metals and Mining

- /

- NYSEAM:GROY

Gold Royalty (GROY): Evaluating Valuation After Sales Growth and Net Loss in Latest Earnings Report

Reviewed by Simply Wall St

Gold Royalty (NYSEAM:GROY) recently released its third quarter results, highlighting a strong jump in sales while also revealing a swing to a net loss compared to last year. Investors have turned their attention to what these figures mean for the company’s near-term prospects.

See our latest analysis for Gold Royalty.

Gold Royalty’s share price has surged in 2024, recording a 204.8% year-to-date gain as positive sales momentum and increased investor optimism have outweighed recent widening losses. The stock’s 1-year total shareholder return is 190.8%, highlighting a turnaround story that has attracted significant market attention.

If you’re curious to see what other fast-moving opportunities are out there, now is the perfect time to discover fast growing stocks with high insider ownership

But with the stock’s sharp rally and mixed results, the real question now is whether Gold Royalty still offers value to new investors or if the market has already priced in the company’s next wave of growth.

Most Popular Narrative: 22.7% Undervalued

Gold Royalty’s most widely followed valuation narrative sets its fair value at $4.89 per share, a solid premium to the recent $3.78 close. Rather than simply riding the momentum, this perspective digs into the outlook for future growth and the assumptions underpinning the higher price target.

The high fixed-cost structure of the business and increasing scale from newly producing royalties will result in meaningful operating leverage, translating incremental top-line growth into disproportionately higher net margins and improving overall profitability.

Curious how top-line expansion could translate into dramatically larger margins? The narrative teases a future where operating leverage drives profits far beyond today’s levels. Learn which financial forecasts and ambitious targets underline this undervalued call. The real numbers behind this thesis may surprise you.

Result: Fair Value of $4.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sustained drop in gold prices or setbacks at key assets could challenge Gold Royalty's growth and potentially undermine the optimistic valuation narrative.

Find out about the key risks to this Gold Royalty narrative.

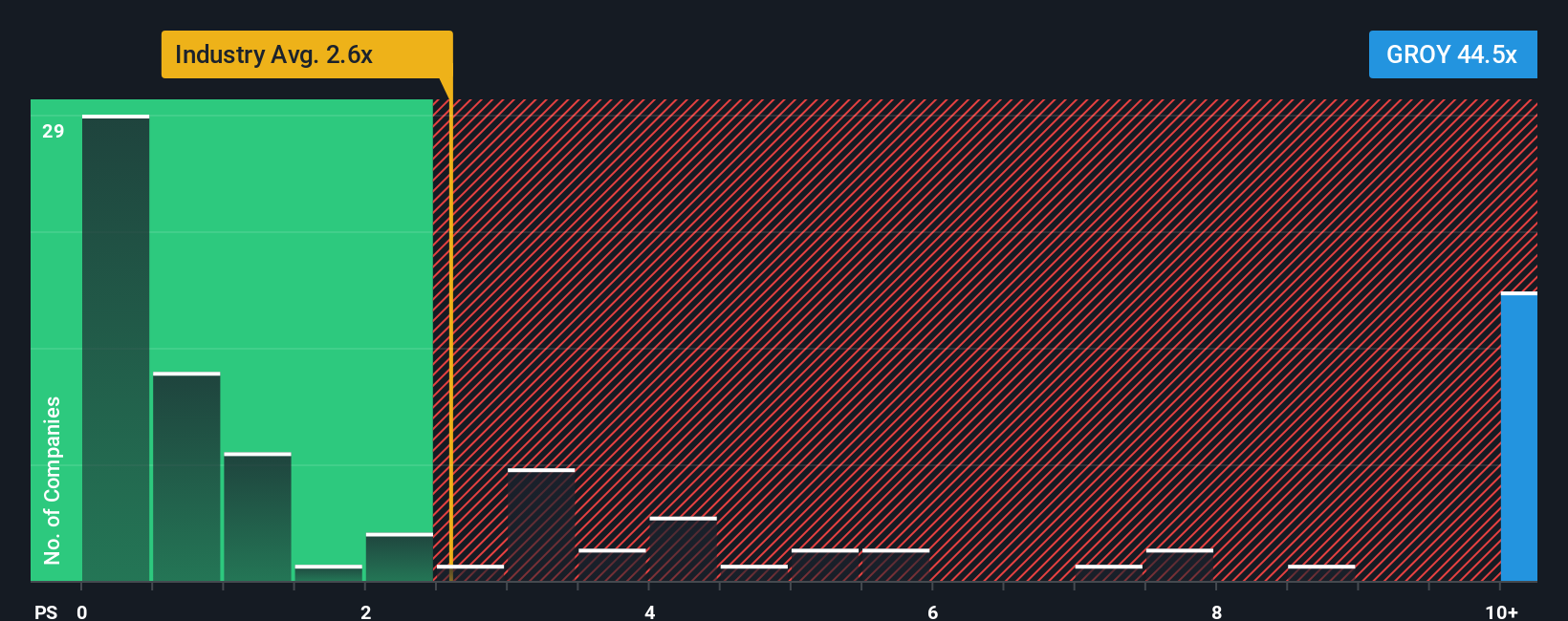

Another View: High Sales Multiple Signals Elevated Expectations

Taking a different approach, Gold Royalty’s current price-to-sales ratio of 45.5x stands dramatically higher than the US Metals and Mining industry average of 2.5x and the peer average of 4.3x. Even compared to the estimated fair ratio of 29.8x, the gulf is significant. This means the stock price incorporates lofty growth and margin assumptions; any stumble could hit valuation hard, but outperformance could keep momentum running. Does this premium signal confidence or highlight real risk for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gold Royalty Narrative

If these perspectives don’t quite fit your outlook, you can always dive into the numbers and craft a personalized story for Gold Royalty in just a few minutes. You can Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Gold Royalty.

Looking for more investment ideas?

Find exceptional investing opportunities that others might miss and put yourself ahead of the market crowd. Unlock new strategies now before you miss another rally.

- Explore high-yield potential by checking out these 15 dividend stocks with yields > 3% which offer robust income streams exceeding 3% annually.

- Accelerate your growth journey with these 27 AI penny stocks, where innovation and AI breakthroughs are powering the next wave of market winners.

- Catch early movers in technological disruption with these 27 quantum computing stocks, featuring companies making headlines in the world of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:GROY

Gold Royalty

A precious metals-focused royalty company, provides financing solutions to the metals and mining industry.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives