- United States

- /

- Basic Materials

- /

- NYSE:VMC

A Fresh Look at Vulcan Materials (VMC) Valuation Following Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for Vulcan Materials.

After steady gains earlier this year, Vulcan Materials’ share price has dipped by 5.3% in the past month but still boasts a 12.9% return so far in 2024. Looking at a longer period, the company’s three- and five-year total shareholder returns of 72% and 122% respectively point to momentum that has rewarded patient investors and continues to support its valuation story.

If you’re tracking trends in construction and infrastructure, this could be a smart moment to broaden your search and uncover fast growing stocks with high insider ownership

The question for investors now is whether this recent dip signals an undervalued entry point, or if Vulcan Materials’ share price already reflects expectations for continued growth in the construction sector. Could this be a real buying opportunity, or is the market one step ahead?

Most Popular Narrative: 8.7% Undervalued

Vulcan Materials’ current share price of $288.55 sits notably below the narrative-driven fair value of $315.91, signaling strong potential upside in analysts’ eyes. The latest research suggests that improving industry trends and robust company execution are combining to support this valuation outlook.

The company's dominant footprint in rapidly urbanizing and growing Sunbelt metros, coupled with a visible pipeline of large-scale public and private projects (notably data centers, highways, and non-residential), positions Vulcan to capture outsized volume recovery and expansion. This could directly benefit revenue growth and sustain robust pricing power.

Want to know which assumptions power that bullish price tag? The future earnings and profit margins embedded in this narrative might surprise you. Could Vulcan’s projected financial strength justify a valuation more in line with market leaders in tech? See the numbers for yourself and discover what turns this analyst consensus into an opportunity worth watching.

Result: Fair Value of $315.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing delays in residential construction or unexpected weather disruptions could quickly challenge the bullish view regarding Vulcan's current valuation and growth prospects.

Find out about the key risks to this Vulcan Materials narrative.

Another View: What Do Market Multiples Say?

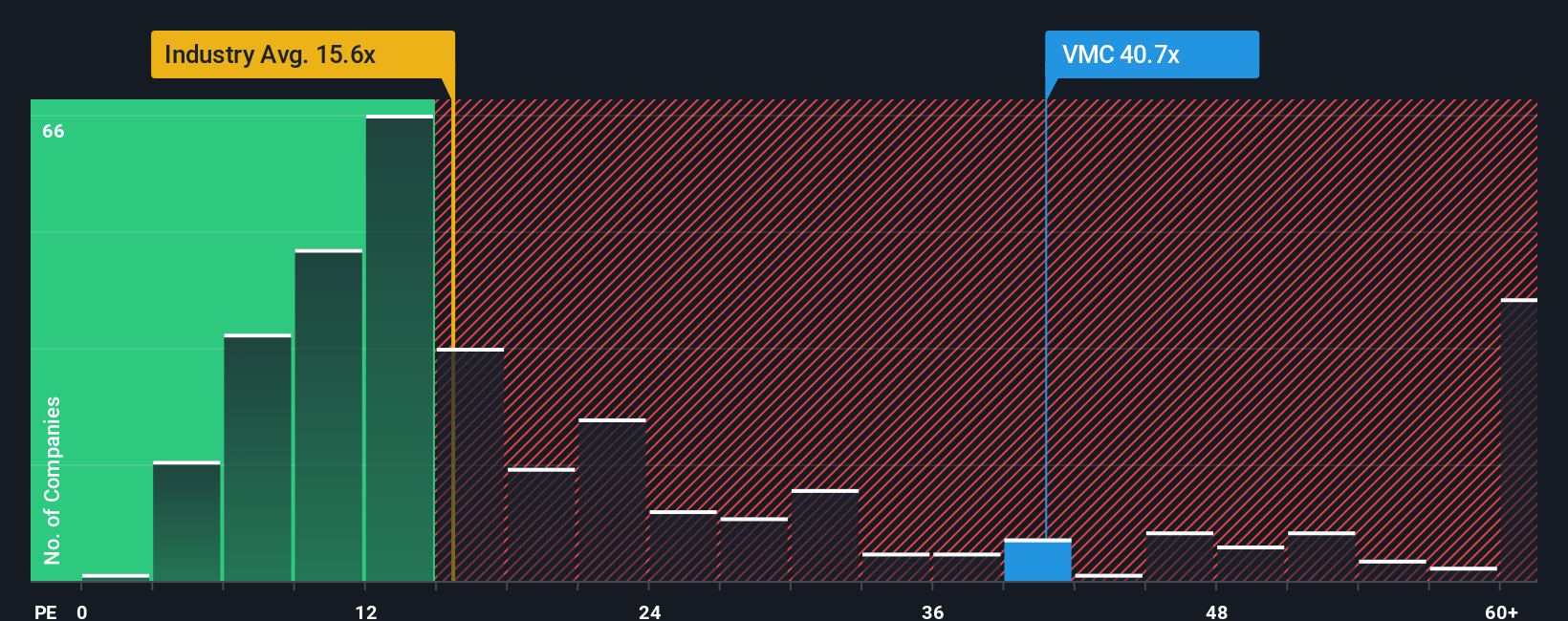

When you look at Vulcan Materials through the lens of the price-to-earnings ratio, the picture shifts. The company trades at 33.9x, which is noticeably higher than both its peers at 23.9x and the global industry average of 15.1x. Even the fair ratio for Vulcan sits lower at 23.2x. This premium means investors are paying up for future growth, which raises the stakes if performance falls short. Is the optimism fully justified, or could a reversion to the mean put pressure on the share price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vulcan Materials Narrative

If you think there’s another angle to Vulcan Materials’ story or want to dig into the numbers firsthand, you can analyze and build your own view in just a few minutes. Do it your way

A great starting point for your Vulcan Materials research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just wait for the next headline. Get ahead with top picks other smart investors are using and expand your watchlist right now.

- Tap into long-term potential with steady cash flows by scanning these 843 undervalued stocks based on cash flows for companies trading below their intrinsic value.

- Boost your income strategy and spot growing businesses offering high yields through these 18 dividend stocks with yields > 3% to find options outperforming the market’s average payouts.

- Capitalize on the digital revolution by tracking breakthroughs and high-growth potential with these 26 AI penny stocks, a resource highlighting companies transforming industries through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMC

Vulcan Materials

Produces and supplies construction aggregates in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives